By Kim McDarison

State Sen. Howard Marklein served as keynote speaker Thursday at the annual meeting of the Greater Whitewater Committee.

Marklein, who is a co-chair of the Wisconsin Legislature’s Joint Finance Committee, offered insight into the state’s budget process and its finances, including the estimated $7 billion surplus within its coffers.

Marklein represents the 17th senatorial district. He is serving his second term. Before winning his state Senate seat, he served as a member of the State Assembly for two terms. He has served as a member of the Joint Committee on Finance, which is the Legislature’s budget-writing committee, for four sessions, according to information presented on his legislative website.

Counted among the 30 people in attendance Thursday were members of the committee and the public, including several Whitewater Common Council members, Whitewater Unified School District Board of Education members, and candidates running for school board seats in this month’s primary and on both bodies in the spring general election. State Rep. Ellen Schutt and Walworth County Sheriff Dave Gerber also were in attendance.

The event was held at 841 Brewhouse, Whitewater.

Kachel to step down as chair

In advance of Marklein’s presentation, Larry Kachel announced that he would be stepping down as Greater Whitewater Committee chairperson.

Speaking from the podium, Kachel, who is also a member of the Whitewater Unified School District Board of Eduction, told those in attendance that Thursday’s annual meeting would be his last as chairperson of the Greater Whitewater Committee.

“I’ll be stepping down in the near future — let’s just say that things are getting quite busy on the school board, and we’ll leave it at that,” Kachel said.

He planned to remain active within the group, he said, noting particular pride in “the spinoff that we did with Whitewater LEADS. That’s our program where we are getting books from the Dolly Parton Imagination Library to the kids ages 0 to 5 in the community. We went over our 20,000 books last August. We now have a grant program that we have money available for Pre-K through fifth-grade teachers in the district. We give out five up to $400 grants per year.”

Goals: Highway 12, UW-Whitewater funding, state payments for municipal funding

Also speaking from the podium, Greater Whitewater Committee President Jeff Knight talked about the organization’s goals and accomplishments.

He, too, pointed to the Whitewater LEADS program, noting its history of becoming a committee goal after the school district received a set of ACT scores, which, he said, caused committee members to reorganize their priorities, create a task force, and develop the program, focused on increasing student literacy by third grade.

Knight updated those in attendance on the status of the U.S. Highway 12 project undertaken by the committee. The goal is to make the now two-lane highway into one with four lanes.

Said Knight: “We worked on Highway 12; we got it into the (state) budget, we got it approved, everything was going fine, and then the state fell behind in the building of all these majors (roads) — there was no money — and unfortunately they did another traffic count after the (COVID-19) pandemic started, when our university kids weren’t here, and I think everybody could understand how that traffic count turned out, and so we are no longer on the list. I think they are starting to get caught up at some of the majors … and I think we are about two years out.”

In addition, Knight said the committee was involved in bringing “equity” to the allocation of general purpose revenue (GPR) to the University of Wisconsin-Whitewater.

Last spring, the group named three lawmakers — State Sen. Duey Stroebel, and then-State Reps. Don Vruwink and Cody Horlacher — each as “Legislator of the Year,” for their efforts in introducing the General Purpose Revenue Equity Bill, which focused on creating an equitable funding formula for the UW System.

According to information released by the committee last year, the GPR funding formula in use by the state allocates funding disproportionately within the UW System. The information cited the UW-Whitewater as receiving the least amount of funding, further noted that UW-Whitewater receives about $1,500 less in funding per full-time student compared to the average number received by the comprehensive campuses in the UW System.

A report describing funding allocations throughout the UW System and at the UW-Whitewater is here: https://www.uww.edu/documents/facsenate/meeting%20archive/2021-2022/2022-04-12_Senate/D2.%20FEAOC%20-%20UWW%20GPR%20Fact%20Sheet%20-%20Spring%202022.pdf.

Within his comments Thursday, Knight said he was in conversations with Schutt, adding: “So our fight has always been your kids and your grandkids — you pay taxes here, your kids deserve the same treatment as the kids up in Stevens Point and Superior. And so we will keep fighting on that issue.”

As a third goal, Knight cited reformations to the Payment for Municipal Services (PMS) program. According to literature supplied by the Wisconsin Legislative Fiscal Bureau, a nonpartisan service agency of the Wisconsin Legislature, the program disperses throughout the state annual payments to reimburse municipalities for property tax-supported expenses incurred while providing services to state facilities. Payments are made for fire and police protection, garbage and trash collection, and other approved direct services.

According to information about the program provided by the bureau in 2021, while statewide entitlements had grown between 2011 through 2020 to $53,703,005, representing a 49.8% increase over the 10-year period, PMS remained at an annual constant level of $18.6 million over the same period, with payments representing, in 2020, 34.6% of the full cost of statewide entitlements.

On Thursday, Knight said: “When the (Whitewater) fire department merged in the city because of the problem with the expense, when you’re in a college town, you’ve got a lot of ambulance, you’ve got a lot of fire, you’ve got a lot of services that other communities don’t have to provide. So one of our goals is to work to see if that 34% of the property value gets raised. It’s crucial to a community like Whitewater. … So we really need to make a case back to the Legislature why it’s pretty crucial that that footprint demands some additional pay.”

Marklein on the budget, the surplus and ‘one-time’ money

Arriving at the podium, Marklein said he was a former resident of Whitewater and attended college at the UW-Whitewater. He is by profession an accountant.

Marklein said he was the third freshman senator in the state’s history to serve on the Joint Finance Committee.

After his election to the Assembly, in 2010, he said he consulted with “one of my governmental audit partners in Madison,” who brought him “up to speed,” on governmental accounting practices, he said.

“So, I walked into that first meeting in the Legislature, and I’ll tell you what: I knew more than the 100-year veterans that were there because they didn’t understand this stuff, so anyway, I’m kind of a geek that way,” he said.

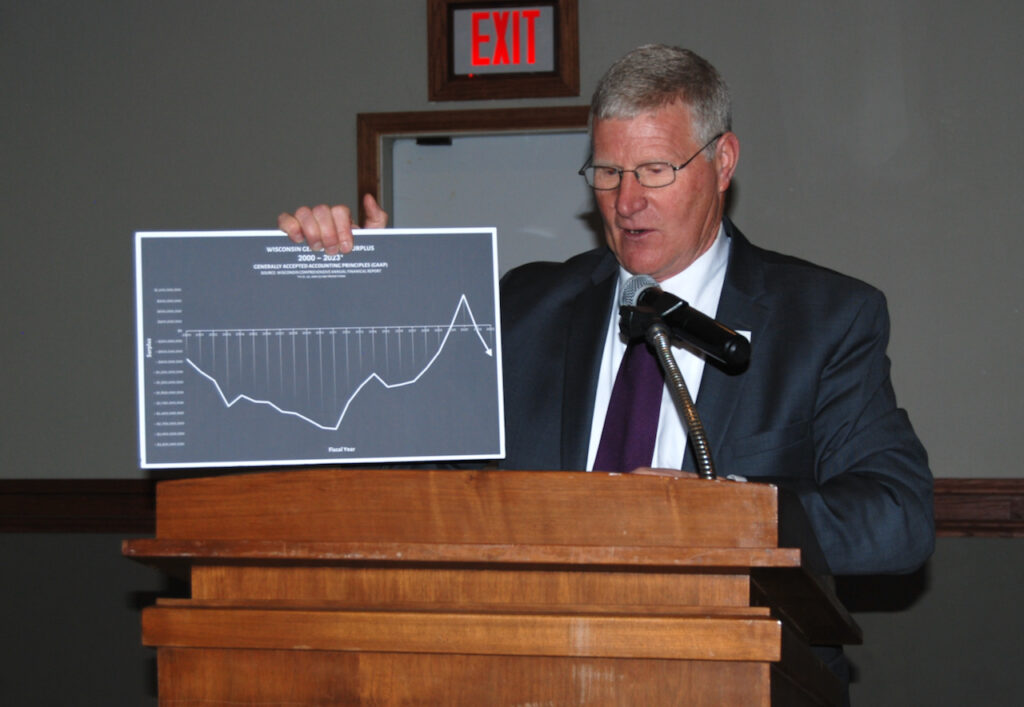

Armed with two graphs, Marklein said the first showed a historical rendering of “the balance sheet, financial position for the state of Wisconsin for the last 20 years.”

In 2000, he said, the state was “about $700 million in the hole by the end of the year and then we just spent it down until we hit a low point, here.” He pointed on the graph to the year 2010. At that point, he said, “we had about a $3 billion hole.”

Said Marklein: “People can ask: ‘I thought we had to have a balanced budget. How could that happen?’ And this was, again, at the end of the last Democratic controlled Legislature and governor, and we borrowed $1.2 billion out of the transportation fund. We took $200 and some million out of the patient compensation fund. We owed Minnesota $64 million in reciprocity payments, and all those kinds of things. You just don’t pay your bills. There’s money in the checkbook.”

Pointing to the upward trajectory depicted on the graph which followed the trough created in 2010, he said: “That was our low point, and this is where we ended up this year. And, again, on a GAP (generally accepted accounting principles) basis, $4.2 billion net surplus at the end of June 30, 2022.”

Sharing a second graph, Marklein said: “I want to point out that what the financial position in the state would have been had we adopted Gov. (Tony) Evers’ budget as is, without any changes, two years ago. And we would have gone for — everything’s the same in this graph, except for — boom — and we would have been back in the hole again. In just one budget cycle.

The graph showed the budget peaking in 2020, followed by a downward trajectory.

Turning his attention to the state’s budget surplus, Marklein said that while the number presented in the media is typically between $7 and $7.1 billion, that figure, he said, “is largely one-time money. And it resulted from increases in tax collections because of all the federal money that has come into the state of Wisconsin since the COVID, since 2020.”

Over the last two years, Marklein said, the state has received federal dollars from such sources as “stimulus payments received by people,” the PPP (Payment Protection Program) payments that businesses got,” and “people that were unemployed got an enhanced unemployment add-on to their checks.

“The governor had $4.5 billion at his discretion, the state received — it’s called FMAP (Federal Medical Assistance Percentage), the financial for Medicaid reimbursement — we got a kicker of 6.2%.”

As of last Wednesday, Marklein said, the state had received a cumulative amount of $65,259,289,581.

“I mean it’s a lot of federal money that came in. The reason I bring this up is because that federal money coming into the state of Wisconsin is also one-time money, which is what juiced the economy, sales tax, and created inflation for us, too,” he said.

He added: “In the short term, if you look at a short-term vision of what’s going on, we’re in great financial shape.”

Marklein acknowledged that several entities across the state — local municipalities, the UW-Whitewater — have expressed an interest in having more money.

“I mean there’s a lot of people that want more money. How much do you think is the ongoing surplus for the state? Because it’s not ($)7 (billion); It’s $2.9 billion,” he said, adding, “and we’ve got, that $7 billion that we have, that has been spent multiple times already.”

Looking at the budget process, Marklein said he believed it would be conducted similarly to the process used two years ago.

He said the process would likely include four public hearings held throughout the state.

“We will be doing some agency briefings and then, probably in early May, end of April, is when we really start acting on the budget,” he said.

Marklein said the governor is expected to release his budget on Wednesday, and the Joint Finance Committee would meet immediately after his address.

“Then we introduce the budget,” he said.

Marklein: ‘What I’m hearing’

Marklein shared comments about the concerns he has been hearing from constituents within his district.

“I’m in southwest Wisconsin … my district borders Iowa, and Illinois. Sometimes when people talk about raising gas tax for example, I always look at my neighbors because I’ve got Dubuque right across the river … I have people working back and forth, and going into Illinois … whether it’s tax, gas tax or for other kinds of things, when you live on a border you have to be concerned about it. People can choose where they buy things and impact our businesses as well.”

Employers in his district have noted a “lack of employees,” he said, adding that several businesses about which he was aware had closed their doors because they could not find people to work. He called the outcome “tragic.”

“To some extent, I believe government has contributed to that situation,” he said, noting that an employer with whom he spoke said he was competing for workers “with the couch.”

“Because of COVID, there’s been so many programs that have been initiated, largely funded by the federal government — all of them funded by the federal government — that, it’s made it easy not to work,” he said.

In addition, Marklein noted what he described as forecasted conditions of declining enrollment at the university level.

“I have UW-Platteville in my district,” he said, adding “the number of graduates coming out of our high schools hits its peak in 2025, and then it starts to fall off, and it’s not going to be pretty for communities like Whitewater or any campus town.”

Said Marklein: “From a policymaker’s standpoint, I don’t see us building — well, first of all, we have a lot of empty state office buildings. We’re not going to build any office buildings, we’ve got all kinds of empty space all over. As far as capacity at universities, I think we are going to have to be very strategic about where we invest state money on our campuses. There are programs obviously that are successful and growing an incredible amount of demand, and then there’s others that probably there’s not as much demand.”

Questions from the audience

Marklein next took questions from the audience.

He was asked to revisit the difference between one-time and ongoing money.

In response, he said: “We have this bubble of surplus that’s one-time money and then we’ve got this $2.9 billion stream going out into the future. I’ll tell you what, anybody could do the budget for the next two years because there is so much money there. The challenge is going to be: city, do you want one-time money or do you want something you can rely on into the future? For the school district, you want ongoing money. The ongoing money is the surplus that we project into the future. Whether its schools, whether it’s prisons, any of the shared revenue, that can rely on, so we have a lot of one-time money. It’s that one-time money, in a perfect world, would be spent on one-time projects. Maybe construction, maybe roads, I’m just thinking out loud here, why bond when you can pay cash for it? That’s one time. You’re not obligating something, an agency, into the future. So, as I’ve told some of my colleagues, I don’t want to be sitting here in two years, or four years, and say ‘jeez, I wish we hadn’t committed so much money because we don’t have the revenue anymore.’”

An audience member asked if the surplus could be used to support roads. “They stink in this state,” he said.

Marklein said he agreed.

Said Marklein: “There is going to be a lot of federal money coming in transportation, you know, federal transportation money coming into the state of Wisconsin. Also an incredible amount of money coming in for broadband. Both are needed. One of the things that I always look at, too, is capacity. Because the industry, you know, road construction, they are looking for workers, too. And sometimes in government we measure success by how much we spend. Like with transportation, I want to make sure that whatever we increase the budget by, that we get more roads, not go with the price will just go up. The money will get spent, I guarantee you that, so I want to make sure we get more done. And the same thing with broadband. And they’ve got some capacity issues as well. I want to make sure we get more miles of fiber, and we get people served, not just spend another billion dollars so that there isn’t any results for it.

“Roads would be in my opinion a great example of legitimate one-time use of that money.”

Marklein was asked to share his opinion on flat tax. He said he agreed with it, but did not see much movement on the concept given the political environment.

An audience member asked: How much of the COVID money is still available to school districts?

Marklein said that money arrived at school districts in three tranches.

“I can tell you that Milwaukee School District has three-quarters of a billion dollars of money yet to spend — federal money to spend. That’s a lot of money,” he said.

Monies remaining in school districts varied by district, he said.

“The governor has about a billion dollars left. He had $4.5 billion in his discretionary kitty and he’s got about a billion left to pay out. There’s a fair amount of money that’s out there,” he said, adding: “I will consider the amount of federal money — I don’t care whether it’s school or anybody has, in determining what the state GPR is — general purpose revenue. Because whether it’s federal money or state money it’s all green. It spends the same.

“Going back to transportation, what we did last time in the budget was the Milwaukee Transit System got an unbelievable amount of federal money. They had so much money that they wouldn’t have to charge a fare for four years and they would be just fine. So we said rather than put state transportation money into the transit system, we pulled out the state money and we allocated it to local roads, which is why our local roads budget was really pretty good. And Milwaukee’s fine, I mean at the transit system, they got plenty of money there. We will likely, you know, certainly take a look at that.”

Looking again at dollars for broadband expansion, he said: “At least $1.1 billion of federal money (is) coming in (to the state) plus there’s a couple others, USDA money coming in for broadband … I’m going to be kind of cautious about putting more state money into it unless there’s a good reason to do that.”

Marklein was asked if the state budget would include funding to help communities provide services and share costs associated with immigrants coming into the state.

Said Marklein: “I don’t know that I have an opinion that really matters. That’s a federal issue and they are going to have to deal with that.”

Responding to a question about crime, Marklein said: “One of the things we are looking at is the whole shared revenue formula and system. The shared revenue formula I don’t think has been touched since about 2004, and it’s broken.”

He added: “Part of that is to reform some of the problems they’ve got in Milwaukee — primarily their pension system — but also part of that is to make sure that if they get new revenue, which they could, that it goes to cops on the street. Because I don’t want them to get a chunk of money and hire a new diversity department or whatever. I want cops on the street. That’s stuff that hopefully, we put new money in, it ends up with more cops on the street.”

An audience member enumerated several issues, which, he said, were “hurting” UW-Whitewater. He cited a lack of a four-lane highway, the absence of building projects on campus, but, he said, the “the biggest one” is the university’s lack of funding provided through GPR.

Citing the GPR program, the audience member said: “Our average investment by the state, per student, is the lowest by far … so this cumulative effect of this disinvestment is incredibly problematic for our town, and especially if we look at the 2025 enrollment cliff that you were talking about.”

“That decision, I believe, is largely made by the Board of Regents. If you want to do that (put more money into the GPR program) you are probably talking a separate bill,” Marklein said, adding: “Given the current environment, it’s not going to be an easy fix.”

Interview with FAO

After the presentation, Marklein granted Fort Atkinson Online a brief interview.

Fort Atkinson Online shared with Marklein our understanding of discussions held at the local level — at school districts and within municipalities — during which officials note that they find themselves placed in a position where they must use one-time monies, such as those received through the Elementary and Secondary School Emergency Relief (ESSER) and American Rescue Plan Act of 2021 (ARPA) funds, to cover recurring or operational expenses. Pointing to reduced or withheld state aid, officials say the message from the state Legislature is to use the one-time money in lieu of state aid. Another alternative is asking constituencies for money to support recurring costs through the referendum process.

Local officials have asked the Legislature to consider increasing ongoing state aid to pay for ongoing expenses.

Said Marklein: “So, Milwaukee Public Schools, they have three-quarters of a billion dollars that they are sitting on right now. Why should taxpayers in my district give them more tax money when they have got a lot of federal money? It all spends the same. I don’t think it’s unreasonable, when you’ve got resources already that, you know, it all spends the same. Now, having said that, I fully understand, like with K-12 school districts, that we’re going to have to make up for … you know inflation is hitting them, I get it. And as far as the communities, you know shared revenue, if we are able to put something together, which I hope we are, they’re going to be receiving a significant boost in their base funding.”

He agreed, he said, that there is a need for local governmental units to receive ongoing funds to cover the costs associated with operational expenses and inflation.

“We are working on all of those issues right now. I can’t tell you where we are going to end up. I fully understand the problem,” Marklein said, adding: “Given the extent of conversation that we have had with local government, the League of Municipalities, Wisconsin Towns Association, Wisconsin Counties Association, I mean and the amount of effort that’s gone in already on this topic, I am hopeful that there will be relief for our municipalities and local units of government in this next budget.”

Advancing possible ideas for the state’s one-time surplus gained through federal dollars, he said: “If we were smart, we’ll dedicate it to one-time kinds of things.”

Considering the full surplus for recurring costs, he said: “It’s not to say you can’t fund that for a while, but eventually that’s going to run out. If you had a pot of money — let’s say you are making $50,000 a year of ongoing salary, that’s what you can live on — and you got an inheritance of $100,000, now, you can live off this $100,000 for a while, but to the extent that you build that into your budget, it’s going to run out.”

Two photos above: At top, State Sen. Howard Marklein, who also is a co-chair of the Joint Finance Committee of the Wisconsin State Legislature, shares a graph showing the state’s financial condition between 2000 and 2022. Above, Marklein produced a second graph, which, he said, showed what the state’s financial condition would have been had the Legislature passed unchanged a budget submitted two years ago by Gov. Tony Evers.

Greater Whitewater Committee Chairperson Larry Kachel addresses audience members.

Greater Whitewater Committee President Jeff Knight addresses audience members.

Whitewater Common Council member Jill Gerber and her husband Walworth County Sheriff Dave Gerber arrive at the Greater Whitewater Committee annual meeting.

State Sen. Howard Marklein, at left, visits with Whitewater business owner Geoff Hale during a reception held in advance of the meeting’s keynote speaker presentation.

Whitewater Common Council President Lisa Dawsey Smith, at left, and State Rep. Ellen Schutt visit in advance of the program.

Sen. Howard Marklein addresses event-goers from the podium.

Whitewater Common Council member Jim Allen, at center, visits with event participants during the opening reception.

Kim McDarison photos.

This post has already been read 1297 times!