Editor’s Note: The following information regarding a resolution passed by the Fort Atkinson City Council on April 8 was emphasized in an April 26 press release from Fort Atkinson City Manager Rebecca Houseman LeMire. It’s contents follow.

In support of a full partnership with the state, the Fort Atkinson City Council adopted a resolution in “support of a strong state and local partnership” at its meeting on April 8, 2021.

The resolution emphasizes the need for a strong partnership with the state to fund critical services like police protection, fire suppression, road maintenance, snowplowing, libraries, and parks that are core components of quality communities and attracting families and businesses.

“We believe a strong funding partnership with the state will facilitate the kind of opportunity for improvement to infrastructure and economic growth we aspire to see year-over-year. We have big plans for the future of Fort Atkinson. Restoring previous levels of state shared revenue will allow the City to keep our local property tax rate stable, which is a valuable step toward ensuring those plans come to life in ways that make our community a vibrant place to live, work, and play,” City Manager Rebecca LeMire said

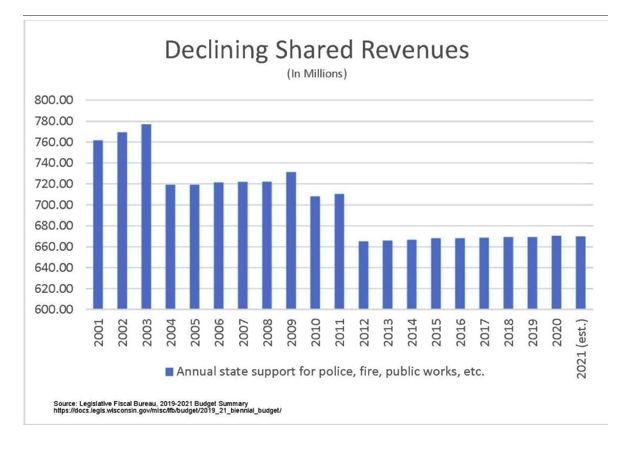

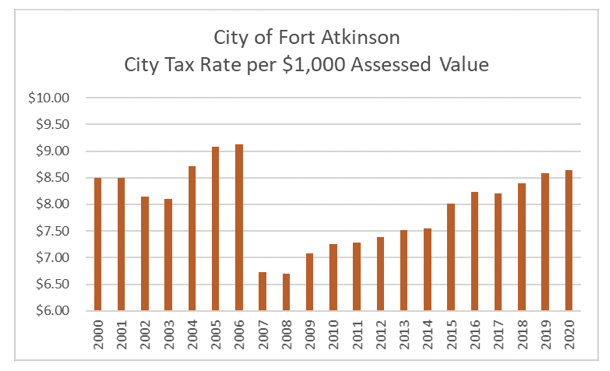

Cities and villages in Wisconsin are funded primarily by property taxes and shared revenues from the state, and Fort Atkinson is no exception. The demands on municipalities, unfunded state and federal mandates, and inflation on the costs to buy products and materials for our services have not gone down. In fact, they’ve increased. At the same time, as demonstrated in the charts below, funding through the shared revenue program has decreased causing property tax revenue to increase.

The resolution adopted by the City of Fort Atkinson is based on a League of Wisconsin Municipalities model being adopted by cities and villages statewide, and the City is a League member. The league is a statewide member organization, advocating for cities and villages large and small, rural and urban.

The above chart, shared by the City of Fort Atkinson, shows declining Shared Revenues from the state to municipalities (2001-2021). Submitted graphic.

The above chart, shared by the City of Fort Atkinson, shows the City of Fort Atkinson Tax Rate per $1,000 of Assessed Value (2000-2020).

Note that there was a citywide revaluation in 2007 that increased the overall value of the city thereby decreasing the city’s property tax rate. The rate has steadily increased since then, as shared revenue from the state continues to decrease. Submitted graphic.

This post has already been read 1447 times!