By Kim McDarison

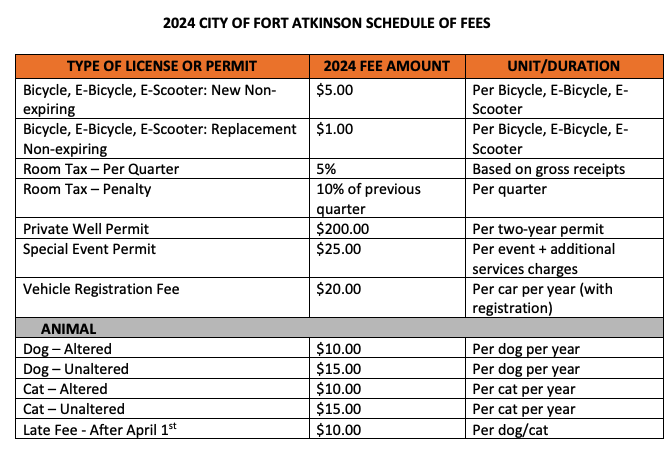

The Fort Atkinson City Council Tuesday in three separate actions approved a 2024 operating budget for the city and set a property tax levy to fund it, confirmed the total levy taxing jurisdictions in the city and determined its mill rate, and established the 2024 schedule of fees which will be charged in 2024 for various licenses, permits and services made available to residents by the city.

Council also approved the city’s capital improvement budget for 2024 and its 2025-2029 capital improvements projects plan (CIP).

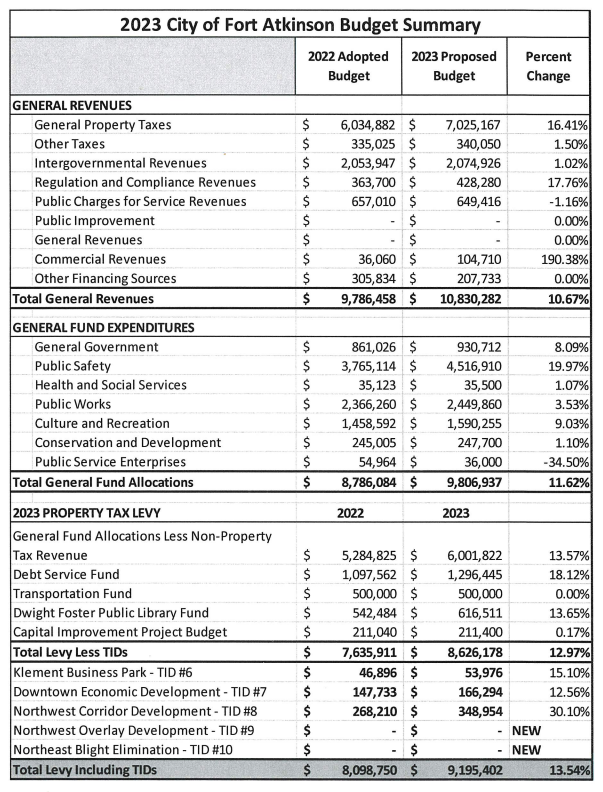

According to a budget summary provided to council members on Tuesday, the city, in 2024, will operate using a budget of $10,070,400, which, the summary noted, is 8.31% less than the budget used by the city in 2023, when it operated using $10,983.423. Of the total budget amount, in 2023, $9,195,402 was collected through the taxpayer supported levy. In 2024, $9,300,627 will be supported by the levy, an increase over last year of 1.14%.

General revenues

A breakdown of general revenues, as supplied by the city, showed that the 2024 budget incorporates $6,052,414 in general property taxes, which represents a 13.85% decrease from general property taxes applied in 2023 of $7,025,167.

Other general revenues included: “other taxes,” of $350,150, a 2.97% increase over similar taxes, in the amount of $340,050, applied in 2023; “intergovernmental revenues” of $2,222,572, representing a 7.12% increase in similar revenues of $2,074,926, applied in 2023; “regulation and compliance revenues” of $452,100, representing a 5.56% increase over similar revenues of $428,280, applied in 2023; “public charges for service revenues” of $682,579, representing an increase of 5.11% over similar revenues of $649,416 applied in 2023; “commercial revenues” of $150,060, representing a 43.31% increase over similar revenues of $104,710 applied in 2023, and “other financing sources” of $160,525, representing a decrease of approximately 55% from similar revenues of $360,874 applied in 2023.

General fund expenditures

Under a heading of “general fund expenditures,” the summary noted the following: fund allocations were made in the amount of $9,862,244 in 2023. In 2024, allocations are the same as general revenues, in the amount of $10,070,400, which represents an increase of 2.11%.

A breakdown of expenditures is as follows: “general government,” in 2023, $962,660, and in 2024, $957,734, representing a 0.51% decrease; “public safety,” in 2023, $4,516,910, and in 2024, $4,758,325, representing a 5.34% increase; “health and social services,” in 2023, $35,500, and in 2024, $33,000, representing a 7.04% decrease; “public works,” in 2023, $2,449,860, and in 2024, $2,428,941, representing a 0.85% decrease; “culture and recreation,” in 2023, $1,600,453, and in 2024, $1,627,315, representing a 1.68% increase; “conservation and development,” in 2023, $260,861, and in 2024, $225,085, representing a 13.71% decrease, and “public service enterprises,” in 2023, $36,000, and in 2024, $40,000, representing a 11.11% increase.

2024 property tax levy

According to the summary, general property taxes achieved through the levy in 2023 were $6,001,822. In 2024, similar levy-achieved revenues are calculated at $6,052,414. Other totals derived through the levy include: “debt service fund collected in 2023 in the amount of $1,296,445. In 2024, the amount that will be collected through the levy is $1,397,791, representing an increase of 0.84%. In 2023, $500,000 was collected for the city’s Transportation Fund. The same amount will be applied in 2024, representing no percentage change. In 2023, $616,511 was collected through the levy for the Dwight Foster Public Library Fund. In 2024, $616,000 will be applied, representing a 0.08% decrease. In 2023, $211,400 for the CIP budget was funded through the levy. In 2024, $201,500 will come from that source, representing a decrease of 4.68%.

Impact to levy from TIDs

As itemized in the summary, the city has five active TIDs, two of which are new this year. They are the “Northwest Overlay Development” area known as TID No. 9, and the “Northwest Blight Elimination” area, knowns as TID No. 10. Older TIDs include: the Klement Business Park or TID No. 6, the “Downtown Economic Development” area or TID No. 7, and the “Northwest Corridor Development” area or TID No. 8.

Taxes collected through the levy in support of the TIDs are as follow: TID No. 6, in 2023, $53,976, and in 2024, $50,990, representing a 5.53% decrease; TID No. 7, in 2023, $166,294, and in 2024, $153,570, representing a 7.65% decrease, and TID No. 8, in 2023, $348,954, and in 2024, $328,362, representing a 5.90% decrease.

Final analysis

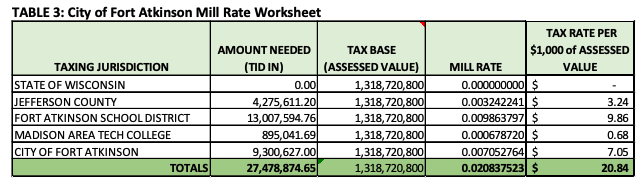

As part of a “final analysis,” provided within a document to council members in Tuesday’s meeting packet, City Manager Rebecca Houseman said the levy was calculated using a total assessed value of all properties within the city of $1,318,720,800, producing a mill rate of $7.05 per $1,000 of assessed property value to support the city’s portion of the full levy.

As stated within the budget resolution adopted Tuesday, the levy calculated this year to support city operations in 2024 shows a $105,225 or 1.14% increase over the levy calculated in 2022 to fund the city’s budget in 2023.

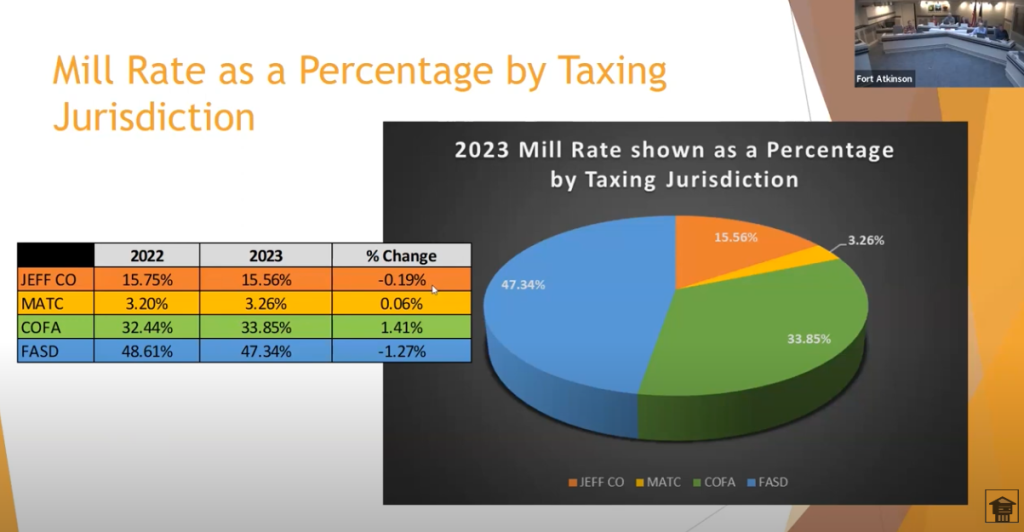

During a presentation made before council on Tuesday, Houseman, offering an understanding of the city’s decreased mill rate, noted that the city’s recent interim market update increased assessed property values by “around 48%.” She added that when property values are increased, typically mill rates are decreased, and taxes “remain about the same.”

Houseman noted that the city’s portion of the levy would be included within the total tax levy, which includes monies used to support three other taxing jurisdictions, including the School District of Fort Atkinson, Jefferson County, and the Madison Area Technical College.

The mill rates for the additional taxing jurisdictions, as reported by the city, are as follow: School District of Fort Atkinson, $9.86; Jefferson County, $3.24, and Madison Area Technical College, $0.68.

Within her presentation, Houseman said that each of the taxing jurisdictions affecting Fort Atkinson taxpayers showed a decrease in their requested funding for 2024.

With all four taxing districts included, the total levy for city of Fort Atkinson taxpayers in 2024 is $28,343,552, which Houseman wrote, equates to an overall mill rate for city-based taxpayers of $20.84 per $1,000 of assessed property value.

She additionally wrote that the calculated mill rate as presented Tuesday did not include the “school levy tax credit,” which, she wrote, “can reduce the overall mill rate by $2 per $1,000 of value.”

During Tuesday’s meeting, Houseman said that with the school tax credit reflected on the December tax bills, the full mill rate, with all four taxing jurisdictions included, should be $18.89.

In November of 2022, Houseman presented an operating budget of $9,195,402, which, she noted at the time, was an increase of 13.54% over the 2021 levy used to support the 2022 budget.

Last November, Houseman stated that the increases were primarily related to wage and benefit hikes across all departments, with the budget including a 4% wage increase for all employees, providing a $10 an hour minimum wage.

The largest increase made in 2022, in support of the 2023 budget, was attributed to changes made to public safety, with those costs increasing by some 20%, Houseman said, which included a mix of negotiated wage and benefit increases, along with additional staffing brought by the public safety referendum approved in April of 2022.

In 2022, the city’s portion of the mill rate was estimated at $9.91 per $1,000 of assessed property value, which, Houseman said, represented an increase over the previous year of $1.21.

An earlier story about the city’s budget and mill rate, as calculated in 2022 to support the 2023 budget, is here: https://fortatkinsononline.com/fort-city-council-receives-budget-presentation-tax-levy-increase-of-13-54-anticipated/.

A story about the city’s approved CIP will soon be published.

A summary, shown above, compares revenues, expenditures and allocations made in support of the 2023 budget and the recently approved budget to fund the city’s operations in 2024.

A summary, shown above, compares revenues, expenditures and allocations in support of the 2023 budget, while offering comparisons to the budget as it was developed in 2022.

A chart, shown above, offers calculations, as provided to Fort Atkinson City Council members in their Tuesday meeting packet, for each of the four taxing jurisdictions which support their budgets through the levy process. Taxpayers with properties in the city of Fort Atkinson can expect to pay the above charted mill rates. Property owners will find the above mentioned rates on their 2023 property tax bill. Revenues will be used to support the city’s 2024 operating budget.

A slide shared by City Manager Rebecca Houseman on Tuesday offers a pie chart showing the percentage of the full levy each taxing jurisdiction uses to fund its budget. The graphic on the left compares the percentages for each jurisdiction collected in 2022, used to fund the 2023 budget, and in 2023, which will be used to fund the 2024 budget.

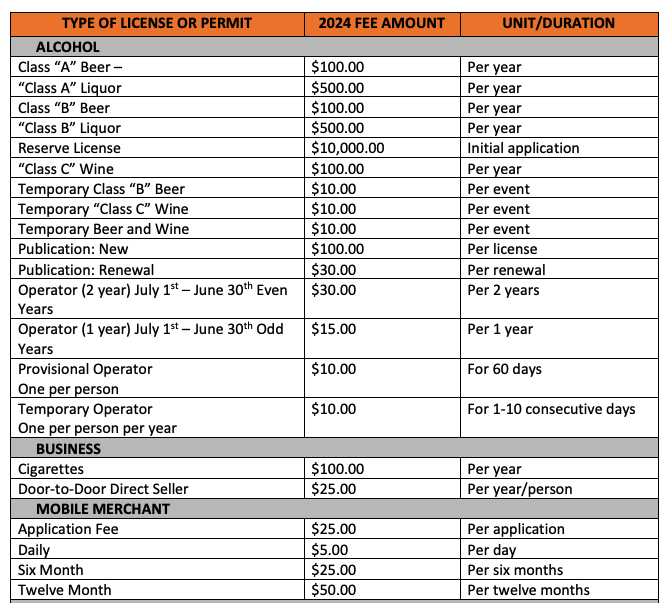

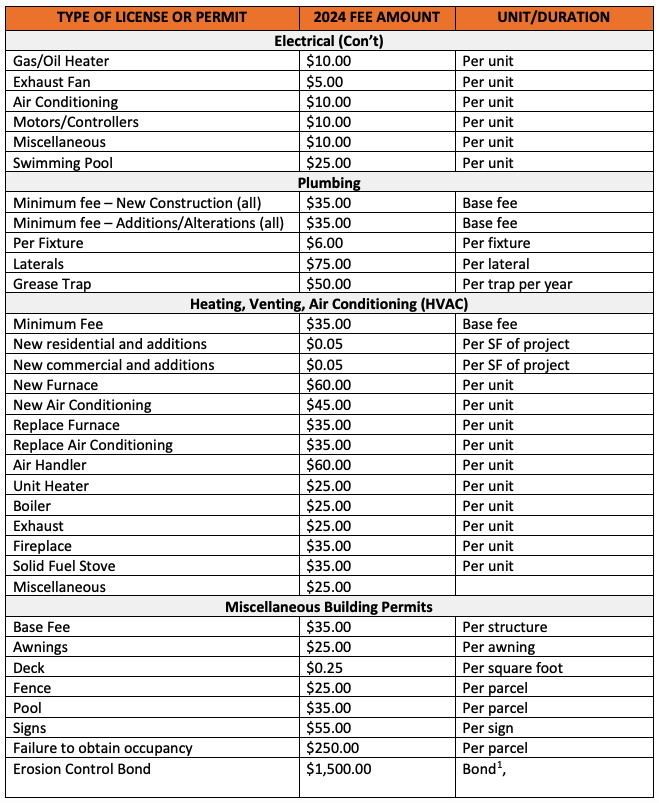

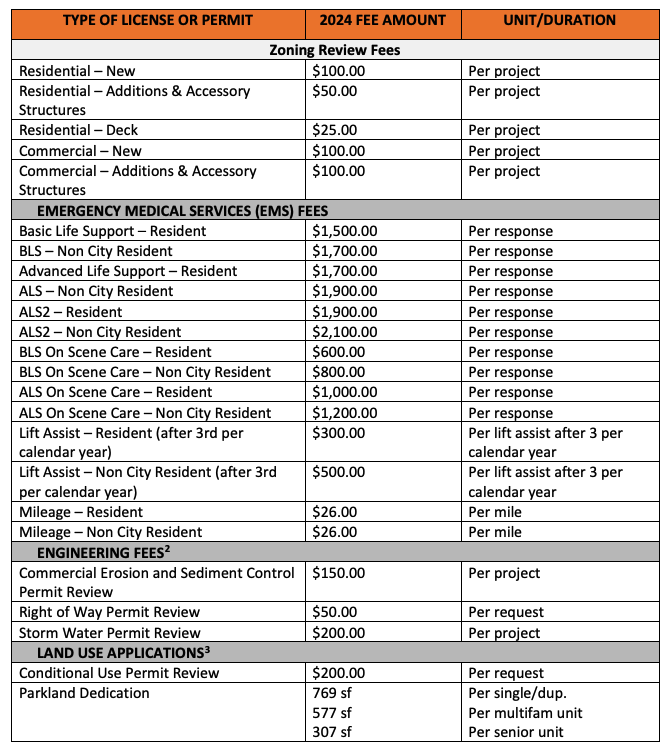

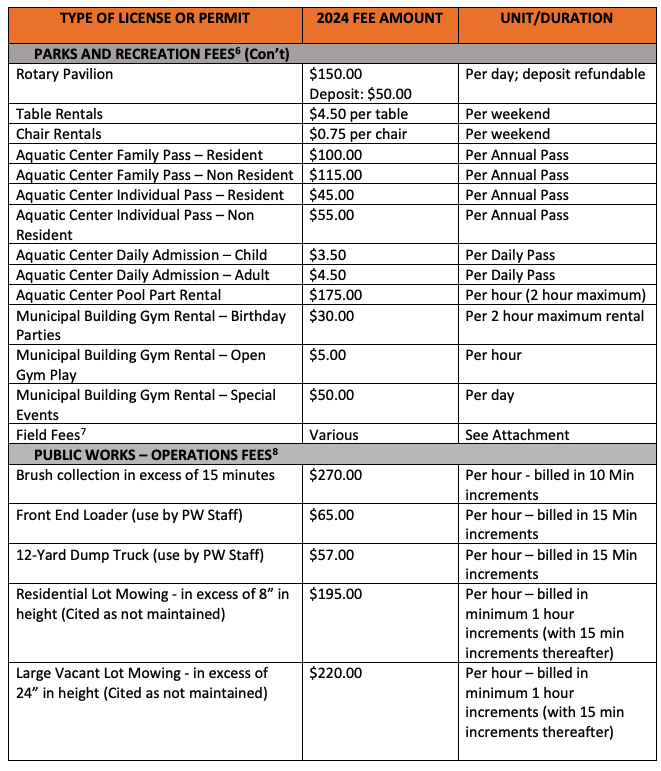

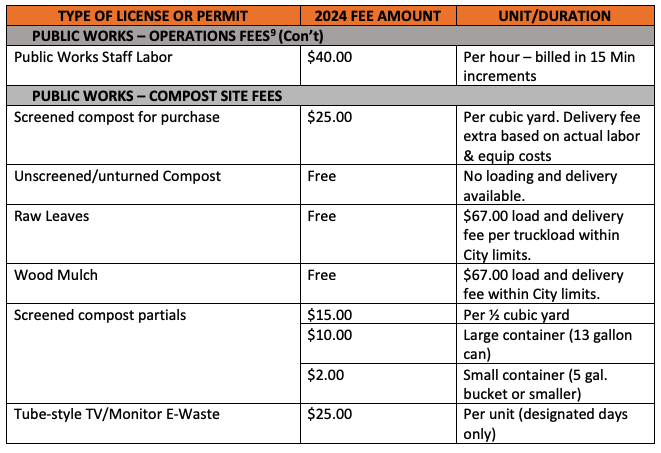

Above is a list of new fees associated with permits, licenses and services within the city of Fort Atkinson. New fees will become effective Jan. 1, 2024.

Members of the Fort Atkinson City Council assemble Tuesday, during which time they approved several resolutions, setting the 2024 operational and capital improvement budgets, along with a schedule of fees to be paid by residents in 2024. members include Councilperson Kyle Jaeckel, from left, City Clerk Michelle Ebbert, Council President Pro Tem Eric Schultz, who presided over the meeting in President Bruce Johnson’s absence, City Manager Rebecca Houseman, City Attorney David Westrick, and councilpersons Davin Lescohier and Mason Becker. Screen shot photo.

This post has already been read 2398 times!