By Ryan Whisner

The Fort Atkinson City Council Tuesday unanimous approved a resolution, urging the Wisconsin Legislature and Gov. Tony Evers to review the state’s system of funding critical local services.

During Tuesday’s meeting, council members described the current system as “broken,” calling for its repair.

Offering his thoughts on the issue, councilman Eric Schultz said: “It’s been my experience on the city council that some of the issues that face our city sit above the level of our local government, and that the shared revenue model is broken. Even the state representatives locally that I’ve met with basically laughed at the idea of revisiting the shared revenue model.”

Despite those actions, Schultz shared his belief that people continue to vote for those lawmakers whom, he said, don’t share the state tax revenue with local jurisdictions.

“We’ve just seen earlier today that the federal government will help provide money to make improvements in our airport, but I haven’t seen any of that done to improve EMS services or other services within the city,” Schultz said.

He pointed to comments made by a resident who spoke during the public comment portion of the meeting. The resident cited tax increases as being of major concern. Schultz stated that it is the failure of the larger government representation that forces the city to bring items to a referendum.

Advocating on behalf of communities around the state, the League of Municipalities’ priority for the 2023-2024 legislative session is critical local services funding. The intent is to urge state leaders to make a change to a system of funding that, from the municipal point of view, is no longer working.

“These budgeting issues, these property tax changes, this is not a Fort Atkinson-exclusive community problem,” council member Megan Hartwick said. “This is a problem for communities, cities and municipalities across our state because to everyone’s point already, the system is not working. This is Fort Atkinson joining in the League of Municipalities putting this out there.”

Illustrating that support, she cited a letter that the League of Municipalities included with the resolution. It was written by the mayors of Brookfield and Madison. Hartwick noted that, within the first two lines, they reference that the support is coming from one very red community and one very blue community.

“This is not Republicans think it isn’t a problem, that Democrats do, or vice versa,” she said. “This is all city municipality leaders, council people, aldermen, and city managers coming together and saying we are tired of having to go to our community for more money. We are tired of having to ask for public safety referendums (for) services that are critical and necessary. There must be a different way to fund that than to continue to go to the people.”

Hartwick said she believed it was never the first choice of likely anyone sitting at the council table to go to a referendum.

“When you are in a position where that is your only choice, that is the route that we have had to go, and that’s what this is focusing on,” she said. “The city does not just have one full bucket of money that we get to decide exactly how to dispense. There are a lot of restrictions and requirements that the city is legally bound to when it comes to budgeting and setting tax limits and other limits. I think it’s important for people to understand that this is a much bigger, broader issue.”

She said residents are always welcome to question the council members and city staff.

“We welcome that discussion, but we also hope you are having that discussion and asking those questions with the people who are representing our community in Madison, who have a lot more power over changing that structure then we do at this table,” Hartwick said.

As an example of the perceived flaws in the system, Fort Atkinson City Manager Rebecca Houseman LeMire noted that in November, Wisconsin voters faced more than 104 referendum questions asking voters to allow a school district, town, city, village, or county to exceed state limits on local property taxes for public safety, school operations or building projects.

Similarly, in April, Fort Atkinson voters approved a public safety referendum to cover the cost of adding 12 full-time firefighters/EMTs and two additional police officers.

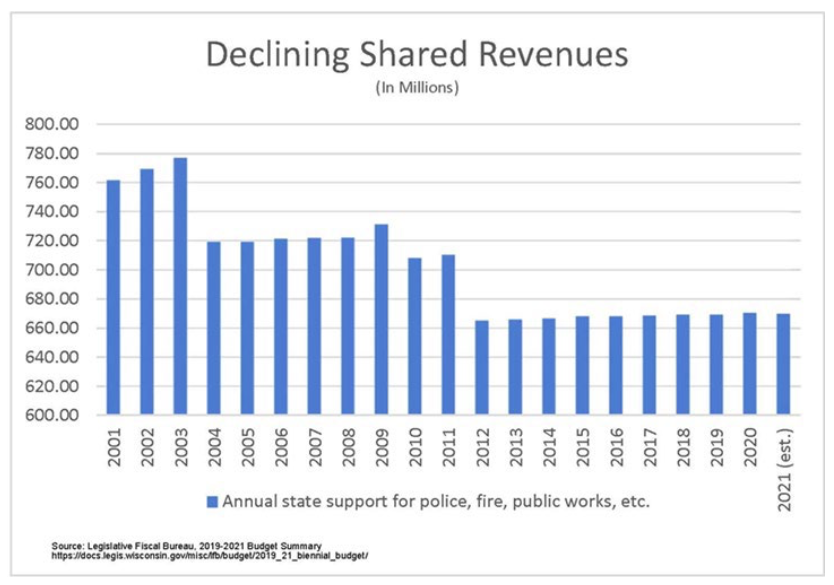

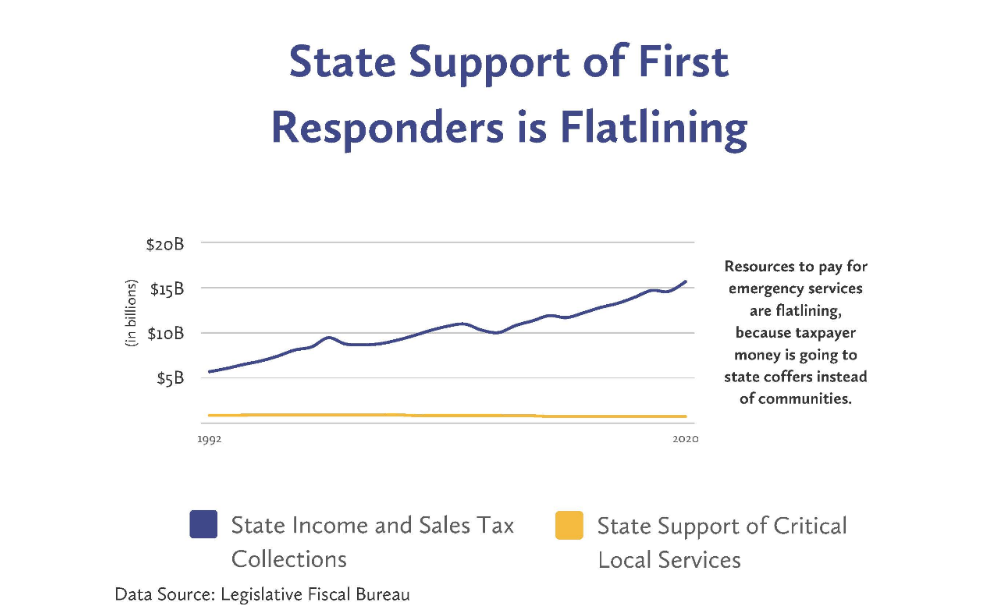

“We are grateful the voters in the city of Fort Atkinson stepped up to support our emergency services, but that’s not the way local government services should be funded,” LeMire said. “Over the last 20 years, state aid for police, fire, and other critical services has steadily declined in real dollars, while inflation has caused average prices to increase by 51%.”

Currently, local governments are primarily funded through property tax revenue and intergovernmental revenue or state-shared revenue. LeMire said Wisconsin is the only state in the country that funds critical first responder services largely from property taxes.

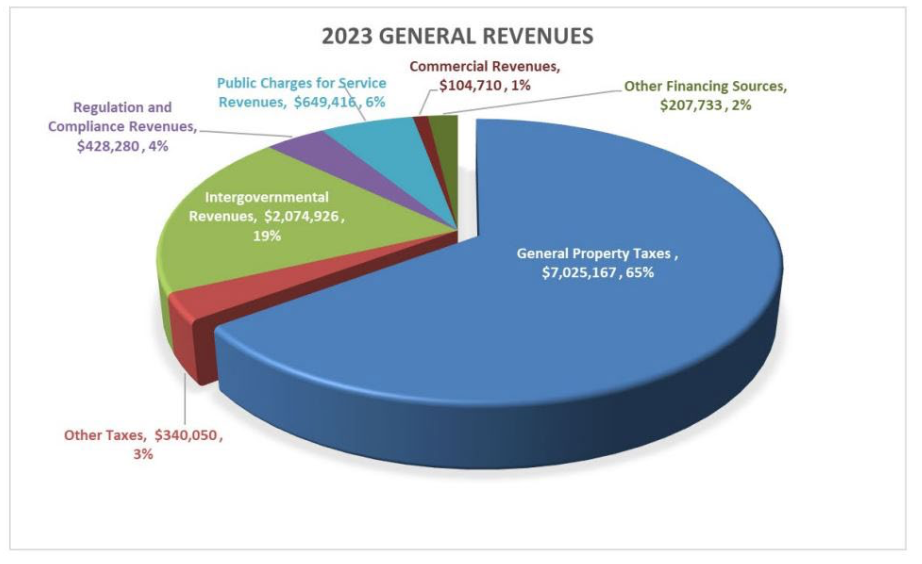

She said within the city’s 2023 budget, 65% of the city’s budgeted revenue comes from property taxes and 19% comes from intergovernmental revenue, for a total of 84%.

LeMire noted that property tax revenue is limited by “levy limits” imposed by state law. This law limits a local government’s ability to increase property tax revenue to the percentage of net new construction for the prior year.

Fort Atkinson’s net new construction in 2022 was .34%, which equated to a levy increase of $22,068. The city manager pointed out that several of the city’s contracted services, such as garbage and recycling collection, are tied to the increase in the Consumer Price Index (CPI) and increased more than the city’s allowable levy increase.

Other funding mechanisms for local government entities are borrowing funds outside the levy limit or seeking voters’ approval to exceed the limit via a referendum process. Fort Atkinson has taken both measures in 2022, leading to a nearly 14% increase in property tax bills that were recently mailed out.

“Borrowing is not an appropriate way to fund annual operations, and the approved public safety referendum amount of $769,335, will never increase,” LeMire said. “These are not growing or sustainable funding sources.”

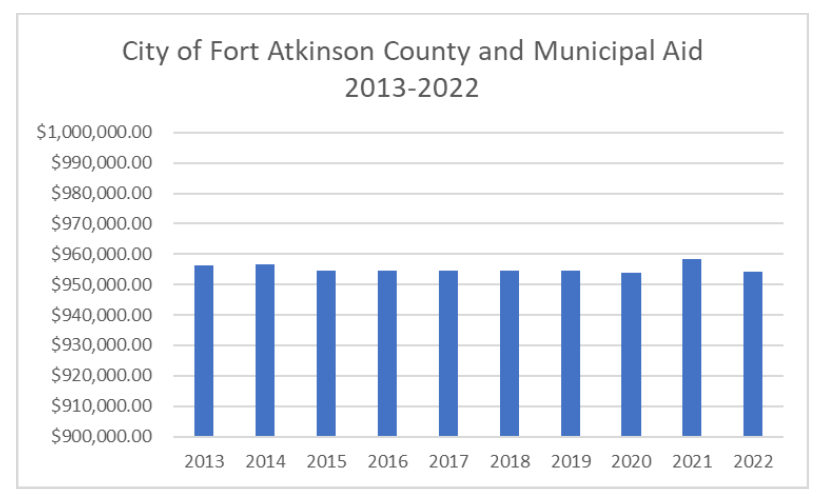

She said the other major source of revenue for local governments is state-shared revenue, which has decreased substantially over the last 20 years statewide. Fort Atkinson’s has been stagnant for about 10 years with the maximum differentiation being just $4,000 from 2013 to 2022.

The funding for county and municipal aid in 2003 was $938,529,507 and today it is 753,032,613. County and municipal aid payments to Fort Atkinson have dropped from $956,453 in 2013 to $954,318 in 2022, while inflation continues to increase.

LeMire also noted that the state is projecting a $6.6 billion budget surplus as of Nov. 2022.

“Over reliance on property taxes to pay for critical local services must end,” she said. “Local governments need reliable, growing, sustainable, and diverse sources of revenue to continue to deliver top-notch police, fire protection, ambulance services, and safe streets now and into the future.”

The council unanimously supported the referendum in hopes that area state leaders would take note and city residents would reach out to those state representatives for answers.

“There are reasons we have had to ask certain things out of our constituents,” council president Chris Scherer said, citing the public safety referendum. “You have every right to ask us questions and want to know why we are doing stuff, but I think it is also extremely important to remember who you vote for in Madison can affect your quality of life right here in Fort Atkinson.”

As an example of the challenges facing cities across the state, Scherer cited the League of Municipalities information which indicates that fire and EMS costs across the state have increased by 16.7% since 2011.

Council member Mason Becker, who has faced challenges while serving on the city council for four terms, pointed to a particular issue that, he said, is seldom raised: “There is no state department that argues in favor of funding for the local services that municipalities provide,” adding that there is no department of local law enforcement or department of state fire and EMS.

Comparatively, in other states, funding is provided by the state government for some of those services. Wisconsin is currently dead last in funding for local law enforcement.

“It’s a broken system that we have,” Becker said.

He said he didn’t like the property tax system and considers it a failed method.

“I understand it is hurting a lot of people,” he said. “I too don’t like the increase that my property tax bill reflects.” He would like to see the state of Wisconsin go to a model where instead of relying on that one big bucket of funding, that there were multiple little buckets to dip into.

“Right now, that’s all we have and at the end of the day we still have services to provide,” Becker said. “I’m not interested in seeing Fort Atkinson become a city where, if you’re having a heart attack, you don’t know when the ambulance is going to show up or if there’s a fire, it takes a half hour for the fire truck to get there. I don’t think that that would be a way to attract young talent and young families to our community either.”

No matter the funding mechanism, Becker said Fort Atkinson will continue to be a city that provides great services, and hopefully, the state leaders will recognize the failure of the overall funding system.

“They’re (the state Legislature) sitting on a $6.5 billion budget surplus,” he said. “That’s tax money that belongs to all of us, that is not coming back to us. They’re just sitting on it and playing political games fighting back and forth, but they’re not talking about addressing local needs.”

With complete support of the resolution, Becker said he is hopeful, though pessimistic about leaders at the state level taking any notice. “I’m frankly not going to hold my breath,” he said. “We all have to keep doing what we can do at the local level to keep the city going because that’s where we’re at.”

Before the presentation about the resolution, Fort Atkinson resident Ron Martin, speaking during public comments, expressed concern about the increasingly growing tax bills.

He cited some comments he had read about the 14% increase, which he said, he thought summed up the situation. He noted: “It is hard for seniors on fixed incomes trying to afford these property taxes. How long can we keep having these increases and stay in our houses?”

Martin referenced the passage of the public safety referendum, which, he said, allowed the city to run a “gold-plated ambulance service.” Also, he mentioned how all part- and full-time city employees received a 4% raise in the 2023 budget.

“I can understand why there’s an increase, but this crushing tax burden that we have living in the city of Fort Atkinson, I know for a fact is causing people to move or to sell houses or to look for relocating because they can no longer afford to live in Fort Atkinson,” he said.

For those on fixed incomes, seniors, or others who can’t afford taxes and the ongoing inflation, Martin questioned if they must decide between eating, buying their medication, or paying their taxes.

“People are making that decision whether you want to admit it or not,” he said. “People are having to come to grips with making those types of decisions.”

No one spoke at the city’s 2023 budget public hearing, except one resident who praised the city’s transparency in its budget process.

“There are people out here who live in the city that are going to be financially ruined by the tax increases that are continuing to eat away at any savings they might have and we’re in a dire situation here,” Martin said.

A pie graph indicates from where resources to fund the city come in 2023. General property taxes are indicated by the largest dark blue portion of the graph.

A bar graph shows funding received by the city through shared revenues provided by the state between 2001 and 2020. An amount is estimated for 2021.

A bar chart shows revenues received by the city through county and municipal aid between 2013 and 2022.

A graphic demonstrates the trajectory for resources used to support emergency services. The graphic shows state support for such services as indicated by the yellow line. The blue line indicates support for emergency services developed through state income and sales tax.

The graphics above are supplied by the city of Fort Atkinson.

This post has already been read 947 times!