By Kim McDarison

Voters Tuesday responded with mixed reaction to two referendums presented by the School District of Fort Atkinson.

A two-part operational referendum failed to garner voter approval, with ‘no’ votes from across the district tallied at 4,162 and ‘yes’ votes tallied at 3,644.

The School District of Fort Atkinson has nine municipalities within its boundary, including, within Jefferson County, the city of Fort Atkinson (wards 1-10) and the towns of Cold Spring (ward 1), Hebron (wards 1 and 2), Jefferson (wards 1-4), Koshkonong (wards 1-6), Oakland (wards 1-4), Palmyra (wards 1 and 2) and Sumner (ward 1), and in Rock County, a portion of the town of Lima.

While city of Fort Atkinson voters chose in favor of the referendum, voting 2,438 to 2,403, it was by a thin margin of just 35 votes. In the town of Koshkonong’s wards 1-6, voters were against the measure, with 1,012 ‘no’ votes cast as opposed to 719 votes cast in favor.

The failure of the measure means that the School District of Fort Atkinson will not be able to increase its taxpayer-supported operational funding over the state-imposed revenue cap.

A second referendum question, asking voters to approve the issuance of general obligation bonds of $22 million to support capital improvements, garnered approval by a vote of 4,154 to 3,696.

Funds will be used to pay for costs associated with secure entry sequencing improvements, maintenance and mechanical projects in all of the district’s school buildings, and traffic flow improvements at the high school.

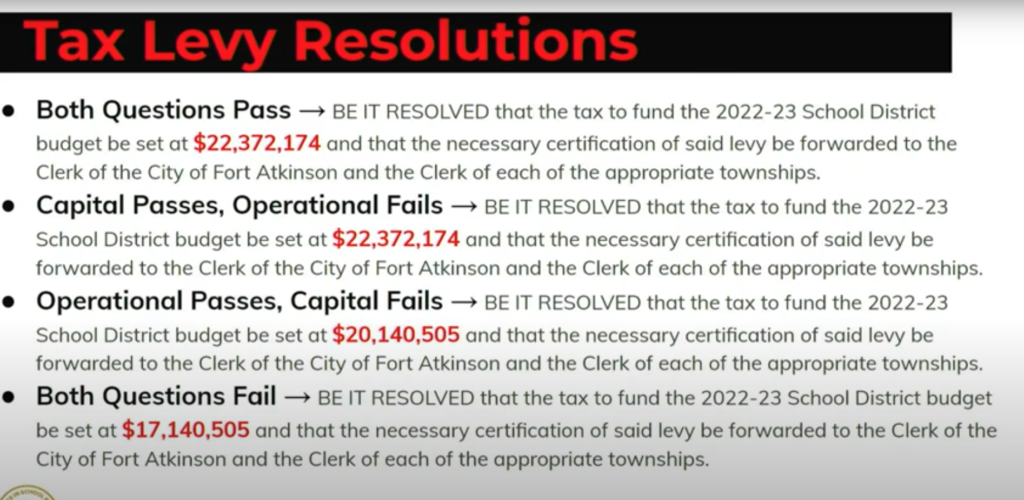

In the event that the capital referendum question would receive voter approval and the operational referendum question would not, according to information presented during the October school board meeting by School District of Fort Atkinson Director of Business Services Jason Demerath, on Nov. 15, the district will certify the following: the district’s tax levy will be set at $22,372,174. Taxpayers this year can expect to pay a tax rate of $10.95 per $1,000 of equalized property value.

The slide above, as shared by District of Fort Atkinson Director of Business Services Jason Demerath in October, shows the four scenarios anticipated by the district in advance of Tuesday’s election.

This post has already been read 3392 times!