By Kim McDarison

The School District of Fort Atkinson Board of Education recently approved three resolutions required to fulfill the district’s funding strategy through the issuance of $22 million in bonds.

The issuance follows the approval of a referendum by the district’s voters in November, allowing the district to seek financing in the amount of $22 million to be used for capital improvements.

Fort Atkinson School District Business Services Director Jason Demerath noted that the district had been working with Baird to determine “the best path forward” for financing the $22 million.

Brian Brewer, a managing director with Baird based out of the company’s Milwaukee office, according to the company’s website, presented information to the board Thursday, Nov. 17, outlining a multi-staged financing approach. The process required the board to approve three resolutions: the first authorized the issuance and sale of not to exceed $22 million bond anticipation notes, a second authorized the insurance and sale not to exceed $10 million in general obligation refunding bonds, and a third authorized the issuance and sale not to exceed $8 million in general obligation refunding bonds.

Aided by slides, Brewer explained the process, noting that he and the district will continue working on and planning for an operational referendum. The district has announced previously and reiterated during the meeting that, in light of its operational referendum failing to garner voter approval during the fall general election, it intends to bring a reformulated operational referendum before voters in April, during the spring general election.

A letter from school board president Kory Knickrehm, announcing the board’s decision made earlier in November, is here: https://fortatkinsononline.com/fort-school-board-president-thanks-community-for-considering-referendums-looks-ahead/.

Looking at the district’s capital improvement plan, funding for which received voter approval during the fall general election, Brewer said he and Demerath, among others, had been “working through different scenarios to try and implement and lock in the financing piece for the $22 million to fund the capital projects.”

The result of their work required the district to approve the three resolutions presented, he said, adding that plans called for the district to lock in its longterm plan within the following 60 days.

“Ideally, we will finalize the longterm in January, “ Brewer said.

He advocated that the district lock in an interest rate as soon as possible, stating: “The strategy is, you know, rates have been moving higher throughout this year — I have an illustration of that — but, ideally, locking in and taking advantage of some federal tax benefits along the way and ultimately getting you the funding in the project account so you can begin earning investment earnings during that time period, which, there’s only two things you can do with those: one is complete the referendum-approved project and then the other is to pay down the debt.”

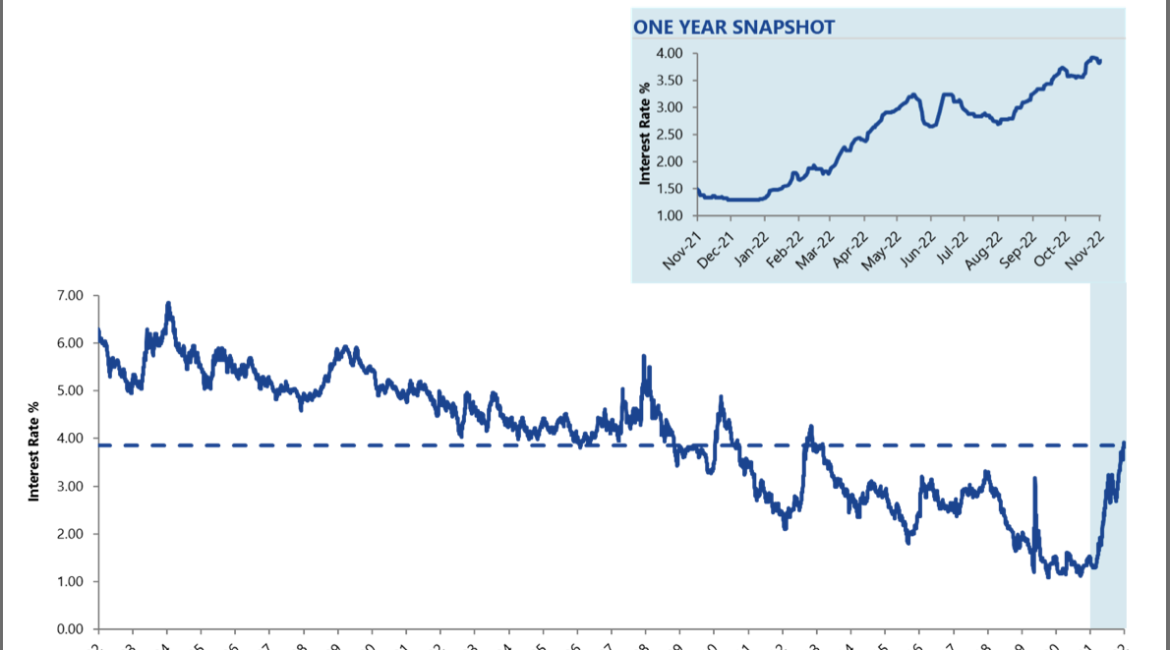

Sharing a presentation slide, shown above, Brewer said the chart showed a trajectory for longterm interest rates, along with a 20-year municipal borrowing daily rate index.

Pointing to the solid blue line on the chart, he said: “This is a 20-year municipal borrowing index, so it’s a daily rate.”

The chart was meant to provide board members with an idea, he said, “of what the general market environment and movement of interest rates have been.”

Additionally, he said, within a callout box, shown in light blue, the slide showed a trajectory of changes in interest rates occurring within the last year.

“So that’s a pretty significant change in one year, and I’ve been doing this since near the beginning of this chart, in ’96 is when I started at Baird, so I’ve seen a lot of movement throughout that time period and you’ll recall you finalized your Fund 38 borrowing in ’21, and those rates were — they topped out at 2 (percent). Like the highest rate was 2 (percent). So the timing was in an abnormally low, post-pandemic-induced interest rate environment,” Brewer said.

Even as interest rates have recently increased, he said, “this year, it’s still, historically speaking, a very favorable time to invest in longterm facilities.”

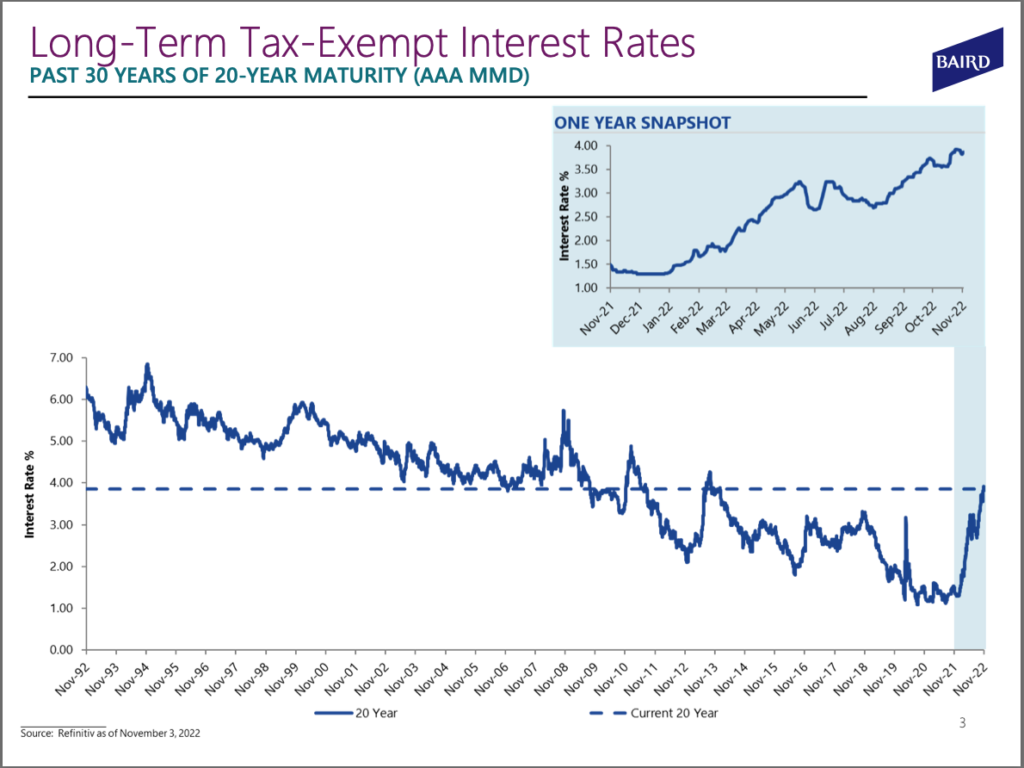

Moving to the next slide, shown above, Brewer said the information provided was a rational for the three resolutions brought before the board.

He shared with the board two terms: “bank qualified” and “non-bank qualified,” saying: “those are technical terms, but bank-qualified is a federal tax code. It allows or incentivizes banks to purchase — actively purchase — debt from what they call a ‘small issuer’ in a calendar year. So they define small issuer as $10 million or less in a calendar year, and your financing $22 million. So, what we are doing with the first resolution, which is a bond anticipation note, it’s to borrow on a short-term basis — think of it as a construction loan — it’s a six-month note with a three-month redemption, so we will pay it off in three months, but it will close in 2022. And the reason for that is I want to lock in the non-bank-qualified on the short repayment in 2022; come back in January, which is what the two other resolutions are, and lock in up to $10 million as bank-qualified.”

Directing board members to a chart, he said: “that’s each year of a 20-year repayment, and so the benefit of bank-qualified begins in about seven years and goes out to about 20 years. And so we’re going to put the $10 million in your 20, 19, 18, 17, 16 (payment year) and kind of work our way backward, to try and maximize that federal incentive that is offered to banks and then translates into anywhere — it changes week to week — but anywhere from (25 to 35 basis points). It may not sound like a whole lot in the grand scheme of things, but on $10 million over 20 years, it adds up to about anywhere between $3-400,000 of interest cost avoidance. If we can do that by straddling the calendar year, I think it positions the district to minimize interest costs and maximize investment earnings.”

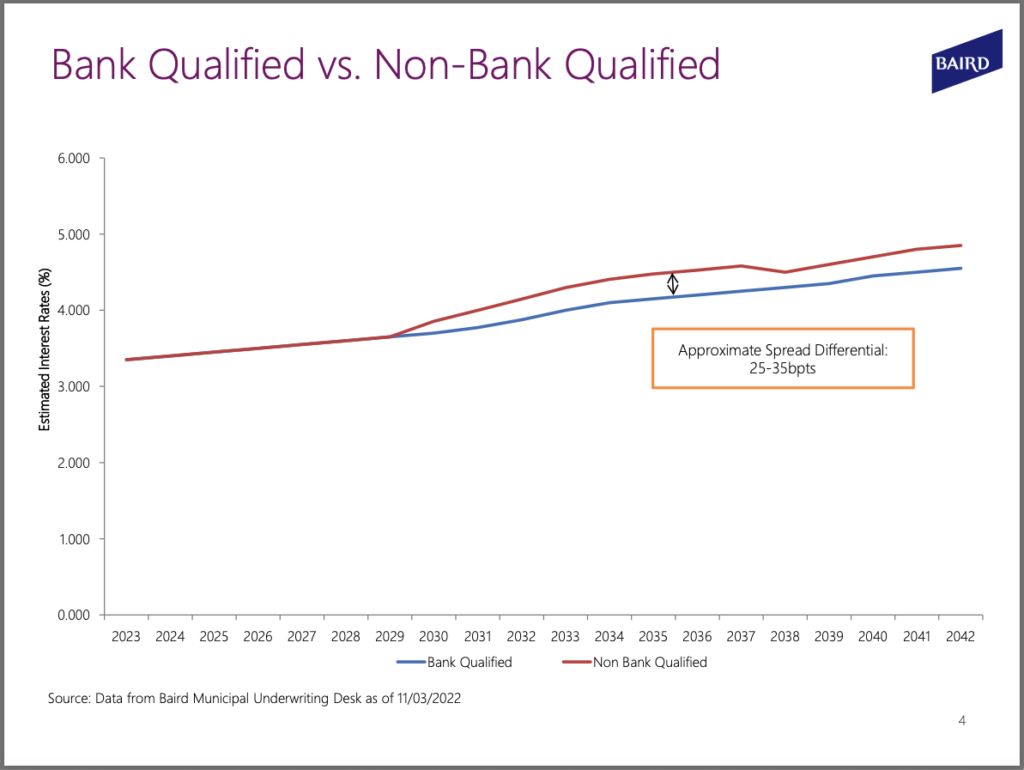

Brewer next pointed to a slide titled: “Financing Considerations,” shown above, which, he said, summarized the process.

Said Brewer: “The goal is to meet your estimated (mill) rate target of $10.95, minimize total interest rate or interest costs, minimize interest risk, which is why we are trying to lock in the loan early in 2023, and then maximize investment earnings by borrowing the $22 million — you’re going to take a few months to a year to spend the dollars, but you begin investing — so one of the benefits of rates moving higher as the federal reserve has raised their rate, your investment rate is also higher than it has been in the last 14 years. So that will be helpful there.”

Additionally, he said: “One of the things that Jason and I will be working on is going to get an updated Moody’s investor service credit rating. So that’s the district’s credit score. Moody’s is a third-party that rates corporate entities as well as municipal entities across the country.”

Based on the district’s prior outstanding debt, Brewer said the district’s Moody’s rate is Aa2, which he described as “two notches from the highest that they offer.

“It’s a very strong credit rating and that’s an outcome of the policies, practices and procedures that you, as a board, working with (Superintendent Rob) Abbott and Jason and the team, implement month-in and month-out. So this is our point at which we can shine a light on that and your fiscal — your five-year trend, and your growth, and your fund balance levels, and your minimal debt that’s outstanding — so I mean it’s all of those things that lead to a Aa2. Why that matters? Very similar to our own credit scores, the higher that score is, the better the interest rate. There are more buyers that want to own it (bonds) and so there’s more competition for those bonds, which then reduces the overall interest cost,” he said.

He continued: “So the repayment plan is a 20-year repayment. Ultimately, we’re structuring those first couple of years to — with the knowledge of the operational question and challenges, so we were toggling that repayment with the rest of the budget — your budget forecast model that Jason updates and presents — we will continue to do that, and ultimately arrive at a level payment after those first few years such that you know what that principal and interest payment is going forward.”

Looking to further explain the three resolutions, he said: One will be for the bond anticipation note, one will be for a general obligation refunding bond, which is to pay off, so it’s refunding as it is paying off a portion on the anticipation note, not to exceed $10 million, and then the final resolution is another, is the remaining general obligation funding bond to pay off the bond anticipation note. They are what’s called a parameter resolution, and so what this is is there will be a ‘not to exceed’ borrowing amount and a ‘not to exceed’ cost, like interest rate.”

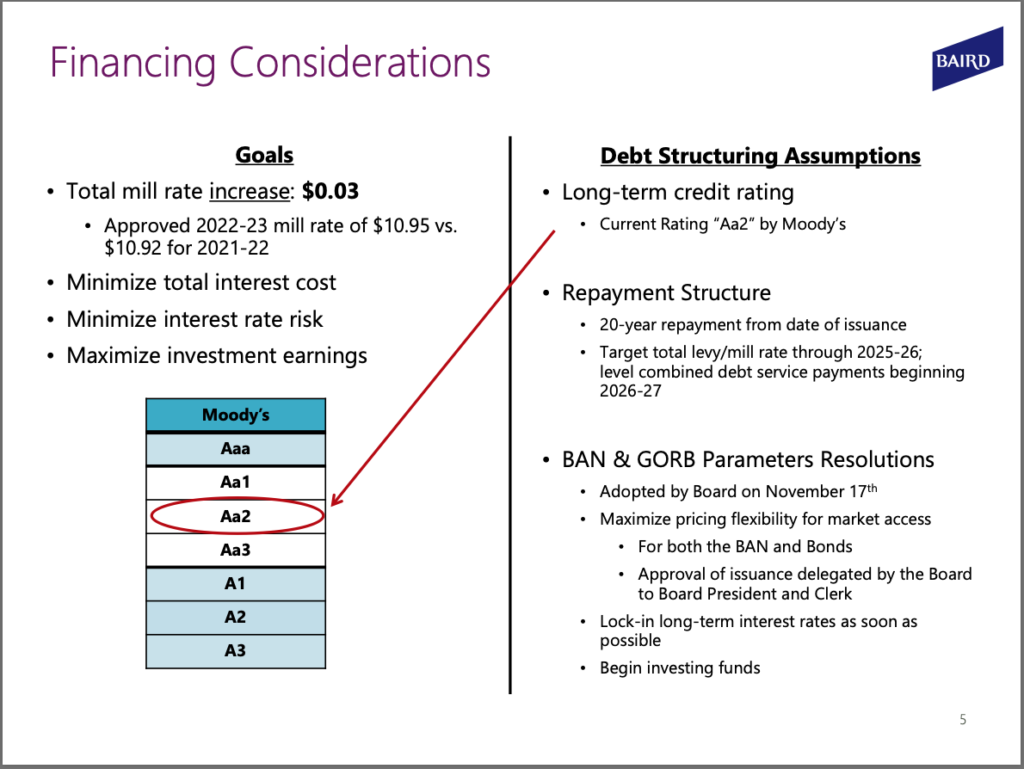

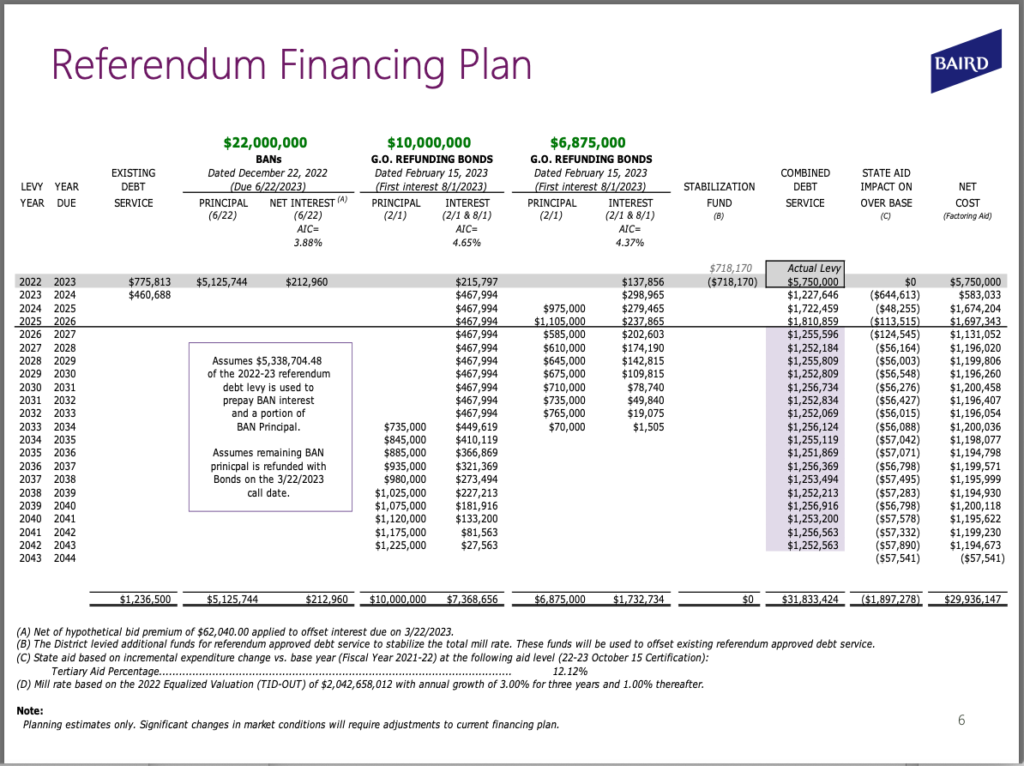

Pointing to another slide, shown above, Brewer said: “This is the detail of the plan that will continue to be updated. As you work your way left to right on the page, the first column is the final payment related to the prior referendum-approved debt. The bond anticipation, the first bond anticipation, is the first $22 million, the general obligation refunding bond is the bank-qualified, and then the six-month plan, $6,875 million is the remaining non-bank-qualified … And then the final amount, which is currently estimated at $6.875 million, will be paid off first. So those will be approximately 10 years. You’ll notice, as well, that longterm, if you add up the two longterm issues, it’s only $16.875 million, and that is because you are levied to pay down debt as you have been doing in recent years — you’ve been accelerating the debt retirement. And so by paying down, by levying to pay down that debt, we are able to pay off with funds on-hand right away, approximately $5 million of the $22 million, so you’re avoiding the 20-year interest rate on that $5 million because of doing that.

“It puts the district is a fiscally stronger position as you approach your next operational discussion,” he said.

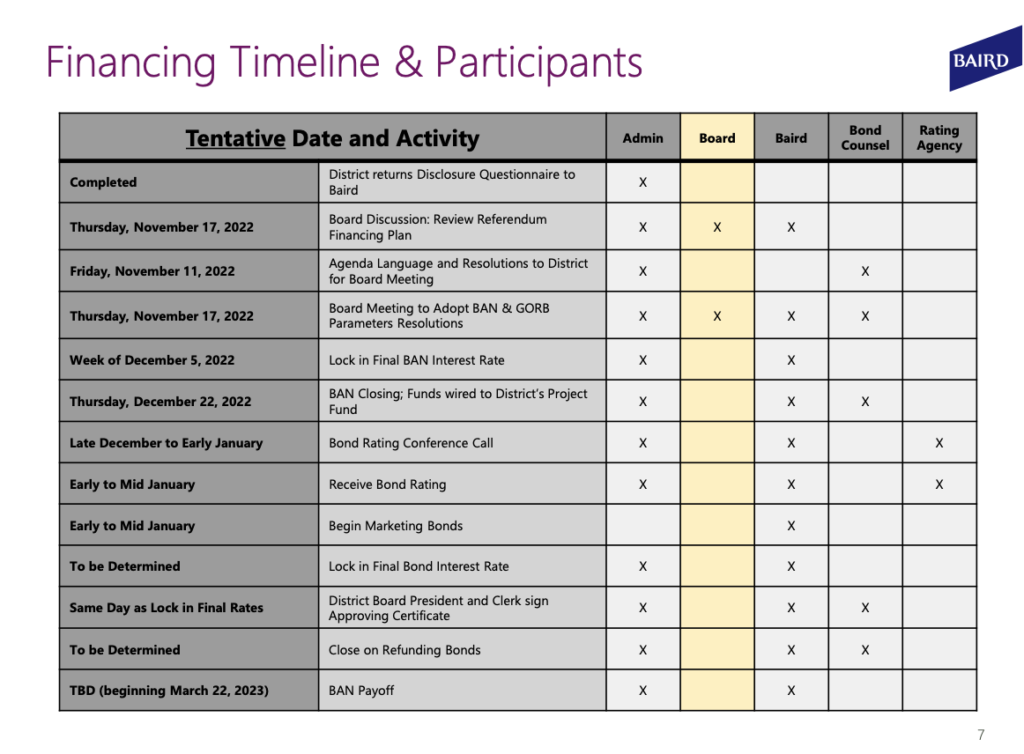

Brewer’s final slide, shown above, presented a timeline.

Said Brewer: “Tonight, action is requested on the three resolutions, the parameter resolutions.”

Next steps, he said, would direct Demerath and himself to continue working with the district’s legal team to ready appropriate paperwork, including working with Moody’s for an updated credit score and finalizing the bond anticipation note rate, with those activities taking place in the first week of December. In early January, he said, “we would finalize the work on the general obligation refunding bonds and try to lock that in in early to mid January.”

Questions from board members

After the presentation, Board of Eduction member Chris Rogers asked: “The second bond issue, they are actual bonds, right? It’s not really a note, I take it. The first resolution deals with borrowing money from a bank.”

Brewer responded, saying that the first resolution was for the approval of a bond anticipation note.

Rogers asked if the note would come from a bank.

Brewer responded, saying: “You can get that from a bank. We are taking bids, but, yes, the intent would be to see where we get the best rate for that six-month note.”

Rogers asked: “And then we will be paying that off and issuing bonds?”

Brewer said that was correct.

Rogers asked if the bonds were double tax exempt.

Brewer noted that in Wisconsin, they are single exempt. He said: “They are federally tax exempt … they’re not state tax exempt.”

Rogers Asked: “What kind of instruments do we or can we invest the loan proceeds to maximize our earnings?”

Said Brewer: “According to your investment policy — I’m assuming that just matches Wisconsin’s investment statute — which is generally speaking, it’s direct obligations of the U.S. government.”

Rogers asked if they were “fed funds and things like that.”

Brewer said they were, along with treasury notes and bonds.

“You can also use some bank CDs that are federally insured by the FDIC; there are also some insured CD products as well from a local bank. You want to make sure that you have collateral backing it during that time period that it’s being invested. So it’s a safety of funds and the rate of return from the funds is what you’ll be focusing on there,” he said.

Board member Robynn Selle asked: “Is there a timeframe by which we have to lock in the money based on referendum?”

Said Brewer: “You have up to five years to wait to borrow from an approved resolution, but this strategy, the plan is locking it in effectively as fast as you can.”

Selle asked: “And it’s a locked rate?”

Brewer responded: “Correct. Once you issue the two longterm issues, each of those rates would be fixed for the term, and then there would be a redemption provision in there, like a date at which it can be refinanced should rates go back lower at some point, which the district has done with previous referendum debt.”

Selle asked: “And this says $6.875 (million), but the third resolution … says $8 million.

Said Brewer: “Yes, so it’s not to exceed $8 million. I did that because I wasn’t exactly sure how to toggle what will happen with the principal repayment. So there’s a chance that $6.875 (million) goes up a little bit, but it’s not going to be over $8 million. That will be fine-tuned once we know what the $10 million amount looks like.”

Selle asked: “And is 20-year repayment pretty standard?” She asked if other time periods were considered.

Said Brewer: “State law limits it to no more than 20, and generally that is decided based on what the asset is. Like if it was equipment that would be with a useful life of one year or five years, we wouldn’t go 20, but the building envelope and facility structures are going to last 20. That’s what you’re paying off … while the aggregate is 20, you’re still paying down each year.”

“Twenty is the maximum, but it’s not more prudent … to look at 15, to get a better rate or something?” Selle Asked.

Said Brewer: “It’s a lot of scenarios that Jason and I have run. You have a long-range plan, and I showed that 30-year chart, while rates are higher, they’re still historically very favorable, so we believe that locking in the 20, now, and then you determine what operational amount is allowed for in future budget cycles, you can pay it down quicker. If the market looked different than it did today, it would be a benefit to doing a 15 … if you were committed to that payment, you actually, by borrowing shorter, you have the lower rate. In this environment, you really don’t because it’s pretty flat right now, meaning the very short rate is over 4 (percent) and the very long rate is over 4 (percent). There’s not really a benefit to lock you into a shorter plan, especially given that you have a multi-year facility plan, a multi-year operational plan, and we might as well lock this in, and if you want to pay it quicker, you can do that, like you’ve done before.”

Selle asked: “And when we are looking for who are we going to borrow from, we are only looking at places where we can pay down sooner without penalty?”

Said Brewer: “Yes, so when you sell the longterm bonds, it’s generally about an 8-year redemption provision. They get you to the lowest rates in the market for investors that typically look to buy single tax-exempt Wisconsin school bonds. There’s going to be the shorter years that won’t be prepayable, but each of them will have a portion that is prepayable as we move forward.”

The board unanimously approved the three resolutions as presented to initiate the proposed financing plan.

This post has already been read 1427 times!