By Kim McDarison

The Fort Atkinson City Council Tuesday contracted with Associated Appraisal Consultants to conduct an interim market update. The company will begin sending property owners notifications about the citywide revaluation of properties in May.

The measure received unanimous approval from council members.

According to City Clerk and Finance Director Michelle Ebbert the measure is required to bring the city into compliance with assessment ratios as set by state statute.

According to information shared by Ebbert in a memo to council, state statutes require the overall assessment ratio of properties within the city to fall within 10% of market value or within a range of 90-110%.

A full revaluation of properties within the city was last performed in 2017, Ebbert wrote in the memo.

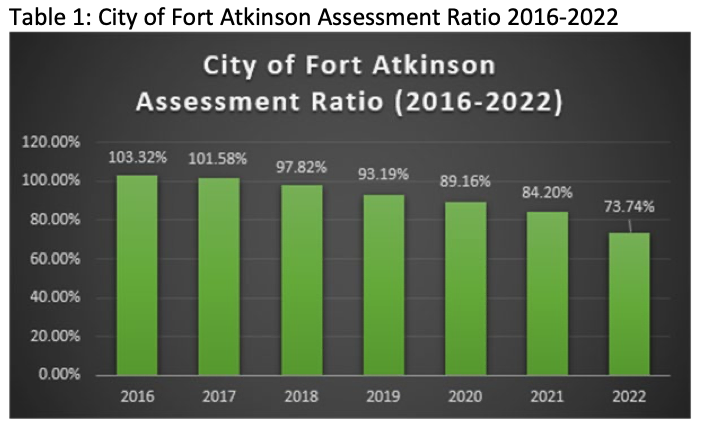

A chart within the memo noted that the assessment ratio within the city has been steadily declining since 2016. The chart further indicated that the city has been out of compliance with state statutes, with the ratio falling below the 90% threshold, beginning in 2020.

Within the memo, Ebbert wrote: “The city of Fort Atkinson has not been in compliance with state statutes relating to assessment ratio since 2019. If a municipality is out of compliance for five years in a row, the state will perform a revaluation at the municipality’s expense.”

Without intervention, the memo continued, 2023 would be the fourth year of noncompliance with state statutes, and would serve to trigger a response process from the Wisconsin Department of Revenue.

According to information supplied by Associated Appraisal Consultants, when a municipality is out of compliance for a period of four years, the Department of Revenue will begin monitoring the level of assessment for the municipality during the next assessment year. The department sends a first notice of noncompliance to the municipality.

Would Fort Atkinson continue on its current trajectory, in 2024, the department would send a second and final notice of noncompliance, and order a state-supervised revaluation for the next assessment year. In 2025, the information continued, the department’s order would become a “stated mandated reassessment,” with the order stipulating its completion by 2026.

To avoid the state-mandated process, the council approved the hiring of Appleton-based Associated Appraisal Consultants, which is the company through which the city already contracts appraisal services, Ebbert said, to perform an interim market update (IMU) at a cost of $35,000.

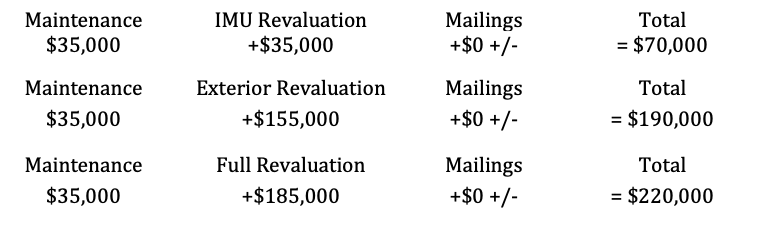

Looking at costs associated with various options available to the city to return to compliance, Associated Appraisal Consultants noted that the city is already under a maintenance contract with the company at a cost of $35,000 annually.

Options to return the city to compliance in the 2023 or 2024 assessment year include conducting an IMU, an exterior revaluation, or a full revaluation.

Would the city have chosen the exterior revaluation, a full cost of services for the year in which it was performed would have been $190,000, including the cost of annual maintenance. Would the city have chosen to have a full revaluation performed, the cost would have been $220,000, including the annual maintenance charge.

Conducting the IMU would keep the city’s full annual cost in 2023 at $70,000, including the annual cost of maintenance.

Associate Appraisal Consultant Project Manager and Appraiser Justin Wiersma was in attendance during Tuesday’s council meeting.

Addressing council from the podium, Wiersma said that the city’s ratio of assessed value to market value in 2022 was at 73.74%.

To bring the city back into compliance, he said he would “adjust the model,” using the IMU.

As he considered property values, he said he would complete maintenance work, looking at “any building permits, sales, things of that nature, I’ll be taking a look at those, splits, new construction, anything like that, I’ll be taking a look at. I’ll bring that onto the (tax) roll as well, and then, from there, we’ll be adjusting everything, bringing us back into the Department of Revenue compliance.”

Wiersma said that every property owner within the city would receive a notice he anticipated sometime in May and the Board of Review, the final step in the updating process, would be held sometime in July. While he called the Board of Review date “set in stone,” he said other steps within the process “are still a little bit flexible.”

“Once those notices are out, the city is probably going to get a lot of calls that will be redirected to us. We are going to be having many PMs (project managers) working on this project, and we will have a formal open book date,” Wiersma said.

He described the open book date as an opportunity for property owners to sit down with him or other project managers from Associated Appraisal Consultants and learn about the changes to the value of their property.

Typically, he said, open book appointments for homeowners take about 15 minutes.

Wiersma said during an open book appointment, he would spend time with property owners to “go through and kind of explain what happened, you know, with this new value that came up and help them understand the process that we have to go through in order to be back into compliance.”

Wiersma said he and his colleagues would plan to spend at least one full day at the Fort Atkinson Municipal Building to meet with property owners, and they would make appointments, if requested by property owners, to conduct interviews by phone.

“All the way up until, you know, pretty much Board of Review day they can give me a call and we can talk about it.

“We want to give people every opportunity we can to talk about their new value, and if they have any evidence supporting that their value should be something different than what I have determined that it should be, I want to give them every opportunity they have before Board of Review comes up that they can bring that to my attention,” he said.

Offering some background, Wiersma said he believed his company conducted an assessment in 2017.

“So it’s fairly recently that we did have one done. Hopefully, it is somewhat fresh in people’s minds, but it’s definitely something that we’ll help the city get through and explain to everybody that has any questions about their value,” he said.

Councilwoman Megan Hartwick asked Wiersma to explain how the city fell out of compliance.

She asked: “If one was done in 2017, what is it that either happened, or didn’t happen that maybe should have, that got the city out of compliance?”

Wiersma described six years as a “very normal in a city time to fall out of compliance nowadays.”

He said the Department of Revenue releases a sales-to-assessment ratio study annually.

“It’s a very detailed sales analysis. So basically, what they are saying to you is that houses are selling higher than they are being assessed for,” he said, adding that the department reviews the ratios every year, looking to make sure that assessments within a municipality are between 90 and 110% of market value.

“What happens is when sales, you know, become higher, you saw, in the last couple years, we’ve all seen it, sales are very high and the assessments that we took back in 2017 are relatively low compared to that. So that makes you fall out of compliance with the Department of Revenue sales-to-assessment ratio faster a little bit. So that’s the reason we need to do the interim market update, to bring you guys back into compliance. So now when we see sales happening, we’re going to be much closer to that assessment ratio,” he said.

Councilman Eric Schultz said that if a property owner’s assessment goes up, that doesn’t necessarily mean that their taxes will go up.

Also, he said, “It doesn’t mean that the city is raising taxes or being able to collect more tax revenue. What it means is that likely the mill rate should go down, and the amount that the city can collect in tax revenue is generally unchanged.”

Wiersma said Schultz was correct.

He added: “There is still a cap on how much you guys are allowed to raise your budgets. So when you guys get the mill rate, which is the number that is applied — your assessment value times your mill rate will give you your tax number … What happens is that mill rate, the way that’s calculated, it’s going to be all the parcels — the value in the municipality — divided by the budget. And when you do that, when you raise the assessments, that number becomes smaller for the mill rate. So that means your assessment might go up, but because the mill rate goes down, your taxes, you know a lot of times are going to stay relatively the same for the most part. There are some outliers of course, you know some styles of houses that sell higher than they previously did … but a lot of stuff stays relatively within the same scope.”

Said Schultz: “I know from some of the comments I’ve seen that when someone gets a new appraisal that the first gut reaction is that their taxes are going to go up, and that is not necessarily true.”

Wiersma agreed, noting that in some cases taxes go down.

“But you hear all the time is that the city wanted to collect more taxes. That’s not the case at all. It’s just bringing you guys back into, the Department of Revenue requires you guys to be in compliance, and that’s all we are trying to establish,” he said.

Councilman Bruce Johnson said he believed coming into compliance was “basically leveling the playing field so everybody’s paying relatively equal to what they should be paying.”

Wiersma agreed, saying that the process was a “distribution of equity.”

Johnson asked: “How will that appear when assuming the economy keeps having inflation and we start raising interest rates, and the housing market goes down for that reason, how will that affect it?”

Said Wiersma: “So the Department of Revenue is going to release its study every year like they have been doing. You know we are not allowed to predict the future … all the values I’m setting are as of January 1, 2023. And that’s kind of part of the equal playing field that you mentioned earlier. So Jan. 1, 2023 is the date that time kind of freezes. If your house is only half built on that day, … even if you finish it a week later, you know that’s not what the state recognizes.”

Weirsma said that changes made rapidly in the marketplace could cause the city to fall out of compliance again.

If that occurred, he said, the city would need to undergo an assessment process to come into compliance again.

Addressing costs associated with compliance, Councilman Mason Becker said: “I think it’s good for everybody to remember if we were not using your services, you know, $35,000 is a good chunk of change, but if we didn’t go through this process, the state would then come in and do a full reassessment that would actually be much more expensive.”

Ebbert also addressed costs, stating that the cost of the IMU was less expensive than costs associated with a full assessment facilitated through the Department of Revenue.

“If we continue to be out of compliance, the Department of Revenue is going to come in and that’s going to be more costly … (City) Manager (Rebecca Houseman) LeMire and I had contacted Associated Appraisal back in July to say we knew we were going to be out of compliance again, what are our options? And they did provide several options that we could look into,” she said.

Additionally, she said, since the city already contracts with Associated Appraisal Consultants, she did ask the company to provide multiple options for the council to consider.

“If we weren’t with a contracted vender we would get several quotes out there,” she said.

Looking at benefits associated with the IMU, Ebbert said information associated with parcels within the city kept on “parcel cards” had been updated in 2017.

She noted building permits and properties that had undergone “drastic changes” could receive an onsite visit from a field inspector.

She said she saw two “negatives” in the process: the first was an absence of field inspections associated with properties that might have undergone changes without a building permit, noting that in those cases, inspectors might not know about changes to the properties “right away.” A potential for a higher attendance during open book days and during the Board of Review meeting might possibly be considered negatives, she said, adding that she thought city staff might use the opportunity to become better educated about the process in order to answer questions for the public.

Ebbert noted that the $35,000 needed to fund the IMU had been planned into the 2023 budget.

LeMire said while entertaining options to bring the city into compliance, staff looked at “going to full value maintenance,” which, she said, was among options provided by Associated Appraisal Consultants.

“That is more expensive on an annual basis than regular maintenance, but it would keep us in compliance year after year. That is something we will be considering in the future,” she said.

A graph, shown above, supplied by Associated Appraisal Consultants, an Appleton-based firm with which the city contracts for property appraisal services, shows the city of Fort Atkinson assessment ratio between 2016 and 2022. Ratios fall out of Department of Revenue compliance, according to the chart, in 2020, when they dip below 90% of market value. Municipalities must maintain ratios between 90 and 110% of market value to stay in compliance with the department, according to City Clerk and Finance Director Michelle Ebbert and Associate Appraisal Consultant Project Manager and Appraiser Justin Wiersma.

A chart, shown above, shared within Tuesday’s Fort Atkinson City Council packet shows differences in costs between three types of revaluations offered by Associated Appraisal Consultants, a company with which the city contracts for appraisal services, to bring assessed values of property within the city into Wisconsin Department of Revenue compliance.

This post has already been read 3306 times!