By Kim McDarison

Members of the Whitewater Common Council Tuesday received an updated budget briefing.

According to Whitewater Director of Finance Steve Hatton, depending on the outcome of a $1.1 million fire and EMS referendum question, which will be brought before city of Whitewater voters for approval during the Nov. 8 election, one of two proposed budgets — one if the referendum is approved by voters and one if it is not — will be adopted by the council on Nov. 15.

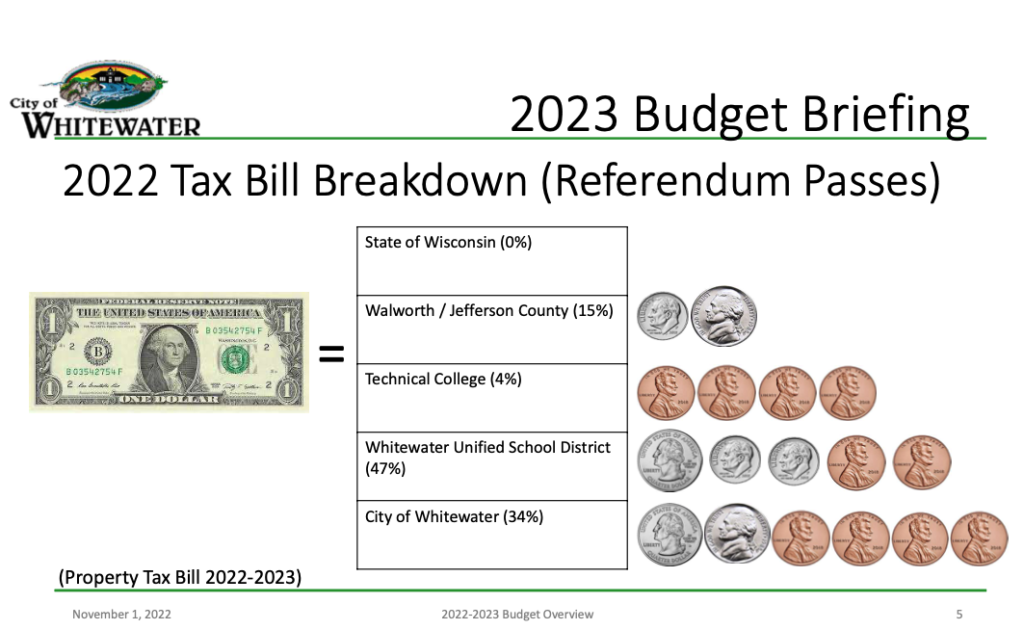

Four taxing jurisdictions

Aided by slides, Hatton noted that four taxing jurisdictions receive a portion of the tax levy charged against property owners within the city, with those dollars used to support services delivered by each jurisdiction. They are: Walworth and Jefferson counties, each of which receive 15% of the overall levy; the area technical college, which receives 4% of the levy; the Whitewater Unified School District, which receives 47% of the levy, and the city, which receives 34% of the levy.

The slide shown above and presented to the Whitewater City Council Tuesday by Director of Finance Steve Hatton uses a graphic to depict the percentage of the full tax levy supported by residents of Whitewater used to fund services provided by each of four taxing jurisdictions: the county, technical school, public school district and city.

Two city budgets developed

Among goals set by the city in advance of the Nov. 8 election, Hatton said two budgets were developed, each of which would deliver a plan for wage treatment given the inflationary environment, which, as reported in August by the Consumer Price Index, was 8.3%, and maintain a fund balance equal to or greater than 20% of the city’s general fund operating budget.

Would the city’s fire and EMS referendum receive voter approval, the city would use $1.1 million collected through the levy and above the state-imposed revenue cap to sustainably close the city’s share of the funding gap. The gap represents a different in cost between operating the city’s fire and EMS department as an outside nonprofit agency as opposed to an in-house department with city-employed staff. The additional funding would be used to maintain EMS onsite staffing up to 17 full-time employees, and allow the city to fully fund the replacement of fire and EMS equipment without accruing debt.

During the presentation, Hatton said the money would allow the city to operate two ambulances staffed by in-house EMS personal on a 24/7 bases.

Additionally, Hatton noted, the full budget, would the referendum pass, would allow the city to offer a 4.0% wage increase which would give more flexibility when recruiting and retaining staff and would also include $28,000 coming from within the general fund to pay for a solid waste and recycling fee increase.

Would the referendum fail, the city would be in a position to operate one ambulance on a 24/7 bases, Hatton said.

Other changes to the budget, would the referendum fail, would include billing a $15.15 per month waste recycling fee directly to service users, and deferring transfers of money that might have been used for street repair and equipment replacement.

Among proposed changes within the city’s operating budget in either scenario — the referendum does or does not pass — plans call for parks and recreation overhead to be move to the city’s Fund 248, and changes to be made within the operation of street lights designed to reduce expenditures for electricity.

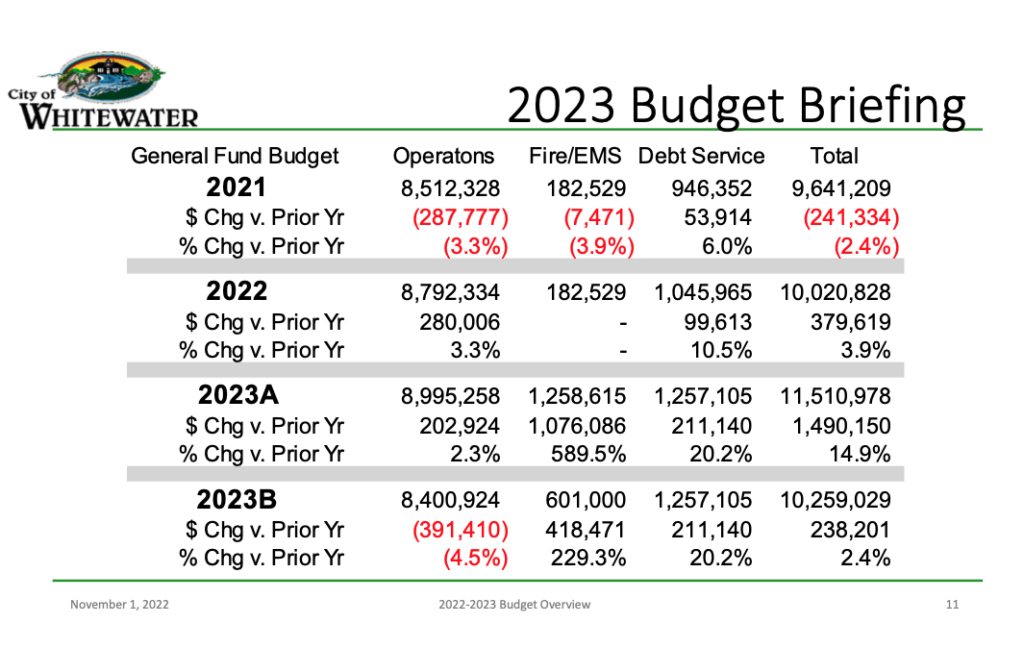

Comparing budgets

Looking comparatively at the general fund budget last year, this year, and including the two proposed budgets for 2023, numbers are as follows:

• in 2021, the city operated using a total general fund balance of $9,641,209, with $8,512,328 used to fund operations, $182,529 used to support the city’s fire and EMS department, which then operated as a nonprofit, independent agency, and $946,352 was used to support debt service.

• In 2022, the city operated using a total general fund balance of $10,020,828, with $8,792,334 used to fund operations, $182,529 used to support the fire and EMS department as a nonprofit, independent agency, and $1,045,965 used to support debt service.

• In 2023, would the referendum succeed at the ballot, the city would operate using a total general fund balance of $11,510,978, with $8,995,258 used to fund operations, $1,258, used to support the fire and EMS department, which, this year, was brought in-house and will henceforth operate as a city-managed agency, and $1,257,105 used to support debt service.

• In 2023, would the referendum fail on Tuesday, the city would operate using a total general fund balance of $10,259,029, with $8,400,924 used to fund operations, $601,000 used to support an in-house fire and EMS department, and $1,257,105 used to support debt service.

The slide above, as provided by Hatton, shows a comparison between monies used to support the city’s general fund, and fire and EMS department, last year, this year, and next year. In 2023, the comparison offers two budgets, one developed with referendum monies included, and one without.

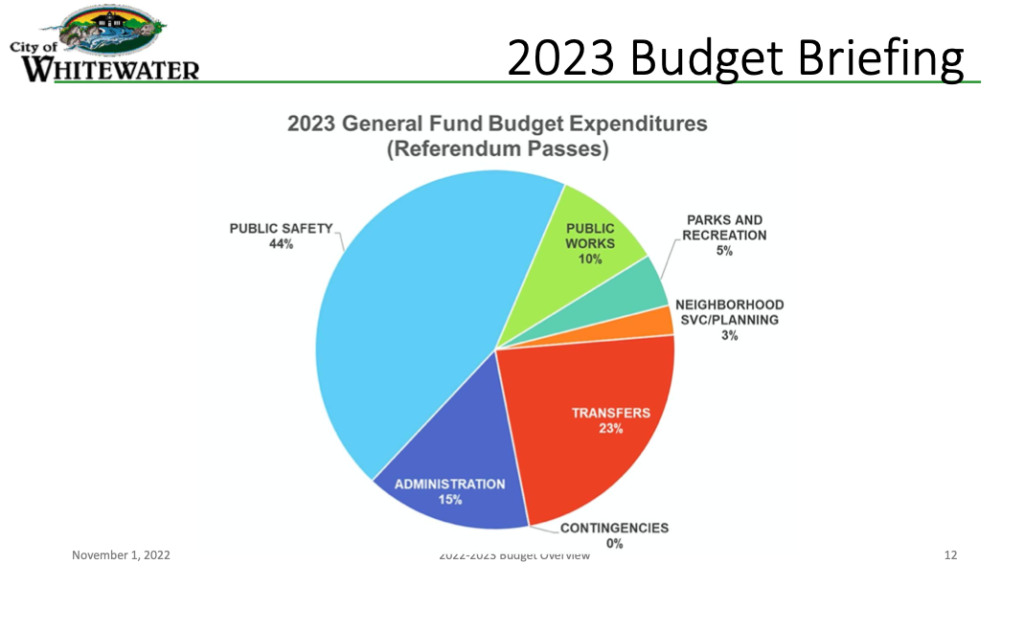

Referendum passes: general fund expenditure, revenue breakdown

During his presentation, Hatton shared a pie chart showing the breakdown by percentages of expenditures funded within the city’s budget.

Among expenditures, 44% of the general fund is used to support public safety, according to the chart. Another 23% was marked “transfers,” with 15% used to support “administration,” 10% used to support “public works,” 5% earmarked for parks and recreation, and 3% used for neighborhood services and planning.

The pie chart above shows the breakdown by percentages of expenditures funded within the city’s budget.

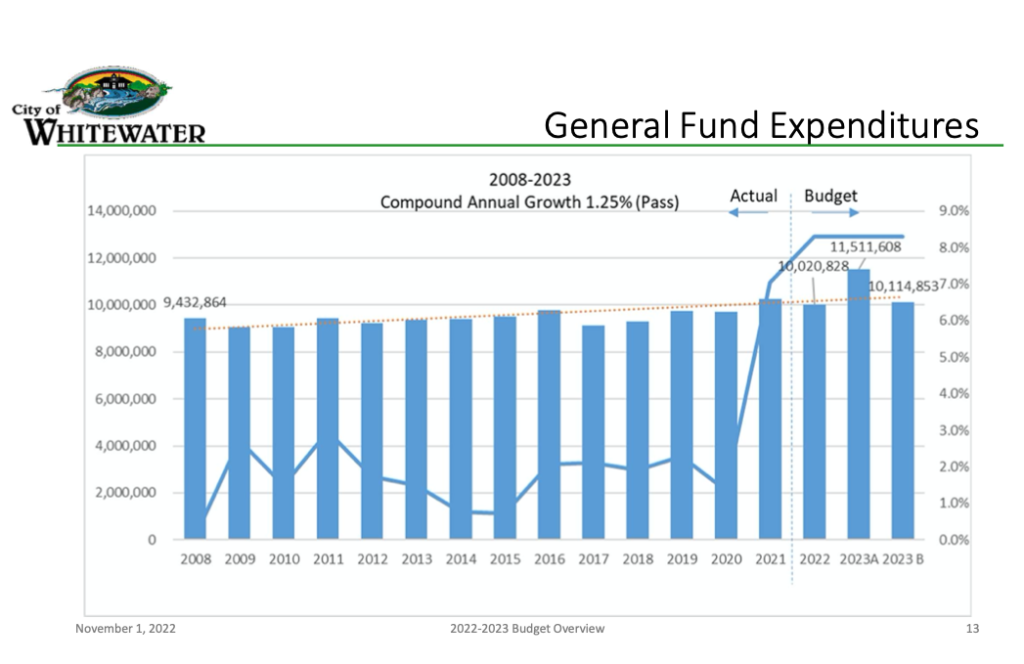

Additionally, Hatton produced a bar chart, above, showing annual growth in expenditures between 2008 and 2023, including a bar to represent each of the proposed budgets associated with the referendum’s outcome.

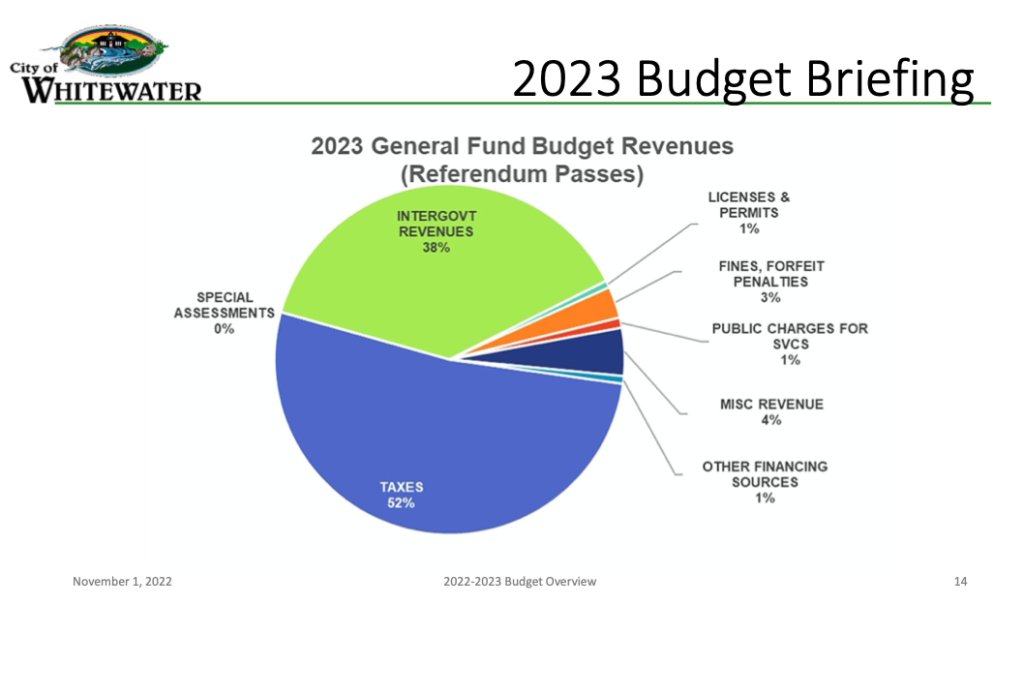

A second pie chart, above, showed the breakdown by percentages of revenues used to fund the city’s budget.

Among revenues, 52% is obtained through taxes. Another 38% is obtained through “intergovernmental revenues,” with 4% coming through “miscellaneous revenue,” 3% gained through fines, forfeitures and penalties, 1% obtained through licenses and permits, 1% coming from public charges for service, and another 1% earned through “other financing sources.”

Referendum passes: total levy, mill rate

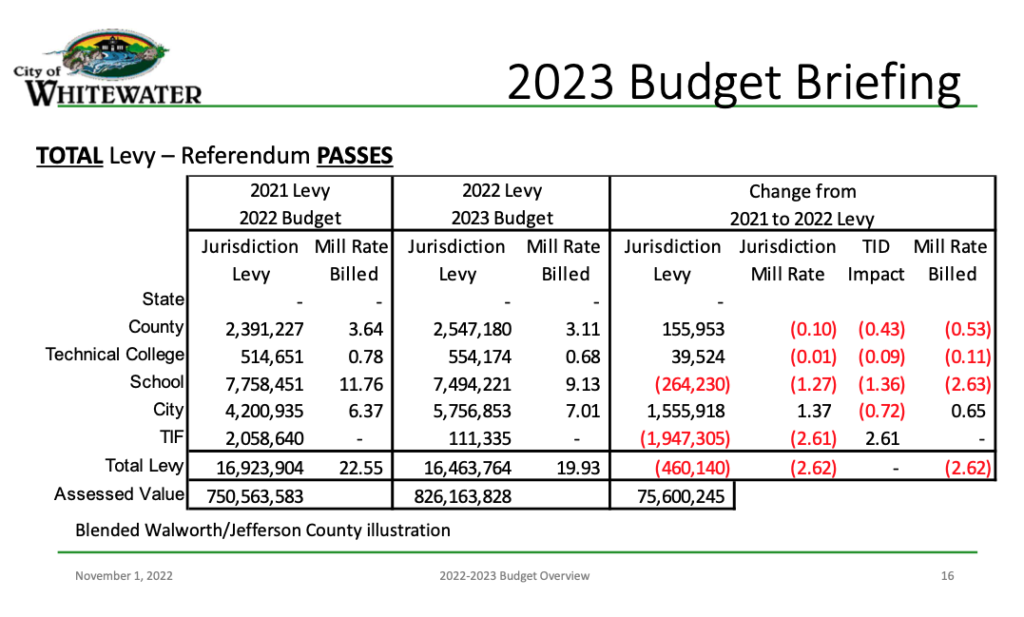

Using a blended Walworth and Jefferson county illustration, defined by Hatton as one using a weighted average mill rate, based on equalized value in each county, used to represent rates in both Walworth and Jefferson counties, numbers presented Tuesday are as follows: the tax levy paid by Whitewater residents in 2021 and used to support services in 2022 delivered by the four taxing jurisdictions — county, technical college, school district and city — was $16,923,904. The levy was assessed against the equalized property value of all homes within the city, and calculated by the Wisconsin Department of Revenue at 750,563,583. The full mill rate paid by the city’s taxpayers was $22.55 per $1,000 of home value. In 2022, would the referendum pass, the levy paid by taxpayers to support 2023 budgets across the four jurisdictions is $16,463,764, calculated against a total equalized property value of 826,163,828, which is collected using a mill rate of $19.93 for taxpayers within the city.

The illustration shows that among factors affecting the full levy and mill rate is the closing of a Tax Incremental Financing District (TID), which, the chart shows, added back into the tax roles some $1,947,305 in revenue, which was then redistributed back to the four taxing jurisdictions. The reintroduction of those monies lowered the full levy and the mill rate, Hatton said.

Looking at the portion of the levy used to support the city’s budget, this year, taxpayers will be asked to support $5,756,853, with a mill rate of $7.01 per $1,000 of home value to support city services delivered in 2023. The number represents an increase in the levy used to support the city’s budget last year, which was $4,200,935, with a mill rate of $6.37.

Looking at the other taxing jurisdictions, the (blended) county levy in 2021 was $2,391,227, supported by a mill rate of 3.24. In 2022, the levy is $2,547,180, supported by a mill rate of $3.11. The technical college levy in 2021 was $514,651, with a mill rate of 78 cents. In 2022, the levy is $554,174, with a mill rate of 68 cents. In 2021, city of Whitewater residents supported a Whitewater Unified School District levy of $7,758,451 which came with a mill rate of $11.76. In 2022, the school district levy is $7,494,221, with a mill rate of $9.13.

The chart above shows total levy amounts developed across the four taxing jurisdictions in 2021 and 2022. Taxes levied in 2021 are used to support expenses in 2022. Taxes levied in 2022 will be used to support services provided in 2023.

Referendum does not pass: total levy, mill rate

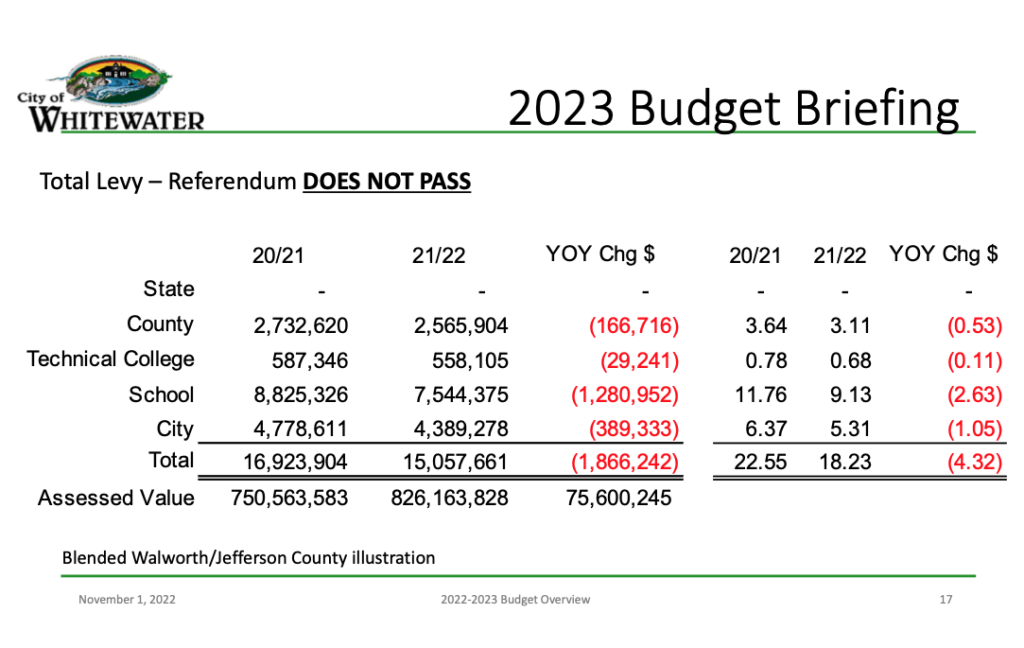

Within his presentation, Hatton shared a slide showing the impact to the levy and mill rate across the four taxing jurisdictions would the referendum fail to receive voter approval.

Would the referendum not pass, the total levy used to support the taxing jurisdictions would drop from $16,923,904, which was the amount collected in 2021 in support of the 2022 budget year, to $15,057,661. The mill rate would also decrease from $22.55 to $18.23.

Looking at the difference in levy and mill rate over last year without the additional revenue from the referendum, the city’s levy would be $4,389,278 with a supporting mill rate of $5.31.

The chart above shows the impact to the levy and mill rate across the four taxing jurisdictions would the referendum fail to receive voter approval.

Impact on average homeowner

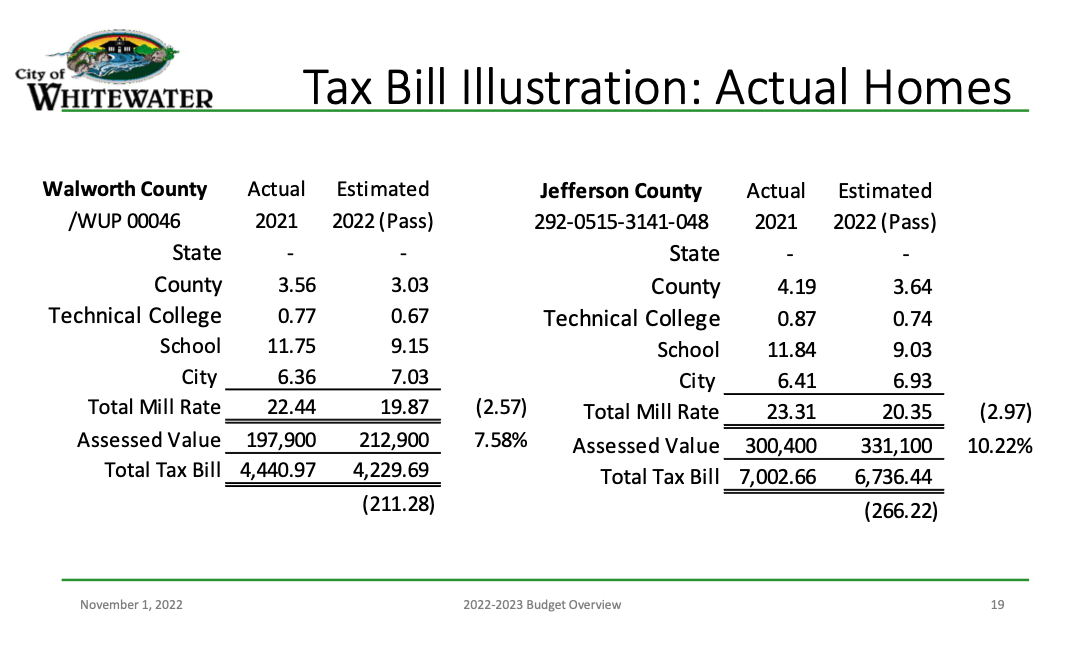

Comparing a slide offering a “tax bill Illustration” for the average homeowner in both Jefferson and Walworth counties with a similar slide presented during a budget presentation made last month, Hatton said the outcome for taxpayers, even with approval given by voters to the city’s referendum and one placed on the ballot by the Whitewater Unified School District, was “better” than initially anticipated.

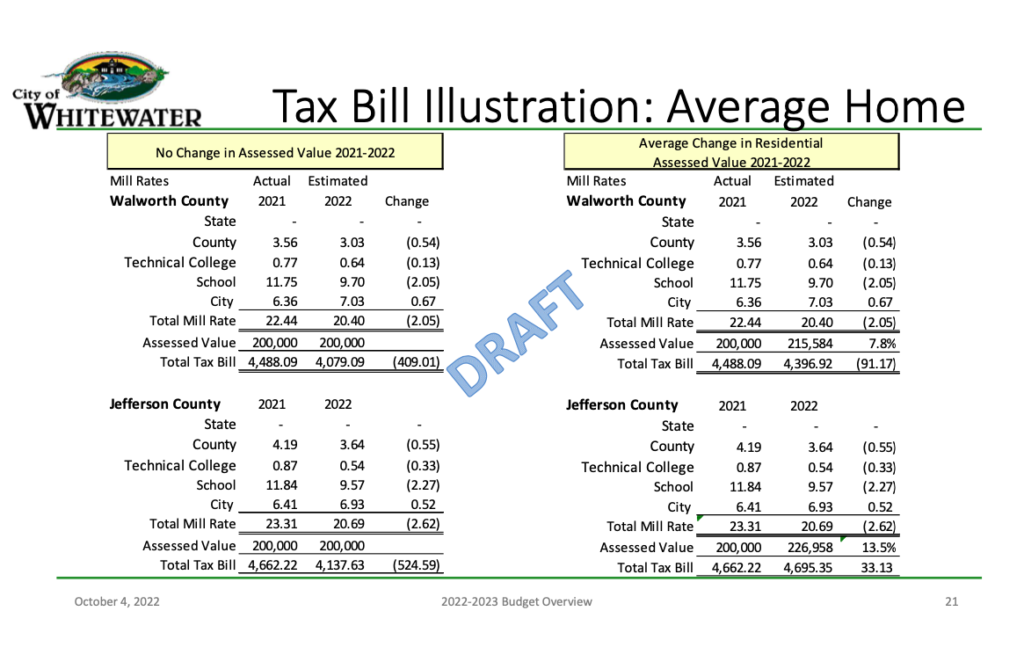

In a “draft” slide presented to council in October, Hatton noted that a homeowner, with a home assessed at $200,000 and living in Walworth County, who, in 2021-22 had seen no change in their assessed value, could expect to see a reduction in the amount of taxes paid across the four taxing jurisdictions by $409.01. In Jefferson County, a similar homeowner could expect to see a reduction of $524,59.

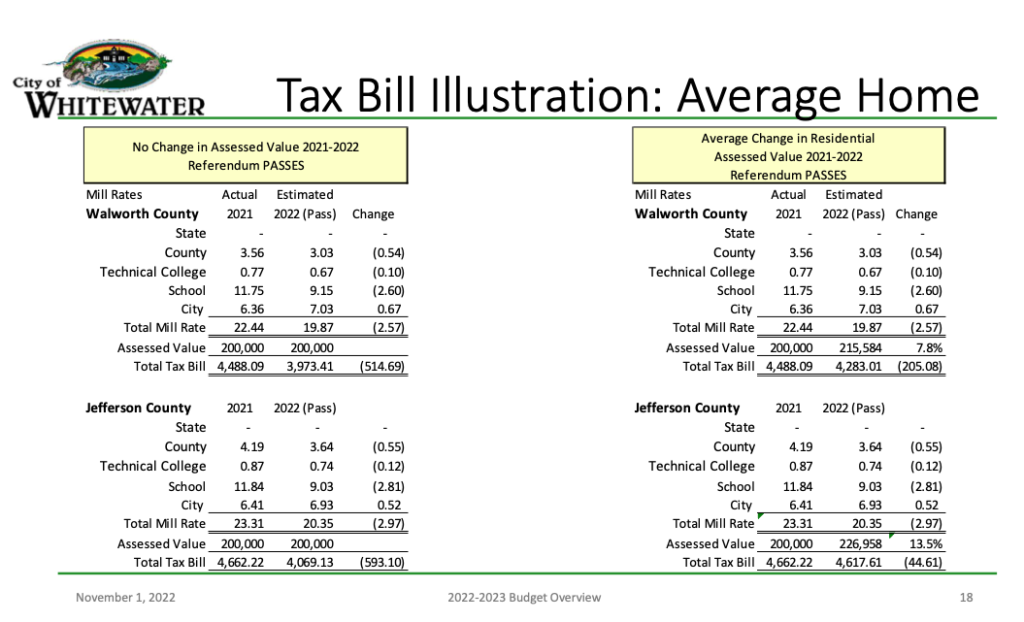

Updated numbers presented Tuesday showed that a Walworth County homeowner meeting the same conditions as presented earlier with no change in their assessment would realize a reduction is their tax bill of $514,69. A similar homeowner in Jefferson County, would see a reduction of $593,10.

According to draft numbers presented in October, for those homeowners who did experience an increase in their assessed value, estimated in Walworth County, according to officials at 7.8%, which would bring their assessed value up from $200,000 to $215,000, that homeowner could still expect to see an overall decrease in their tax bill of $91.17. In Jefferson County, the average assessment increase, city officials said, is 13.5%, which would mean a house worth $200,000 in 2021 would be worth $227,000 in 2022. In that case, according to city officials, the homeowner would see a modest increase in their overall bill of $33.13.

Updated numbers presented Tuesday showed that Walworth County homeowners whose homes did experience an increased assessment could expect to see a decrease in their tax bill of $205.08. A similar homeowner in Jefferson County could expect to see a decrease in an overall tax bill of $44.61.

The chart above, shared in October, shows impacts to taxpayers’ property tax bills with no increases in home value assessments and increases in home value assessments for city residents living within Walworth and Jefferson counties.

The chart above, shared Tuesday, shows impacts to taxpayers’ property tax bills with no increases in home value assessments and increases in home value assessments for city residents living within Walworth and Jefferson counties. During Tuesday’s city council meeting, Hatton noted that impacts to tax bills are more favorable than the city had initially anticipated.

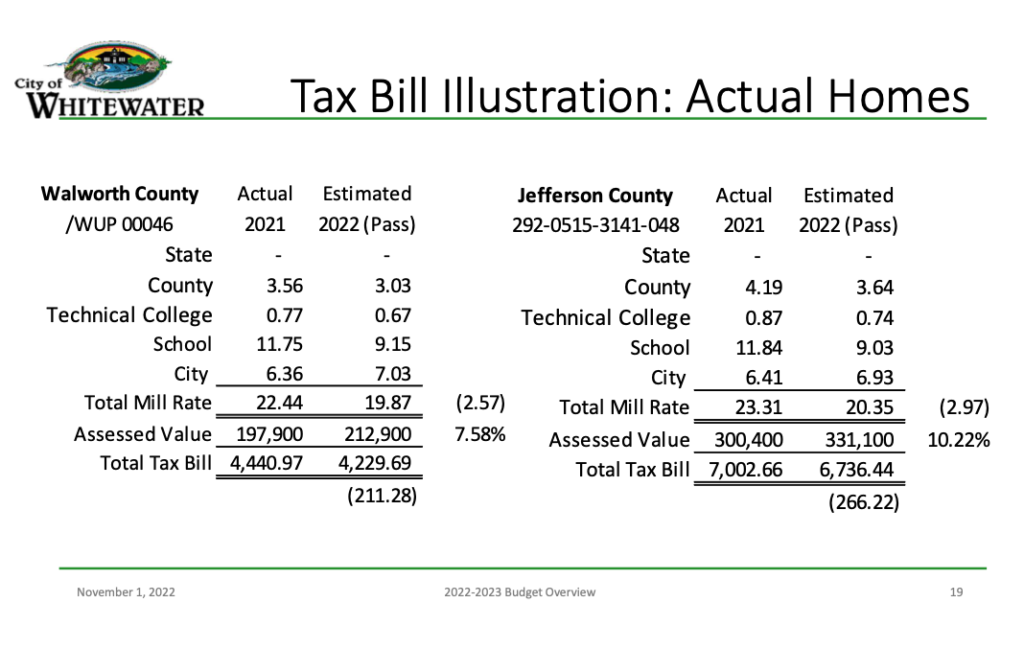

The chart, shown above and shared Tuesday by Hatton, shows the actual tax bills in 2021 of two residents living within the city. One, Hatton said, was the tax bill for a council member’s home in Walworth County and the other was the tax bill for a staff member’s home in Jefferson County. In each case, he said, with the city’s referendum passing, estimates calculated for 2022 show a reduction in both taxpayers’ bills.

This post has already been read 1013 times!