By Kim McDarison

The Fort Atkinson City Council Tuesday received a presentation outlining the scope of work required to raze existing structures at the city’s public works facility and build a new campus.

Additionally, council members were presented with a plan to pay for the proposed work which, if approved, comes with an approximated price tag of $16 million.

Department of Public Works Superintendent Tom Williamson kicked off the presentation by sharing with council members some history associated with the existing structures, which, he said, were constructed over a period between the “early 1960s” and the “early 1980s.”

His presentation including a short video, offering a tour of the department’s office and garage space.

Aided by slides, Williamson said that the city had spent several years evaluating, planning, and designing a new facility to house public works and parks operations.

An assessment of the condition of the public works facility was commissioned in 2016, he said, noting that it found that the building “was rapidly deteriorating.”

City officials opted not to pursue building a new facility in 2016, Williamson continued, adding that in 2022, a “more thorough” assessment was commissioned. He identified the second assessment as the beginning of the city’s planning and design process for the project being brought before the council for consideration on Tuesday.

City staff, over the last “several months,” he said, had been working with the Janesville-based architectural firm of Angus-Young to design a new facility, which, he noted, “will serve the needs of the city well into the future.”

Williamson told council members that Bradley Werginz, of Angus-Young, who also was in attendance Tuesday, would serve as the lead architect would the city opt to undertake the project.

The new facility, as proposed, will be built at 600 Talcott Ave., he said.

Additionally, he said, council would learn about a proposed schedule for construction, costs associated with the project, which he described in a memo as between $15 and $20 million, with an actual cost made available after proposals from general contractors bidding on the work were received later this year.

Further, Williamson wrote in a memo to council, which was included in the meeting packet, that “the city intends to include this project in the 2024-2025 general obligation borrowing,” also noting that the city’s financial advisor, Justin Fischer, of Milwaukee-based Robert W. Baird and Co., would come before the council in December to present information about the proposed borrowing.

Following the video tour, Williamson offered historical information, noting that the building’s main office and maintenance shop were built in the “early 1960s,” followed by the “north truck shed,” which was built in the “early 1970s.” Fuel tanks and pumps were also added during that timeframe, he said. The facility’s “west Parks Building,” was added in the “early 1980s,” and a salt shed was constructed in 2015.

Looking more closely at steps taken in advance of the project, following assessments performed by Milwaukee-based Barrientos Architects in 2016 and Milwaukee-based Engberg-Anderson in 2022, Williamson said Angus-Young was contracted in February to create a facility design.

In addition, he said, the city adopted a “resolution to reimburse through borrowing” in April, and the city’s purchase of the “Nasco Properties,” closed in May. The property is located “due east of the current facility,” he said.

Among next steps, he said, Angus-Young would present a site plan. Along with Werginz, the city would be working with the company’s landscape architect Katie Udell.

Addressing the council, Werginz described his company’s role in the process, which, he said, revolved around creating a set of bidding documents, which would include “drawings and specifications that the city puts out to public bid per state statutes for open bidding to any contractors interested in building the project.”

Werginz said that his company would not build the campus, but would “supervise the construction process to make sure that the contractor selected is building the building per the specs and drawings that we put together for them.”

Werginz said his company designed the project based on information it received from the city, including the assessments from 2016 and 2022.

A new campus

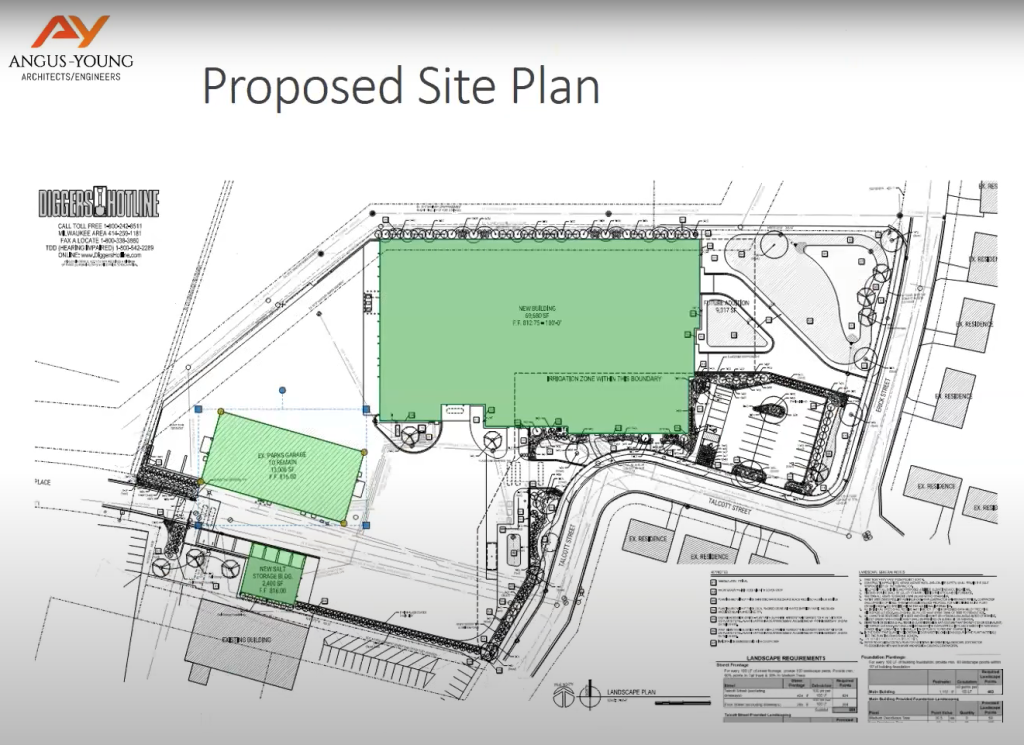

Aided by slides, Werginz offered visual representation of several buildings, including a 70,000-square-foot “main building,” including 48,000-square-feet of vehicle and equipment storage space, along with an area for fleet maintenance, a wash bay, cold storage, administrative offices and an area titled “employee welfare.”

Additionally, he said, plans call for the renovation of the existing Parks Storage Garage, a 13,000-square-foot building used as trailer and seasonal equipment storage. Renovations would include heating and ventilation system replacement, interior finish improvements, and exterior painting.

Included as part of the overall project, he said, were activities associated with demolition of existing buildings and mass grading, the installation of 30 parking stalls, street front sidewalks, gated facility entrances with perimeter fencing, concrete facility door approaches and asphalt drives, a truck scale, landscaping and site lighting, and a stormwater management system.

Project plans also include the construction of a new 2,400-square-foot salt storage and materials building, with a 900-square-foot lean-to on its north side “that allows some bunker storage for materials that you don’t want to get wet, like your top soils and that,” Werginz said.

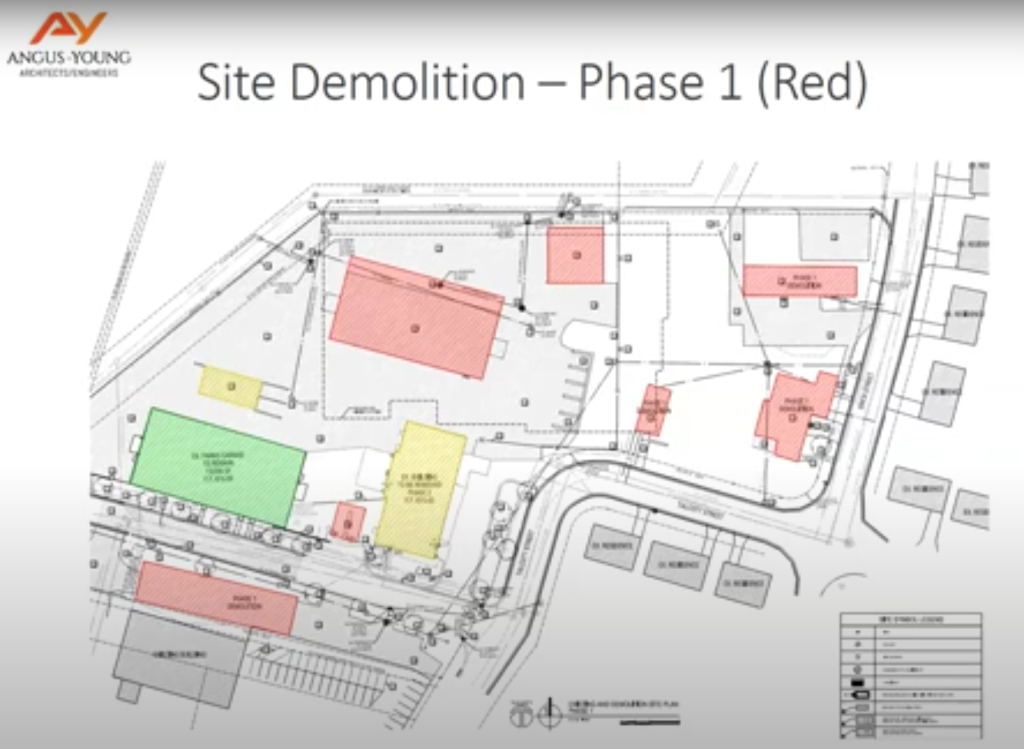

Addressing the demolition process, Werginz said it would be done in two phases, with Plase 1 focusing on razing the existing quonset hut, the large vehicle storage garage, the existing salt storage facility and three buildings that were acquired as part of the land acquisition on the east end of the project site.

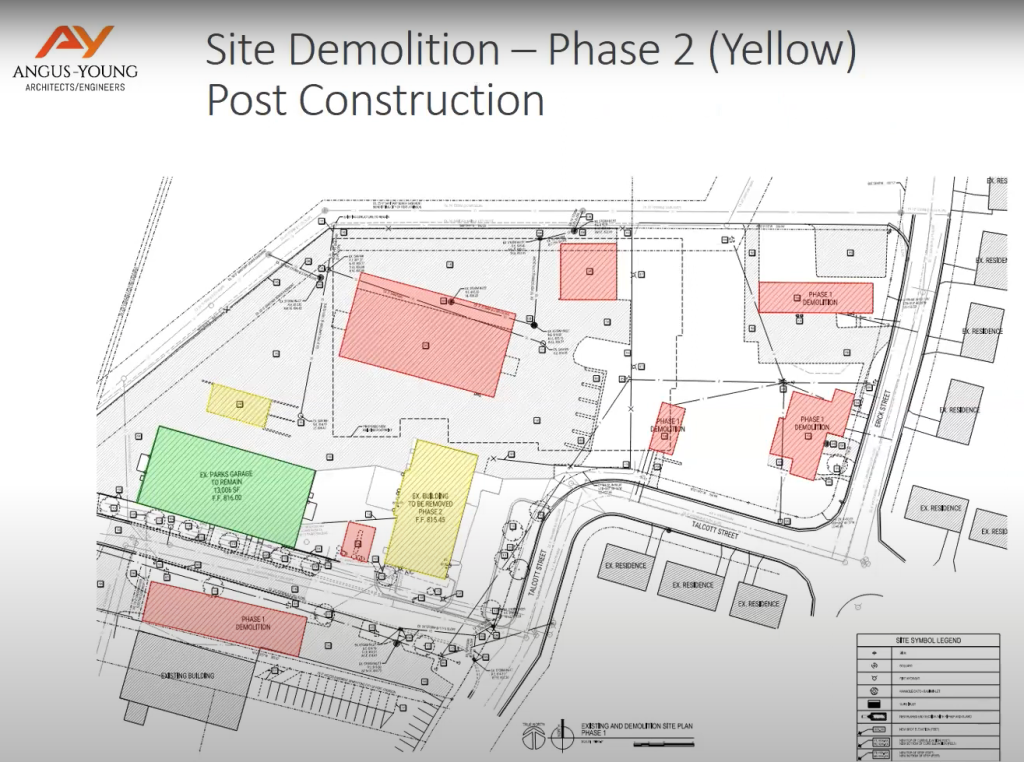

The second phase of demolition would raze the existing parks maintenance garage and office building.

The two-phased system would allow the city’s departments to continue operations while the new campus was under construction, he said.

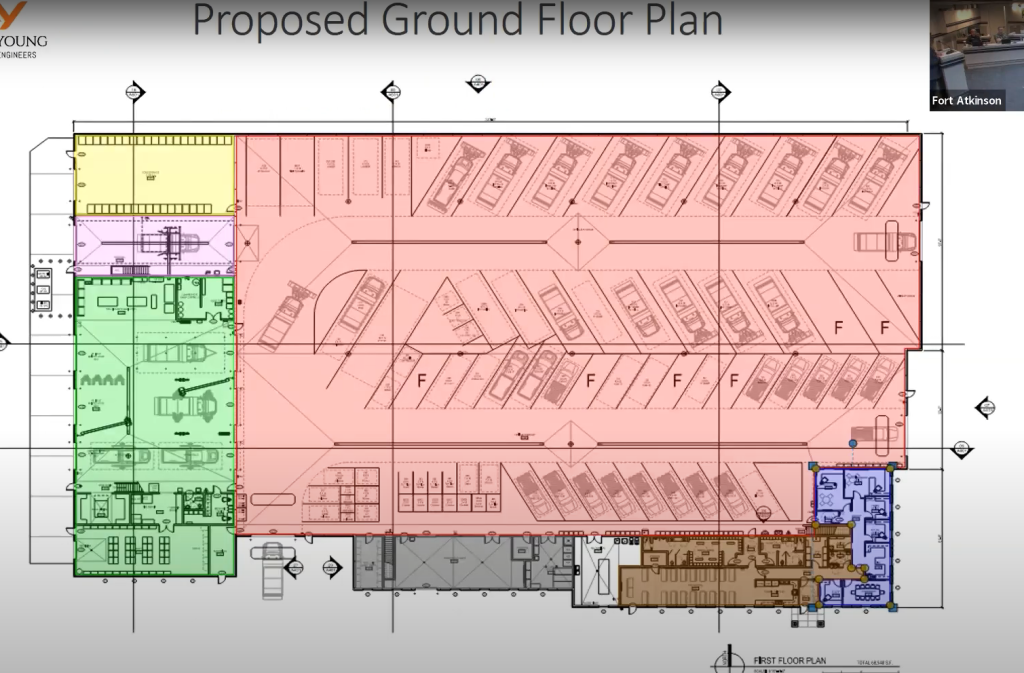

Aided by a slide, a closer look inside the new main building identified space for use as a vehicle storage garage, an administrative suite, an employee welfare area, a vehicle maintenance bay, a drive-through wash bay, and a cold storage area, which, Werginz said, was originally planned as a separate building on the site, but, he added, “just squaring off the building instead of creating an interior notch in that corner, we decided to just add two exterior walls and create this cold storage space that the facility needed as part of the study.”

A portion of the building would additionally include a “mezzanine” level, which would allow for extra storage. Christmas decorations and other parks-related materials could be stored in this area, he said.

Werginz said the exterior elevations of the main building would be built using pre-cast concrete wall panels, each of which are 12-feet wide by 30-feet tall.

The panels are fabricated off-site, brought to the site and put in place. He described the product as “energy efficient” and “long lasting.”

He additionally shared an elevation drawing of the salt shed and an artist’s rendering of the new main building as it would appear upon completion.

A look at costs

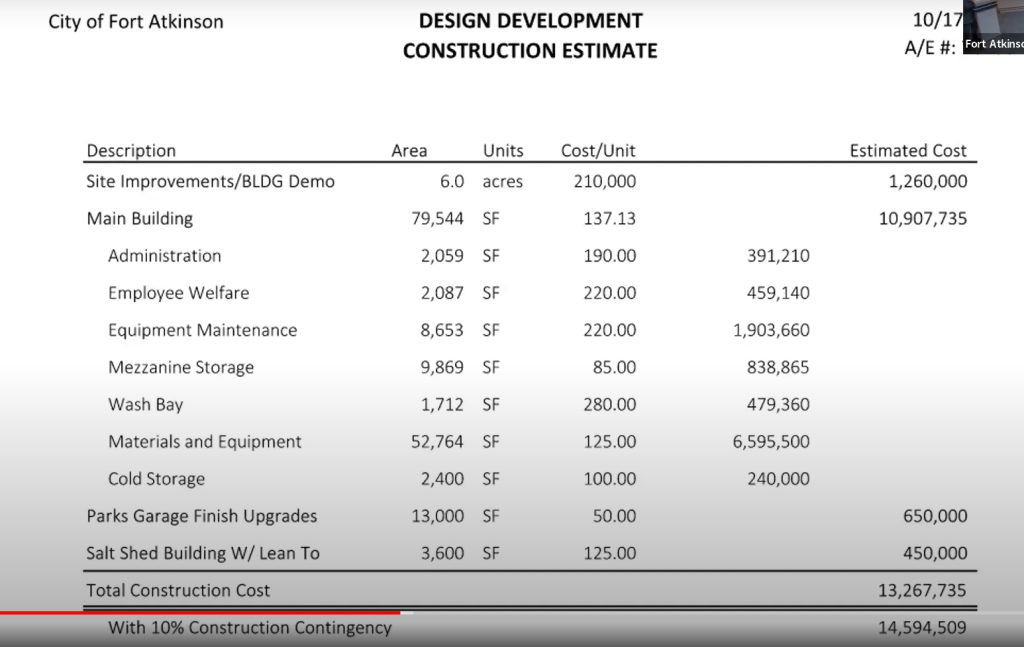

Werginz, too, provided a breakdown of costs associated with the project, noting that the estimate for construction of the outlined improvements totaled some $14.5 million.

Directing council to a spreadsheet, he said: “The first portion is site improvements, which includes the building demolition of approximately 6 acres, coming at an estimated cost of $1.26 million. Main building construction is estimated at $10.9 million. The parks garage is estimated at $650,000, and the new salt shed comes in at $450,000. The total construction cost is approximately $13.2 million.

“In addition to that, we typically carry a 10% construction contingency on top of that to bring the total project construction costs to $14,594,509.”

He next shared what he termed an “all-in” cost, which, he said, included, along with the cost of construction, design fees, acquisitions fees, site survey costs, geotechnical engineering, and other costs associated with constructing “a building like this.”

A slide broke costs down to include design and pre-construction, $1.04 million; building construction, $14.5 million; furniture and equipment costs, 325,000, and construction management, $120,000.

A total all-in cost was approximated at $16 million.

Questions from council members

Fielding questions from council members, Werginz said elevations of the new main building, as compared to the one existing on the site, would be “significantly taller.” Describing the functional space needed for 16-foot overhead doors, he said, “typically, you’re at 24 feet,” for the building’s exterior height.

Comparing the project estimates as presented Tuesday to other projects with which he was familiar, Werginz said that is 2018, his company was involved with building a similar building in Stoughton. The building cost less than $8 million to construct.

Citing the estimate for the Fort Atkinson project, he said: “We are incorporating quite a bit of escalation into those costs just to accommodate what we’ve seen in the market over the last three years.”

Offering an understanding of his company’s familiarity with public works projects, he said that within the last 10 years, it had been involved with such constructions in Watertown, Oak Creek, Delavan, Janesville, and Rock and Dodge counties.

Next steps

Williamson next described steps required to move the project forward. A timetable included the presentation of a certified survey map, which, he said, the council saw Tuesday, a site plan and conditional use permit review which, he said, would be presented at the Plan Commission meeting on Oct. 24, the initiation of a formal borrowing process, which, he said, would begin in December, and the selection of a contractor, which, he said, was anticipated to be completed around the end of December or the beginning of January 2024.

“We are hoping to put this project out to bid in November,” Williamson said, adding that he anticipated giving the contractors “about a month to bid.”

Looking at an extended timeline, he said he anticipated that construction would be underway in the spring of 2024, with partial occupancy of the campus planned for the fall or winter of next year. Final occupancy was anticipated in the spring of 2025.

Fielding questions from council members, Williamson said that several employees from his and the parks departments worked at the facility, including 13 public works department personnel, and five who are members of the parks department. The number did not include seasonal workers, he said.

As a matter of equipment, he said, his department used seven single-axle wing plow trucks, three tandem-axle trucks, and one tri-axle dump truck, along with “a smattering of three-quarter-ton pickup trucks and one-ton pickups.”

A council member asked what the cost might be to maintain the current facility for “another couple years.” The council member said he recalled the cost at about $5 million.

Williamson said he believed the council member was remembering the discussion accurately.

Looking into the future, Williamson said, “the savings, though it is an expenditure now, is evident in the fact that from 2018 to now, the cost of a building similar to this was down around $9 million. I can imagine the escalation cost over the next three to five year could be quite substantial, frankly.”

Councilman Mason Becker, offering support for the project and addressing Williamson, said: “I know a lot of people, you know, are going to be skeptical of why we are doing this now, but, you know, I think back, you know, when we did that original facilities in 2016 and it’s maybe a little bit of a shame that we didn’t act on it then, but I just, frankly, think the city just was not ready. We were not in any kind of position where we could move forward on that at the time, and, I think, at the time, I think we were just getting the message that, well, we’re kind of making due, we’re kind of getting along for now with it, and, yeah, we’ll have to get around to it eventually. Well, now it’s time to get around to it, and now we do have a plan in place, where we can pay for it and make it work, and, you know, our city, I think, is sitting in a good position right now. We’ve got the Banker Road development coming up and we need a new facility to make sure that we can maintain those additional investments we’re going to be making, so, I think you and your team, and everybody there, have waited more than long enough for this day to come.”

Council President Bruce Johnson also supported the plan, saying: “I definitely believe that the numbers, when added up about savings for this reason or for that reason, total enough money that we’re acting in good faith for the citizens of Fort to move forward on this.”

Borrowing, tax impacts

City Manager Rebecca Houseman next talked about the financial aspects of the project.

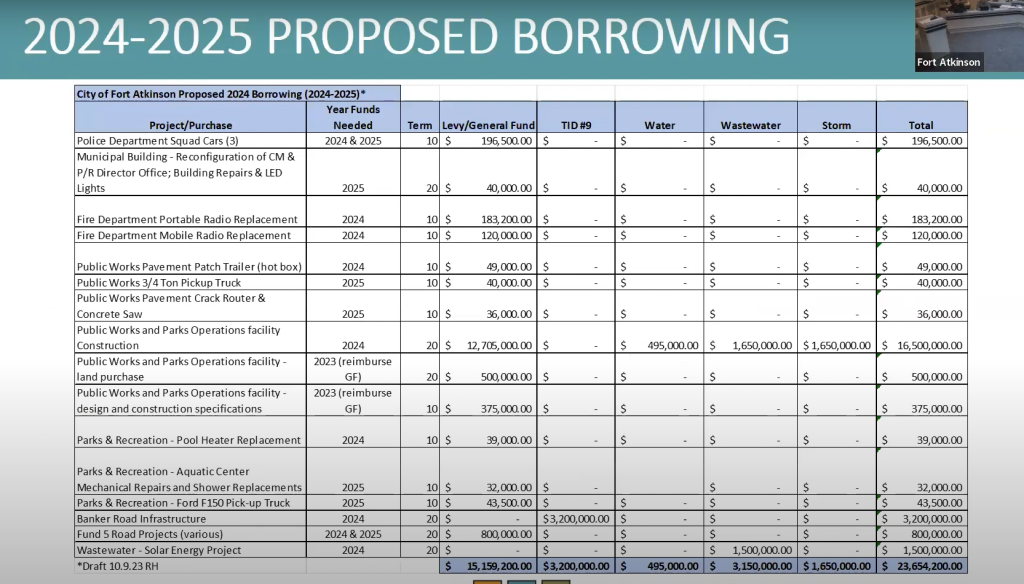

Sharing a spread sheet, she said: “there is a lot of information in this, but it’s not necessarily meant for you to see all the details. This is just a listing of our CIP projects, our Capital Improvements projects, through ’24 and ’25, that are included with the proposed borrowing.”

Houseman said that more detailed information would be presented by Baird in December.

“I wanted to provide this just to give you some context and show you that there’s the bigger borrowing, and, of course, this public works and parks operational facilities is a major piece of that, is by far the largest piece of that, but it is within the context of other items,” she said.

Houseman said the costs associated with the project would be paid for using a borrowing, with those monies paid back through the general fund levy, with some “additional support” from other funds such as the city’s storm/sewer utility.

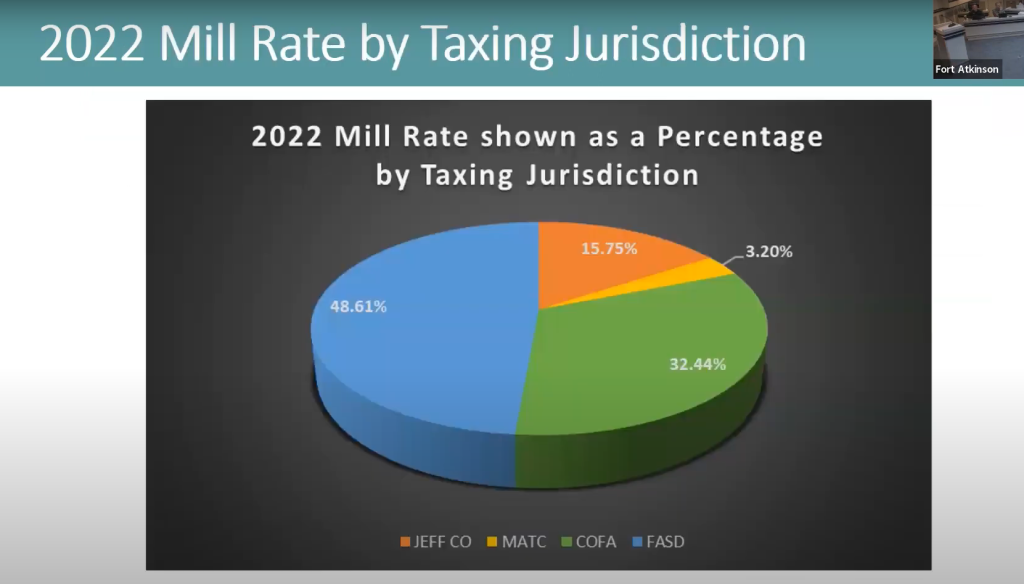

Houseman next sought to offer a recap about tax collection and the city’s portion of the property tax bill.

She reminded council members that the full tax bill received by property owners included monies used to support four taxing districts. They included the city, school district, county and technical college.

The structure was not unique to Fort Atkinson, she said, adding that tax bills are structured the same way for every Wisconsin municipality.

Using mill rates from 2022, Houseman said that the city’s portion of the tax bill represented approximately 32.5% of the total tax bill.

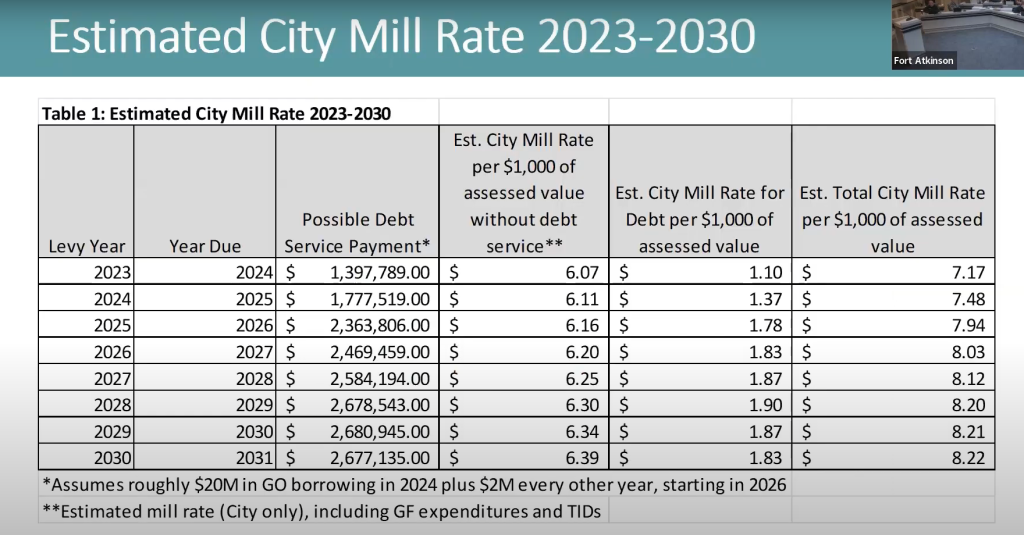

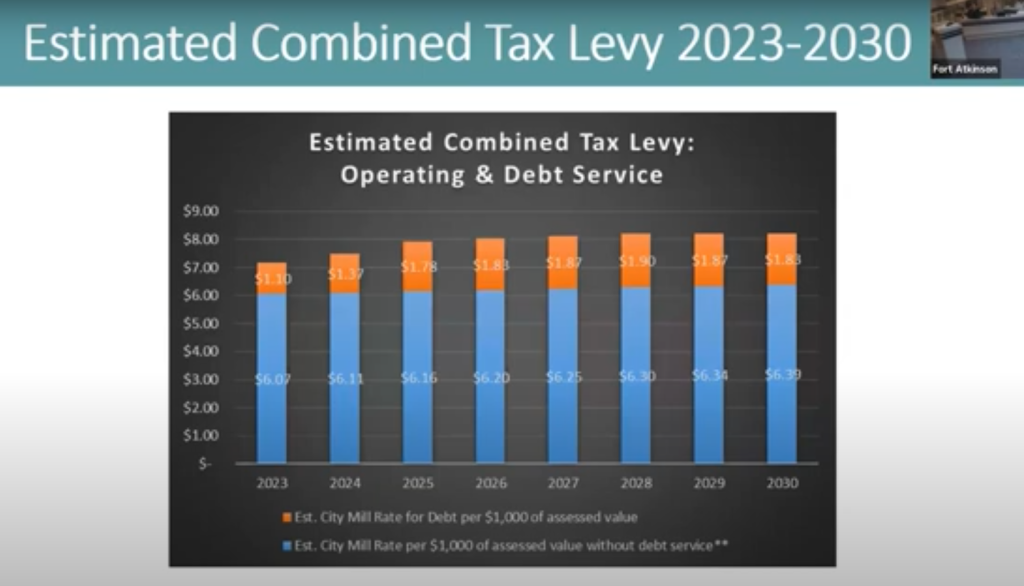

She next produced a spreadsheet presenting estimated mill rates beginning in 2023 and extending to 2030.

Moving across the spreadsheet, Houseman explained that the city currently borrows $2 million every other year. The new borrowing to support the public works project would come in addition to the already existing borrowing schedule.

In 2024, she said, the city, as a matter of existing obligations, would pay $1.4 million against debt accrued in 2023. The monies would be included in the budget through the 2023 tax levy.

“We borrowed those funds already. We obligated ourselves to pay those … that part’s not in question.” she said.

Using an estimated mill rate per $1,000 of assessed property value, without debt service for 2023, she said the estimated mill rate is $6.07. Adding an additional $1.10 to include the debt service, brought the estimated mill rate to $7.17.

She said she was using estimates because the city did not yet have from the state “the aggregate assessed value of all of the property in the city.” She anticipated receiving it by the end of this month.

Anticipating that the city would take on in 2024 the additional $20 million in general obligation debt to cover the cost of the public works campus, she said, the spreadsheet showed the amount of general fund levy supported debt to be paid back year-over-year, including both the $20 million borrowing and the $2 million in borrowing every two years, starting in 2026.

Houseman said that the city began borrowing the $2 million every other year in 2022.

Citing the spreadsheet, Houseman said: “So you can see the debt service payments increase over time and then they kind of level out. That estimated city mill rate per $1,000 of assessed value without debt service, that is simply — those increases — they’re simply what the state law, with levy limits, allows for a levy increase, based on net new construction. So I did assume a .5% net new construction year-over-year to get to that number. It also assumes a very small increase in aggregate assessed value of all the property in this city. And that small increase is .27%, and that is an average of the increase in that from 2012 to 2022. So of course we all, we want to also understand, and that estimated total with city mill rate for $1,000 assessed value, that looks a lot lower than it has in the past, well that is because the interim market update that was completed in 2023, when those assessed values increased, then the mill rate decreases, and taxes remain about the same.”

Within a chart, Houseman showed a schedule of debt service payments, and the associated tax impact, year-over-year, between 2023 and 2030. The estimated total city mill rate, including the impact from both borrowings — the ongoing and approved $2 million and the proposed $20 million — beginning in 2023 at $7.17 per $1,000 of assessed value, rose each year, topping out in 2030 at $8.22.

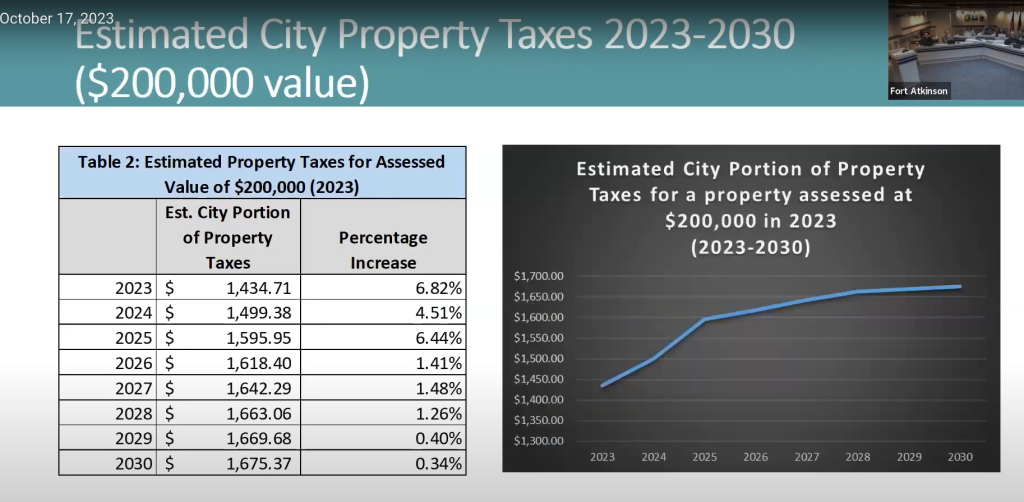

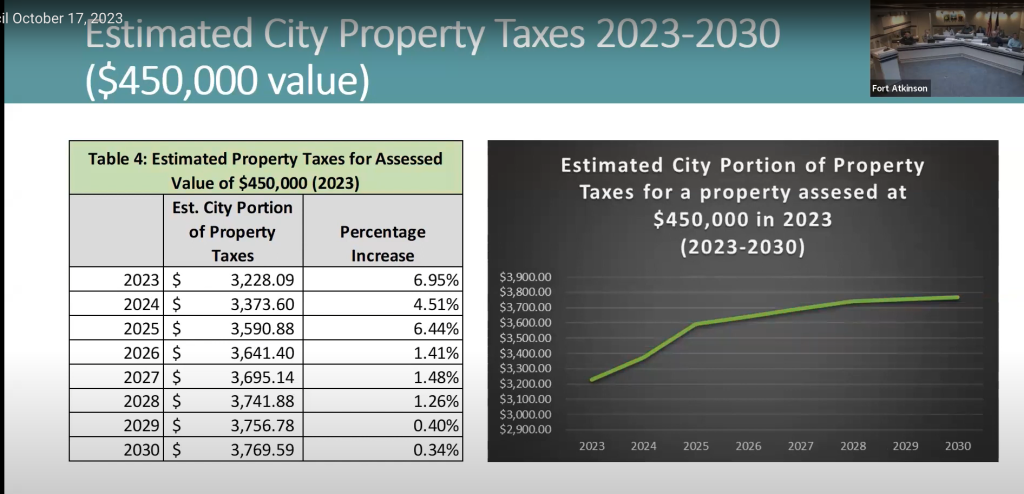

Within her presentation, Houseman additionally offered calculations showing what a taxpayer within the city, with a home valued at $200,000, might pay given the impact of the borrowing.

She reminded council members that the chart represented only the city portion of the taxpayer’s bill.

The chart offered estimated impacts between 2023 and 2030.

Citing the chart, Horseman said: “As you can see, there’s a little bit of a sharper increase for the first couple years and then it levels out. I will say that between ’23 and ’24, looks like a 4.5% increase in the city’s property tax, the city’s portion of the property tax, … it seems like a lot, but it is about sixty-some-odd dollars over 12 months — it’s not a significant increase.”

Houseman noted that after the interim market update, the assessed values of properties within the city went up on average by about 48%.

“So in 2023, if $200,000 is the assessed rate, … in 2022, it was probably around $135, $136,000, which was just about the average assessed value of a property in the city,” she said.

With a decision to borrow, she said: “There will be an impact on property taxes. We can’t borrow 20-plus million dollars, or continue to borrow $2 million every other year, without there being an impact on property taxes.”

Even with the substantial borrowing proposed for 2024, she said: “We are still far below our debt capacity that the state allows you to borrow up to 5% of the equalized value. This council has further limited that to 60% of 5% of the equalized value in order to stay conservative, which the city council has been very conservative with borrowing over the last many years, which is why we have the borrowing capacity to do this project at this time.

“We will still be under 50% of our borrowing capacity per state statutes in 2024 if this borrowing is approved.”

Responding to questions from council members, Housemen said that over the course of the next 20 years, the city will continue to pay down its debt, so, she said: “There is debt that comes off this whole time. So we have existing debt that we continue to have to pay, and we are adding to it while we are paying some off.

“There’s a lot of things that are going to happen over the next five to seven years, including some tax increment districts closing, so that will change the value of the city. That will change the mill rates again significantly. So this is just projecting out with the debt in ’24 and also assuming that $2 million every other year continues because we continue to have needs as far as facilities and equipment.”

The borrowing to fund the department of public works facility would be for 20 years, she said, which, she added, is a limit set by state statute.

Becker said that while taxpayers would be paying the project-related debt down for 20 years, he saw the investment as “multigenerational,” saying that he believed that the improvement would last 50 years or more.

Two graphics above: Plans, if approved, as described Tuesday by Angus-Young representative Bradley Werginz, call for demolition at the city’s Public Works and Parks facility to take place in two phases, after which two new buildings, including a nearly 70,000-square-foot main building, featuring garage and office space, will be erected. An additional building serving the city’s Parks Department, will be renovated as part of the project. At top, buildings depicted in red will be included in the first phase of demolition. Above, buildings, depicted in yellow, will be razed within the second phase.

The graphic above shows placement of two new buildings and a renovated structure that will be included as part of the proposed Public Works and Parks campus. The full project is anticipated to cost approximately $16 million.

A graphic shows the interior of an approximately 70,000-square-foot main Public Works Department building. Within the depicted floor plan, the pink area shows the main portion of the building, including a vehicle storage garage, the blue area shows office space, the brown area shows an employee welfare area, the green area shows a vehicle maintenance bay area, the lavender area shows a drive-through wash bay, and the yellow area depicts cold storage space.

An artist’s rendering shows the proposed 70,000-square-foot main building as it will appear when completed.

A chart shows a breakdown of estimated costs associated with project construction. The total “all-in” estimate rises to $16 million after various fees and commodities such as equipment and furniture are added to the project.

A spreadsheet, as prepared by Fort Atkinson City Manager Rebecca Houseman, shows a 2024-25 list of municipal needs proposed to be supported through borrowing, totaling $23.6 million. An expanded view of the list is found here: http://fortatkinsononline.com/wp-content/uploads/2023/10/Screen-Shot-2023-10-21-at-3.42.21-PM.pdf.

A pie chart shows the portion by percentage each of four taxing jurisdictions — the city, school district, technical college and county — levy annually as part of a Fort Atkinson city resident’s property tax bill. The portion used to support the city of Fort Atkinson, according to the chart, is 32.44%.

Two charts above: At top, a spreadsheet shows the mill rate, as required by the city to sustain its budget, and the affect on that rate brought about by borrowing over a period between 2023 and 2030; Above, a bar graph shows the mill rate levied by the city to obtain its portion of the tax bill over a period between 2023 and 2030 without the added impact of proposed borrowings, in blue, and with the added impact of the borrowings, in orange.

Two charts above show the estimated tax impact, as calculated by Fort Atkinson City Manager Rebecca Houseman, for a Fort Atkinson taxpayer with a property valued at $200,000, at top, and $450,000, above, between 2023 and 2030.

This post has already been read 3751 times!