By Kim McDarison

The Fort Atkinson City Council approved a developers agreement with Garrison Holdings, LLC, Tuesday offering tax incremental financing (TIF) assistance in an amount up to $66,500.

In a memo to council, City Manager Rebecca Houseman LeMire noted that the project was reviewed by the city’s Economic Development Commission in September of 2020, at which time Garrison Holdings requested from the city assistance in building a new dental clinic. The proposed site is in the city’s tax incremental financing district (TID) No. 8 at 1530 Doris Drive.

At that time, LeMire wrote, the committee recommended that staff draft a developers agreement between the two entities which would provide support through the district in an amount up to $66,500. Site plans for the project were approved by the city in 2020, according to the memo.

More recently, LeMire wrote, city staff met with James Garrison to “reaffirm the site and building plans and review the draft of the developers agreement.”

To bring the project into compliance with new zoning ordinances, LeMire wrote, there will be “some minor changes to the site plan,” which, she noted, would include some additional curbing.

An anticipated completion date for the project is Dec. 31.

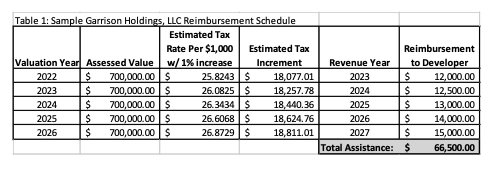

According to the developers agreement, the city, through TID No. 8, will reimburse Garrison Holdings for construction costs of the project up to $66,500, provided that the completed project brings an assessed value for inclusion within the city’s tax rolls of $700,000.

Construction of the full project is expected to cost approximately $1.175 million and provide some $17,500 in annual tax revenue, according to a letter written by Garrison to then-city manager Matt Trebatoski in July of 2020.

The $66,500 will be paid by the city over the course of several years from the increment added based on the value of the project.

The agreement, LeMire wrote, is structured with “pay-go” financing, which, she added, “means that the only funds reimbursed to the developer are those added through the increment created by the developer. No general property tax dollars from other property owners will be provided to the developer.”

The purpose of incentivizing the developer in this manner is to achieve an incremental value, defined as monies achieved over a set base value within the TID, for the TID, thus increasing the value of the TID.

LeMire further noted that the payment and reimbursement schedule is subject to change based on the project’s actual completion date, the assessed value of improvements after completion, the tax rate and the increment generated.

The above chart shows the payment schedule, with payments made by the city to Garrison Holdings, over a five-year period.

A site plan for the new dental clinic to be built within TID No. 8 on Doris Drive is shown above.

An artist’s rendition depicts the new dental clinic to be built on Doris Drive. The project is anticipated to complete by the end of this year.

This post has already been read 1688 times!