By Kim McDarison

The Jefferson County Board of Supervisors Finance Committee met Thursday during which a countywide levy and mill rate were approved and recommended by the committee for final approval by the full board.

The resolution to approve the countywide levy and mill rate will come before the board for final approval on Tuesday, Nov. 9.

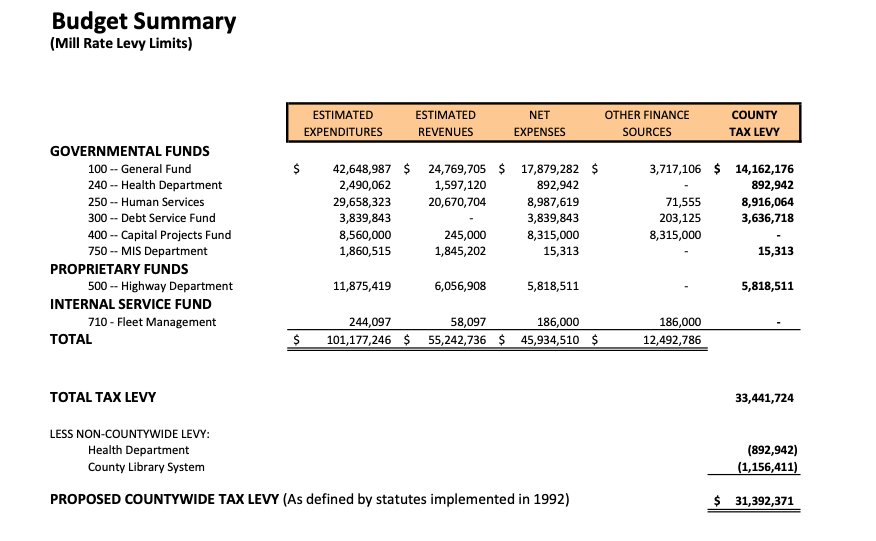

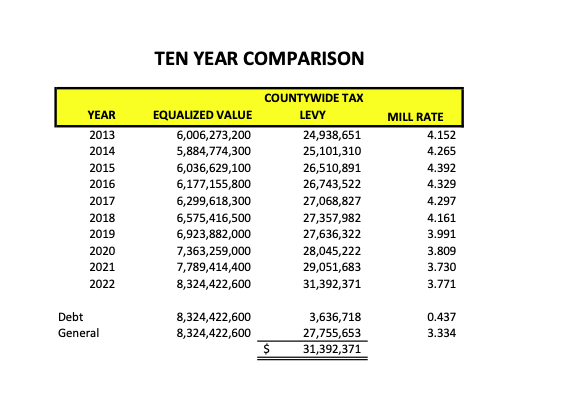

A summary sheet within the full 488-page budget document notes that county residents in 2022 will be asked to support a tax levy of $31,392,371. Taxpayers will find a mill rate of $3.77 included on their property tax bills, which is the apportioned amount paid to support countywide services. The countywide mill rate is applied to the equalized value of property, meaning county residents will pay $3.77 for every $1,000 worth of equalized property value.

The countywide equalized value, which represents the full taxable value of property within the county as determined by the Wisconsin Department of Revenue, is just over $8.3 billion.

An explanation of equalized value and how it is calculated is here: https://www.revenue.wi.gov/DOR%20Publications/wieqval.pdf#:~:text=The%20%EE%80%80Equalized%20Value%EE%80%81%20is%20the%20estimated%20%EE%80%80value%EE%80%81%20of,two%20broad%20categories%2C%20real%20property%20and%20personal%20property.

The county budget document also provides a ten-year comparison of countywide equalized value, including tax levies applied in each of the last ten years and the associated mill rates. (See chart below.)

In 2021, taxpayers saw a mill rate of $3.73 which was used to support a levy of $29,051,683.

Levy calculation

Numbers appearing on the budget summary sheet show eight funds used to comprise the budget, including: Fund 100, general funds; Fund 240, Health Department; Fund 250, Human Services; Fund 300, Debt Service Fund; Fund 400, Capital Projects Fund; Fund 750, MIS Department; Fund 500, Highway Department, and Fund 710, Fleet Management.

Of the eight funds, six are funded, in part, through the county tax levy. They are: the General Fund, in the amount of $14,162,176; Health Department fund, 892,942; Human Services fund, $8,916,064, Debt Service fund, 3,636,718; MIS Department fund, $15,313, and the Highway Department fund, $5,818,511.

Two funds, the Capital Projects fund and the Fleet Management fund, show no funding coming through the property tax funded levy.

Of the county’s full budget, with expenditures estimated in 2022 at $101,177,246, $55,242,736, or 55%, is funded through sources other than the tax levy. Another $12,492,786, or 12%, is funded through “other finance sources,” with the total tax levy of $33,441,724 accounting for 33%. The calculation next removes two “non-countywide levy funds included under the headings of “health department,” in the amount of $892,942, and “County Library System,” in the amount of $1,156,411, bringing the countywide levy to $31,392,371.

Breakdown of revenues and expenditures in 2022

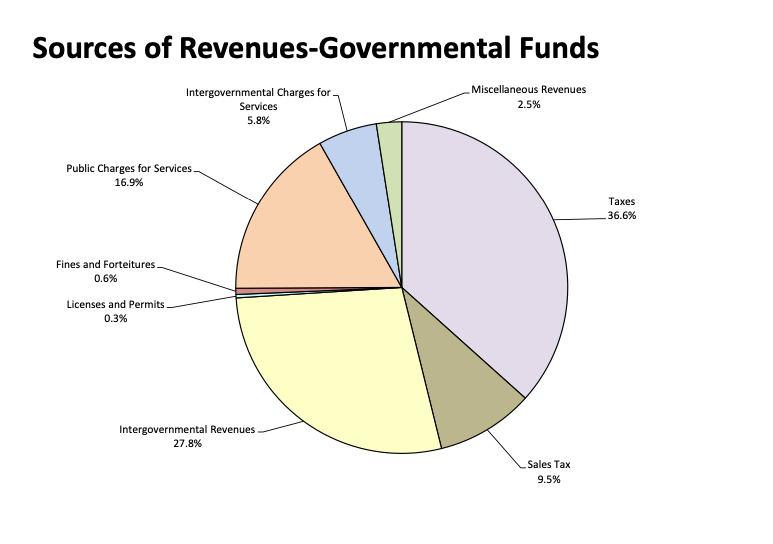

A pie chart within the document breaks down “sources of revenues-governmental funds,” by percentage of funding for the full budget as follows: “Taxes,” 36.6%; “Intergovernmental Revenues,” 27.8%; “Public Charges for Service,” 16.9%; “Sales Tax,” 9.5%; “Intergovernmental Charges for Services,” 5.8%; “Miscellaneous Revenues,” 2.5%, and shows categories such as fines and forfeitures, and licenses and permits each contributing less than 1%.

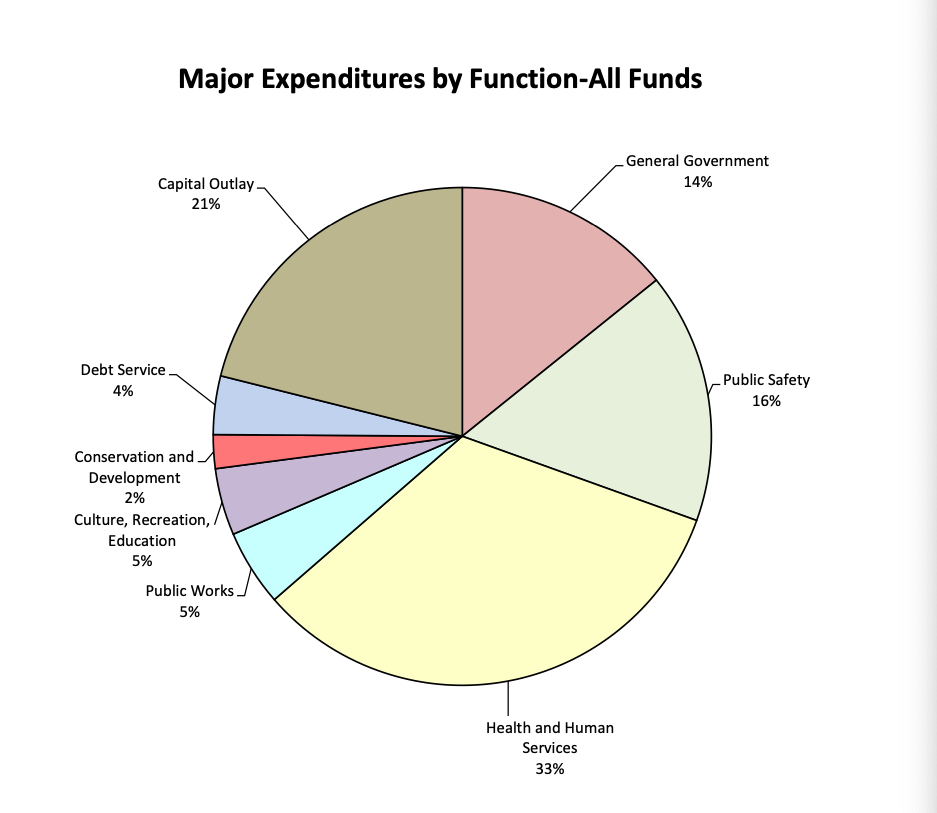

Of the county’s total 2022 anticipated expenditures, calculated at $101,177,246, a pie chart, indicating expenditures associated with eight “major” functions within “all funds” as associated with county government, shows Health and Human services, with expenditures of $33,504,402 or 33%; Capital Outlay, with expenditures of $21,345,444, or 21%; Public Safety, with expenditures of $16,467,512, or 16%; General Government, with expenditures of $14,385,861, or 14%; Culture, Recreation, Education, and Public Works, each coming with expenditures representing 5%; Debt Service, with expenditures representing 4%, and Conservation and Development, with expenditures representing 2%.

Capital projects 2021, 2022

According to a “Summary Highlights” narrative included within the budget document, amounts spent for capital projects in 2021, in the amount of $4,298,243, and monies earmarked to be spent in 2022, in the amount of $8,560,000, coming from intergovernmental revenues and “other financial sources,” will be used to fund 911 telecommunications upgrades and an improvement project on the county’s “South Campus Building.”

Funds meant to support any work left undone in 2021 will, through the “budget carryover process” be moved to the 2022 budget, according to the summary.

“The county anticipates that it will issue $8 million in bonds for improvements to the courthouse/sheriff/jail complex during late 2021,” the summary states.

Further, the document notes that two improvements to the South Campus will be funded using federal ARPA (American Rescue Plan Act of 2021) proceeds. They are: $130,000 to be spent for HVAC and ventilation improvements at the Workforce building and $115,000 for LEC lighting improvements at the Human Services building.

The full county budget document is here: https://files4.1.revize.com/jeffersoncountynew/Budget/2022%20Budget/2022%20Budget%20Book.pdf.

The above chart, as included within the Jefferson County 2022 budget document, shows the calculations used to produce the 2022 countywide tax levy.

The above chart, as included with the county’s 2022 budget document shows, a 10-year history of the countywide total equalized value, tax levies and their associated mill rates.

The above pie chart, as included within the county’s 2022 budget, shows revenue sources used to fund expenses in 2022 as a percentage of the total budget.

The pie chart above, as included within the county’s budget document, shows major expenditures anticipated in 2022 as a percentage of the total budget.

This post has already been read 830 times!