Gov. Tony Evers on Thursday announced the Wisconsin Department of Revenue (DOR) has distributed the first round of increased payments to counties and municipalities under the historic shared revenue legislation signed by the governor in June 2023.

The release included a link showing shared revenue increases within each county by municipality.

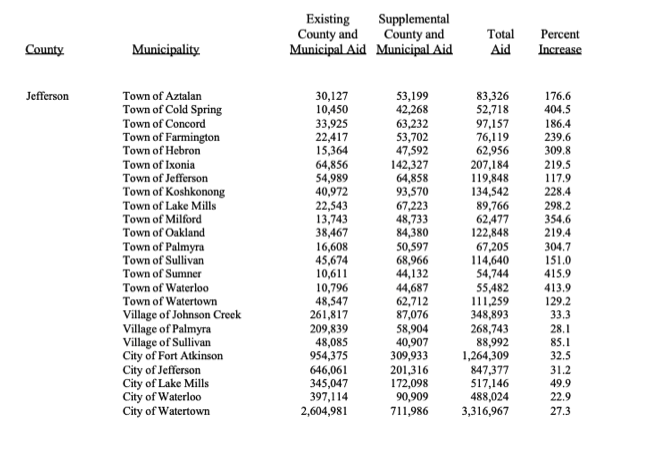

In Jefferson County, the city of Fort Atkinson will see a 32.5% increase in its supplemental county and municipal aid. Previously, the city received $945,375 in county and municipal aid. The new distribution figure is approximately 1.26 million, which represents an increase of $309,933.

The city of Jefferson will see an increase of $201,316 or 31.2%. Previously, the city received $646,061 in county and municipal aid. The new supplemental county and municipal aid figure is $847,377.

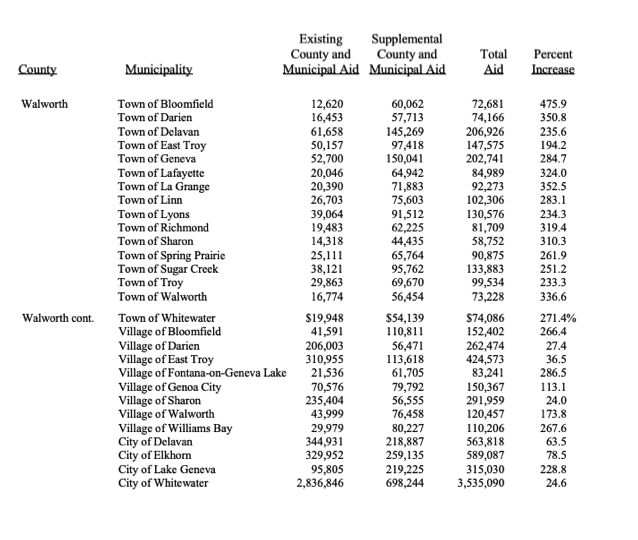

In Walworth County, the city of Whitewater will see a 24.6% increase, with a bump of $698,244 in supplemental county and municipal aid for a total of approximately $3.53 million. The city was receiving in county and municipal aid approximately $2.83 million.

Charts showing the increase in supplemental aid for municipalities within both Jefferson and Walworth counties are found below.

The chart above, as supplied by the governor’s office, shows the increased distribution from the state of supplemental county and municipal aid as compared to the previously distributed county and municipal aid package for each municipality in Jefferson County.

The chart above, as supplied by the governor’s office, shows the increased distribution from the state of supplemental county and municipal aid as compared to the previously distributed county and municipal aid package for each municipality in Walworth County.

Gov. Office: ‘significant milestone’

According to information released by the governor’s office, the distribution marks a “significant milestone as it includes the new supplemental county and municipal aid (CMA) established under 2023 Wisconsin Act 12, which is specifically allocated to support essential services such as law enforcement, fire protection, emergency medical services, emergency response communications, public works, courts, and transportation.”

Within the release, Evers was quoted as saying: “After more than a decade of this funding being cut or held flat, it was long overdue for the state to do its part to meaningfully support local communities, and I’m thrilled these funds will be going out the door to help municipalities support essential community services like fire and EMS, fixing local roads, cleaning up PFAS, and more. While this historic increase to shared revenue is one of the most significant accomplishments of my administration, we know our work is not over. We will continue working to ensure that every community has the resources and support needed to respond to residents’ needs today and to plan for tomorrow.”

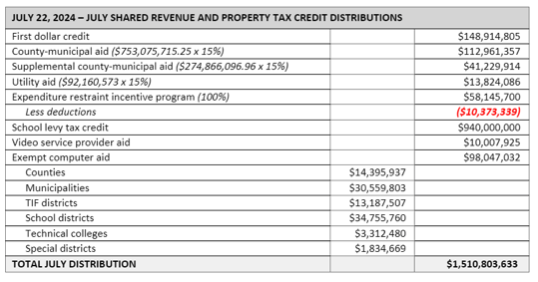

The following table includes the July distributions of shared revenue and property tax credit payments to counties, municipalities, school districts, technical colleges, and special districts, the release stated.

Some shared revenue history

As stated in the release, according to data from the nonpartisan Legislative Fiscal Bureau (LFB), since 2011, state aid to communities had been cut by more than 9%, while public safety costs increased by more than 16%. As a result, over the last decade, local communities had been asked to do more with less and forced to make difficult decisions to cut critical services, including public safety.

“From Day One,” the release read, “Gov. Evers has been clear that the state must do its part to ensure communities have the resources they need to meet basic and unique needs alike.”

The release noted that during his 2023 Biennial Budget Message, Evers outlined his 2023-25 budget plan to send 20% of the state’s sales tax revenue back to local communities for shared revenue. The proposal meant more than half a billion dollars more per year in new resources for local communities to invest in key priorities like local health and human services, transportation, EMS, fire, and law enforcement services, and other challenges facing Wisconsin communities such as PFAS and district attorney recruitment and retention—the largest increase in aid to municipalities and counties in decades. This commitment ensured communities would see growth in shared revenue in the future after years of state investment not keeping up with communities’ needs.

The release read: “The governor’s budget provisions built on his previous efforts to increase shared revenue for local governments. In both of Gov. Evers’ previous biennial budgets, he proposed increasing shared revenue payments by two percent annually. Unfortunately, legislative Republicans repeatedly rejected these efforts and, in fact, passed legislation that would have further reduced shared revenue payments to counties and municipalities, which the governor vetoed. In his 2021-23 biennial budget proposal, Gov. Evers also proposed allowing municipalities with populations over 30,000 to impose a 0.5 percent sales tax to diversify local revenue sources and better empower local governments to fund public safety. This was also rejected by Republicans in the Legislature.

“Last June, Gov. Evers announced he and Republican leaders had reached a tentative compromise regarding shared revenue, which ultimately included at least a 20 percent increase in support to most municipalities statewide. Gov. Evers signed into law key portions of that bipartisan compromise on shared revenue on June 20, 2023, as 2023 Wisconsin Act 12. The agreement represented a generational increase in the state’s commitment to local communities, and it ties local government funding to the state sales tax going forward, allowing for growth in the future. A full breakdown of additional funding communities will receive under 2023 Wisconsin Act 12 is available here.

“Importantly, the compromise enacted by Gov. Evers contained provisions ensuring the city of Milwaukee and Milwaukee County were enabled with the tools, flexibility, and resources to avoid insolvency, including requiring a two-thirds vote by the City of Milwaukee Common Council and the Milwaukee County Board of Supervisors to implement a local sales tax of two percent for the city of Milwaukee and 0.4 percent for Milwaukee County.”

The release described Wisconsin as having “a long history of sharing state revenues with local governments,” adding that the policy began in 1911, with the enactment of the state income tax and evolved over the years.

More information about shared revenue and the new supplemental CMA can be found here:

Tony Evers

This post has already been read 2347 times!