By Kim McDarison

Members of the School District of Fort Atkinson Board of Education during their June 17 monthly meeting discussed budgetary impacts identified by the district’s Director of Business Services Jason Demerath.

Information about the district’s 2021-2022 preliminary budget, and the process to create it, was shared in advance of the meeting by Demerath in a 14-minute video presentation, which remains available on the school district’s website.

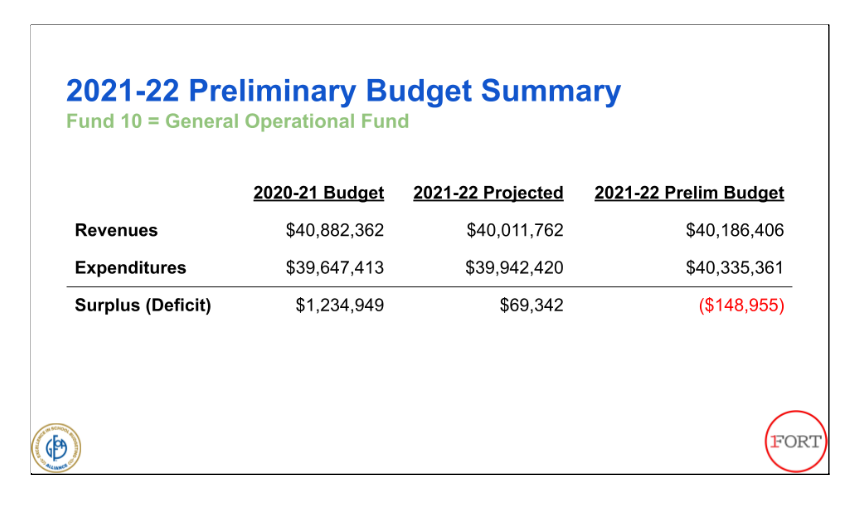

The preliminary budget, as summarized in the video, shows revenues coming in at $40,186,406 and expenses at $40,335,361, leaving a $148,955 deficit.

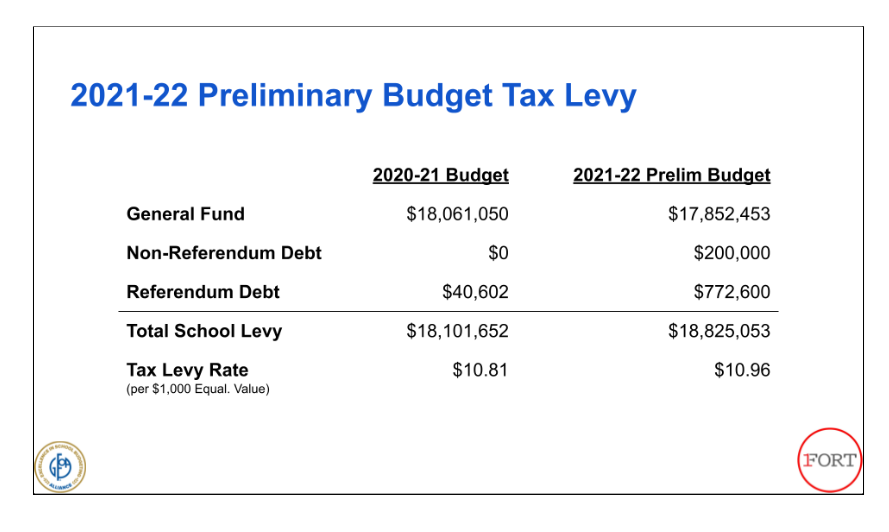

The preliminary 2021-2022 budget further anticipates a total school tax levy of $18,825,053, with a tax levy rate of $10.96, which Demerath said, is 15 cents more than the district’s property owners are currently paying per $1,000 of equalized property value.

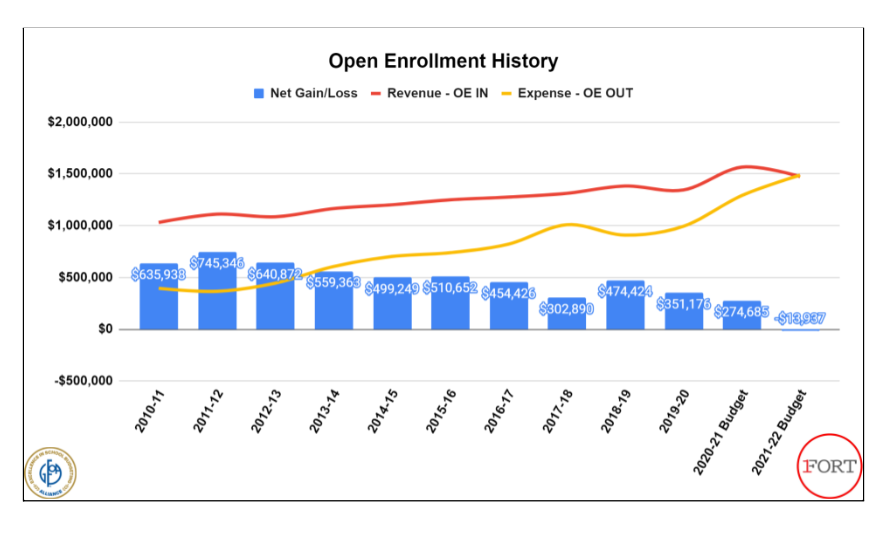

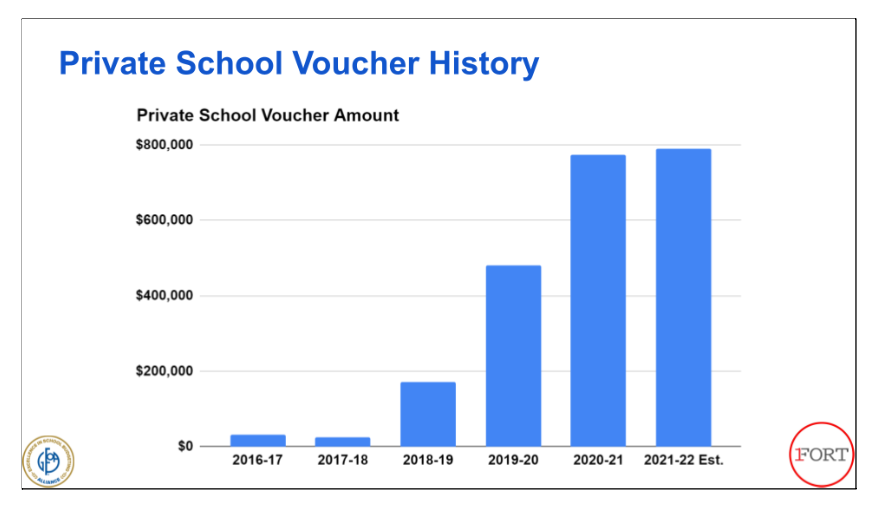

In his presentation, Demerath said the state’s private school voucher program, declining enrollment brought about by the pandemic and associated school closures, decreases in open enrollment revenue, and a potential for state legislators to view one-time pandemic relief funding as an alternative to increasing state aid this year were among determining factors which played a role in the forecasted revenue shortfall.

During the meeting, School Board President Mark Chaney said the video helped him better understand the impact the state’s voucher system has on public school financing. He praised the district for its ability to continue to be good stewards of the taxpayers’ money, even with new challenges brought about by impacts from the voucher program and a change this year in the way state aid may be distributed. He urged the district’s constituents to watch the video produced by Demerath.

School District Superintendent Rob Abbott said state aid, and how much, if any, the district might receive within the upcoming budgetary cycle, was a variable worth watching.

Details about how the preliminary budget was calculated, as shared in the video, follow.

The budgetary process

Demerath began his presentation by sharing an annual year-round budgeting process undertaken by district staff and the board, which includes the following highlights:

- The administrative team meets monthly.

- Once the current year’s budget is set in late October, a long-range financial projection is presented to the board of education in December.

- With that information as a backdrop, the administrative team then presents compensation and other budget recommendations to the board at its April meeting.

- Based on the board’s decisions, the first draft of the upcoming year’s budget is presented in June, and a second draft is presented in July.

- The budget that is approved by the board in July is then brought before the local electorate at the annual meeting held in August.

- The annual cycle concludes with board approval of a final budget and tax levy in late October.

Summary of projections

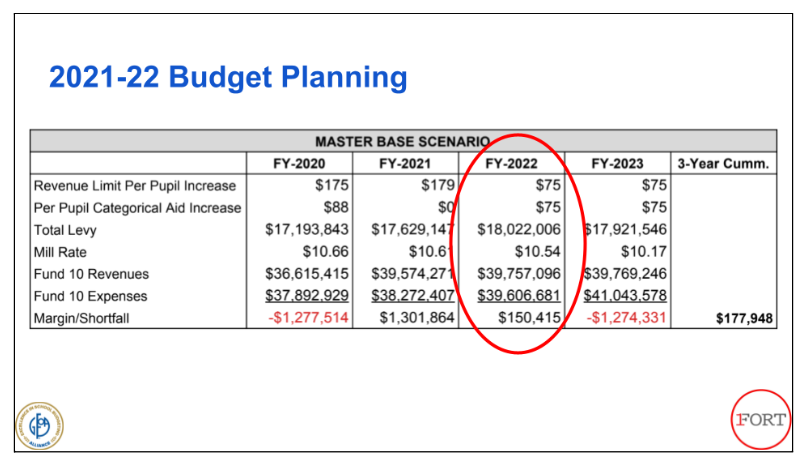

Demerath next shared “a summary of the projection from the district’s financial planning,” which led up to the operational referendum approved by the voters in April of 2020. The referendum covers fiscal years 2021 through 2023, he said.

The referendum passed last April, according to school district documentation, authorized the district to exceed state revenue limits beginning with the 2020-2021 school year by amounts not to exceed $2,250,000 each year, on a recurring basis, and $3 million each year on a non-recurring basis for a period of three years.

Financial assumptions used for budgetary planning from 2020 through 2023 were as follows:

In 2020, the district was projected to operate with Fund 10 (the district’s general operation fund) revenues of $36.6 million, with $17.2 funded through a tax levy. Fund 10 expenses were calculated at $37.8 million, projecting a shortfall that year of $1.27 million.

In 2021, the district was projecting Fund 10 revenues of $39.5 million, with $17.6 million achieved through a tax levy. Fund 10 expenses were projected at $38.2 million, leaving a surplus of $1.3 million.

Projections built for the 2022 budget showed Fund 10 revenues projected at just over $39.7 million, with a tax levy of $18 million. Fund 10 expenses were projected at $39.6 million leaving a surplus of $150,415.

Projections calculated for 2023 showed Fund 10 revenues at $39.7 million, with $17.9 million coming through a tax levy. Fund 10 expenses were projected at just over $41 million, leaving a projected shortfall of just under $1.3 million.

Mill rates as projected over the four-year period are as follows: 2020, $10.66; 2021, $10.61; 2022, $10.54, and 2023, $10.17.

Also included within the projections were “revenue limit per pupil” and “per pupil categorical aid” increases. In 2020, the projected impact of the combined total was $263. In 2021, it was $179. In 2022 and 2023, it is projected at $150 for each year. The projection in 2022 and 2023 showed a per pupil increase of $75 in each of the two categories.

Demerath next worked to compare those projections to what he said “is currently being planned for next year.

“As I just shared, that projection from our referendum planning included a $75 per pupil increase on the revenue limit and a $75 per pupil increase in categorical aid.”

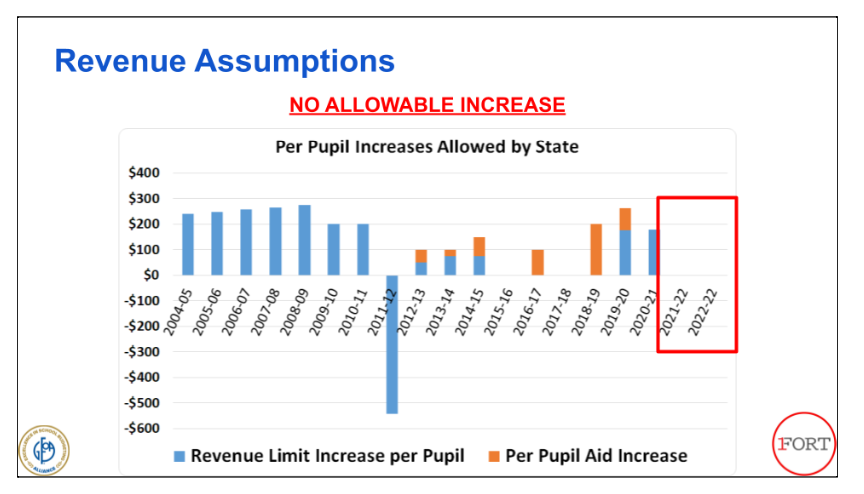

‘No allowable increase’

He next showed a chart, titled: “Revenue Assumptions, No Allowable Increase,” which showed the history of the two revenue increases over the course of 19 years. The chart noted the absence of per pupil state aid during the 2021-22 and 2022-23 school years.

Explaining the chart, Demerath said: “Over the last decade, any increase in these revenues has been hit or miss based on the decisions made as part of the state budget process. As opposed to getting $75 per pupil in each of these two revenue sources, we are assuming in this budget that we see no increase in allowable revenue from the state for local public schools. This assumption is based on the Legislature’s Joint Finance Committee’s action taken in late May where they passed a motion for no revenue increase for public schools as part of their budget recommendations. This was done with the thought that the one-time (COVID relief) federal funds we are receiving could be used to offset any recurring operational increases, something that we as local districts try to stay away from as a practice to ensure recurring resources support recurring expenses for our programs and services.”

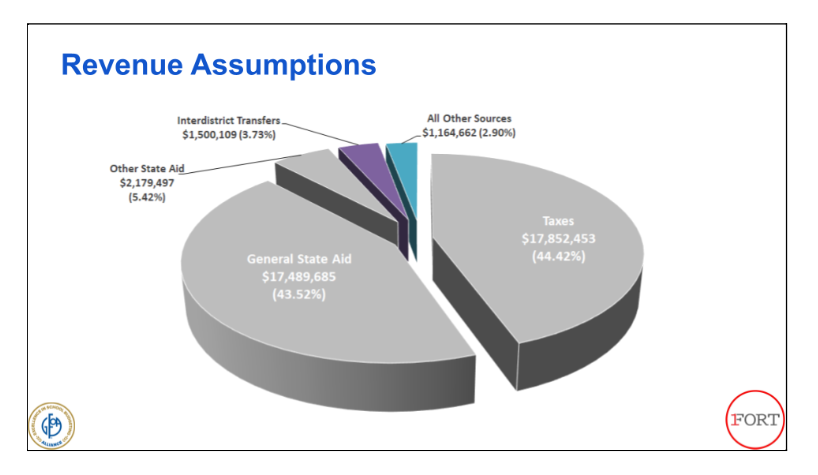

A distribution of district revenues

Demerath next shared a pie chart showing a distribution of district revenues.

The distribution shows that general state aid and taxes collected from residents within the district each account for approximately 44% of the district’s total revenues. The remaining categories include “other state aid,” accounting for 5.42%; inter-district transfers, accounting for 3.7%, and “all other sources,” accounting for 2.9%.

Looking at the chart, Demerath said, “We can see that all but 6.63% of our $40 million budget is dictated directly by the state through the revenue limit, state general aid, and state categorical aids.”

Inter-district transfers is “almost exclusively” open enrollment revenue, he said. “Other sources” includes grants and local fees.

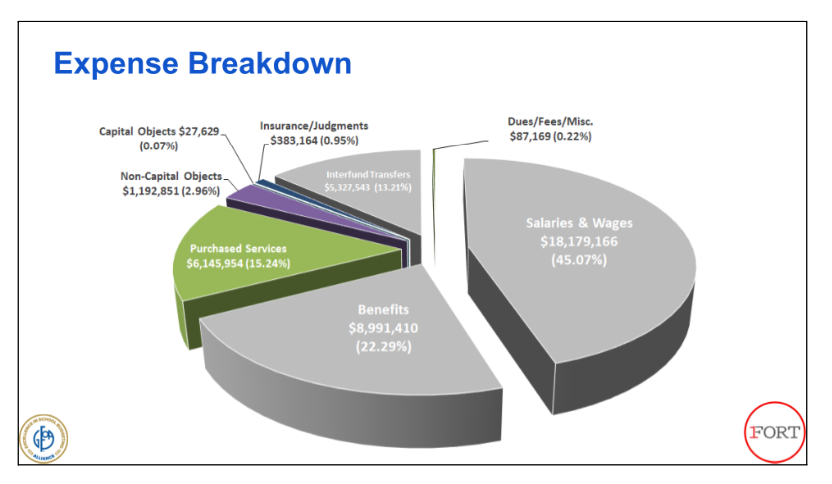

A distribution of district expenses

A pie chart, showing a distribution of expenses, indicated that 45% or some $18 million is spent on salaries and wages. Another 22.2%, or nearly $9 million, goes toward benefits. Purchased services account for 15.2% of expenditures and inter-fund transfers make up another 13%. Other expenses include non-capital objects, at 2.96%; insurance/judgments, at 0.95%, capital objects, at 0.07%, and dues, fees and miscellaneous, at 0.22%.

Said Demerath: “As a service business, about 80.5% of our budget is spent on personnel to provide the service of educating our community’s children.”

Looking at other categories, he said, purchased services includes such items as transportation, utilities, and open enrollment payments to other districts for residents whose students are using the program to receive education in other districts.

Looking more closely at the 80.5% spent on personnel, the breakdown includes the following: a wage and salary increase of 2.26% which was approved for district employees by the board in April, health insurance premiums saw no increase for HSA plans and a 4.8% increase for HRA plans. Dental insurance premiums saw an increase of 2%.

The board also approved in April several new positions, including: three full-time positions for social workers; one full-time position for a secondary school psychologist; one full-time position for an academic advancement coordinator; one full-time position for a special education and student services coordinator; three full-time and one part-time positions for elementary math coaches and interventionists, with some of those costs paid through federal ESSER (Elementary and Secondary School Emergency Relief) funds, and one full-time high school science teacher.

The budget also includes recently approved monies for high school energy efficiency projects and the associated debt.

Budget summary

An overall budget summary produced the following numbers: actual revenues in 2020-2021 were $40,882,362, with actual expenses coming in at $39,647,413, leaving a surplus of $1,234,949; In 2021-2022, projected revenues, showing updated numbers and taking into account new positions approved by the district in April and approved projects at the high school, were $40,011,762, with expenses projected at $39,942,420, leaving a projected surplus of $69,342.

In 2021-2022, taking into consideration open enrollment revenue declines and the potential absence of per pupil state aid, the preliminary budget is built using revenues of $40,186,406 and expenditures of $40,335,361, leaving a deficit of $148,955.

Demerath also shared a preliminary tax levy projection model, showing that in the 2020-2021 budget, the general fund included $18,061,050, non-referendum debt of zero and referendum debt of $40,602. In the 2021-2022 preliminary budget, the general fund includes $17,852,453, with non-referendum debt of $200,000 and referendum debt of $772,600.

In 2020-2021, he said, the school tax levy was $18,101,652, with a tax levy rate of $10.81. The preliminary 2021-2022 budget calls for a total school levy of $18,825,053, with a tax levy rate of $10.96. The tax levy rate is the amount paid by individual property owners per $1,000 of equalized value. The levy rate represents an increase of 15 cents over the current year, Demerath said.

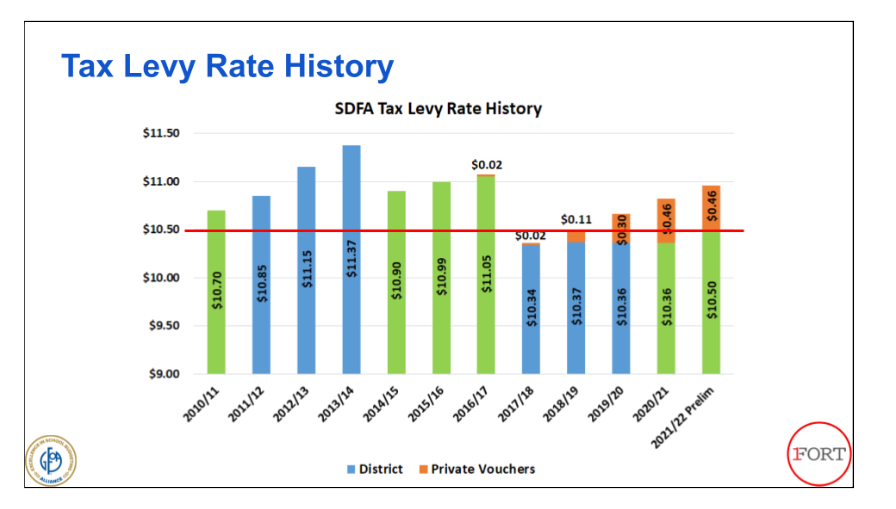

Explaining fluctuations in levy rates, Demerath said: “in recent years, the state has approved funding private school vouchers with public tax dollars. The cost of those private school vouchers used in the local school district by community members passes through the local school’s tax levy, resulting in increased local taxes beyond the taxes used by the public school.”

Demerath said that if the dollars used for private school vouchers were removed from the levy calculations, the tax levies used to pay for public schools would be less.

“While as a local school district we work to manage the tax rate for the local taxpayer, the impact of private school vouchers on taxes is out of our control and is a pass-through on our tax levy to fund those private vouchers with public tax dollars.”

Looking ahead at further planning, he said, “larger items that are on our radar and could have a major impact on the final budget” include: enrollment and open enrollment.

Looking at regular enrollment, Demerath said: “We are still waiting to see what might happen in the fall as we saw a larger than expected decrease in enrollment this past year due to the pandemic and the closure.”

He described enrollment as a major factor in school finances in Wisconsin.

“We won’t fully know what to expect until about Oct. 1,” he said.

Private school vouchers also have a major impact on the local tax levy and rate, he said, adding, “Should they increase for 2021-22, so, too, would the public taxes associated with those private vouchers.”

The state’s 2021-23 biennium budget is still under development. The outcome of the budget will have a “major impact” on local public school finances, Demerath said.

How long the process takes, and its ultimate impacts to schools, and the Fort Atkinson school district “is unknown at this time,” he said.

As part of the state’s budget planning, ESSER Funding, the district’s one-time federal funding which was intended for pandemic response and reinvestment, is now being considered by the state as a potential source of income to be used for ongoing operational costs.

The state is considering this measure, according to Demerath, “So that the state does not have to increase our allowable recurring revenue.

“How the state budget shakes out, will impact how we use this one-time federal funding.”

Said Demerath: “For the first time in our history, we are projected to have a net loss in open enrollment next year. This could be, and should be, somewhat alarming. From a programatic and leadership perspective, our work on the strategic plan, and district goals this summer, is meant to positively impact our offerings, as well as our brand and image as we face increasing competition for students.”

The change presented by open enrollment, he continued, represents a financial shift of about $290,000, which, he said, accounts for the nearly $150,000 deficit the district is currently facing.

Looking at trends in private school vouchers, he said, if costs continue to climb, the district could be facing taxing residents as much as $1 million to cover the costs associated with funding the private school voucher program.

He noted that public schools and voucher programs are “another growing source of competition for our local public schools.”

From a facilities perspective and addressing competition in the marketplace, he said, “We will continue our master plan to improve our facilities in the coming years, just as other schools have done over the past several years, and continue to do.”

Budget timeline

Demerath concluded his presentation with a budget timeline, noting that on July 1, the district will receive state aid estimates. On July 15, the board will approve the district’s budget. On August 19, the budget will be brought before the district’s electorate during the annual meeting. On Sept. 17, the district will make its fall pupil count. On Oct. 15, the district will receive from the state its certified amount of state aid. On Nov. 1, the district will determine its tax levy for the upcoming budget, and that information will be shared with municipalities within the district by Nov. 10.

The complete presentation made by Demerath can be viewed here: https://www.loom.com/share/88233579cdc64ac8b75331ad557b11ae.

The above chart, shared within School District of Fort Atkinson Director of Business Services Jason Demerath’s 14-minute video presentation, shows the “summary of the projection from financial planning leading up to the April 2020 referendum.”

The above chart shows a history of state aids through revenue limit increase per pupil and per pupil aid. Assumptions made by the district for the 2021-2022 school year shows that no aid in these categories is anticipated, according to Demerath, following a recommendation made by the State Legislature’s Joint Finance Committee in May to withhold revenue increases for public schools as part of the state’s biennium budget.

The above pie chart shows revenue assumptions made by the district for the upcoming district budget. Revenues collected by the district come largely through two sources: the tax levy, at 44.42% of the budget, and general state aid, at 43.52% of the budget.

The above pie chart shows the distribution of expenses within the district, with the largest portions used for salaries and wages, and benefits.

The chart above shows the projected versus the preliminary budget for 2021-2022.

The chart above shows the tax levy rate calculated in association with the 2021-2022 preliminary budget and compares it with calculations made last year.

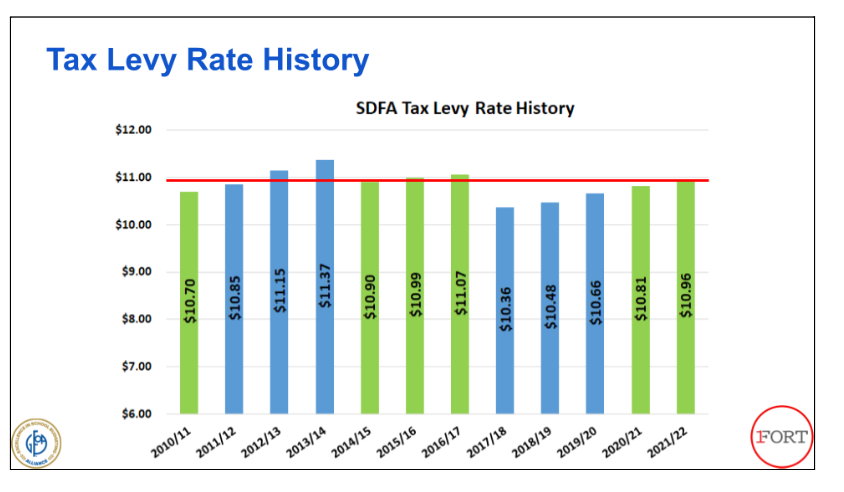

The above graph shows the School District of Fort Atkinson’s levy rate history.

The above graph shows increases to the tax levy associated with the state’s private school voucher program.

The above graph shows a history within the district of open enrollment revenues and expenses.

The above graph shows a history of tax levy dollars utilized within the private school voucher program.

Above graphic representations supplied by the School District of Fort Atkinson.

This post has already been read 2583 times!