By Kim McDarison

The School District of Fort Atkinson Board of Education on Tuesday finalized its 2021-2022 operating budget and certified a tax levy to help fund it.

School District Director of Business Services Jason Demerath, in a presentation given to the board Tuesday, noted that the budget had undergone some changes since it was approved by electors at their annual meeting in August.

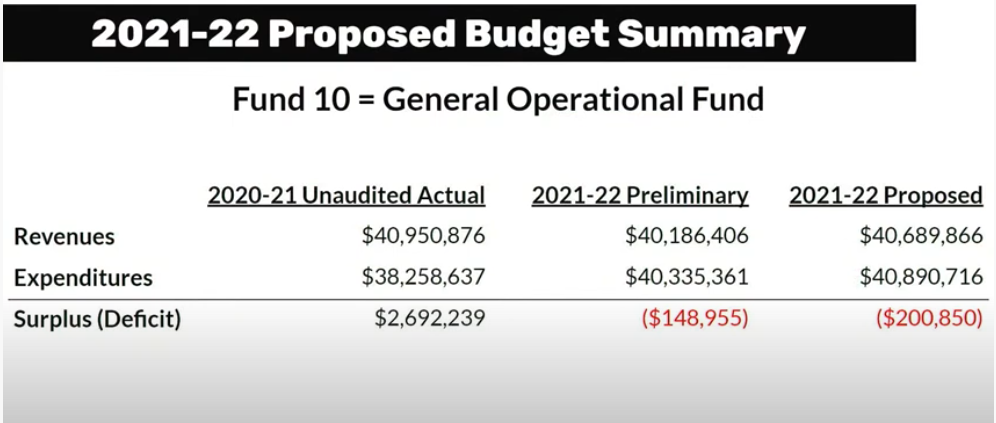

Aided by slides, Demerath noted that the district’s general operational Fund 10 budget as approved during the annual meeting in August showed revenues of $40,186,406 and expenditures of $40,335,361, leaving the district with a deficit of $148,955. The revised budget as proposed and approved Tuesday, showed revenues of $40,689,866 and expenditures at $40,890,716, leaving a deficit of $200,850.

Demerath said that the 2021-22 budget represented the second year of the district’s three-year operational referendum, and the district was hoping to “break even” this year.

The district ended last year “better than budgeted” he said, with unaudited actual figures in 2020-21 showing revenues of $40,950,876 and expenses at $38,258,637, leaving a surplus of $2,692,239.

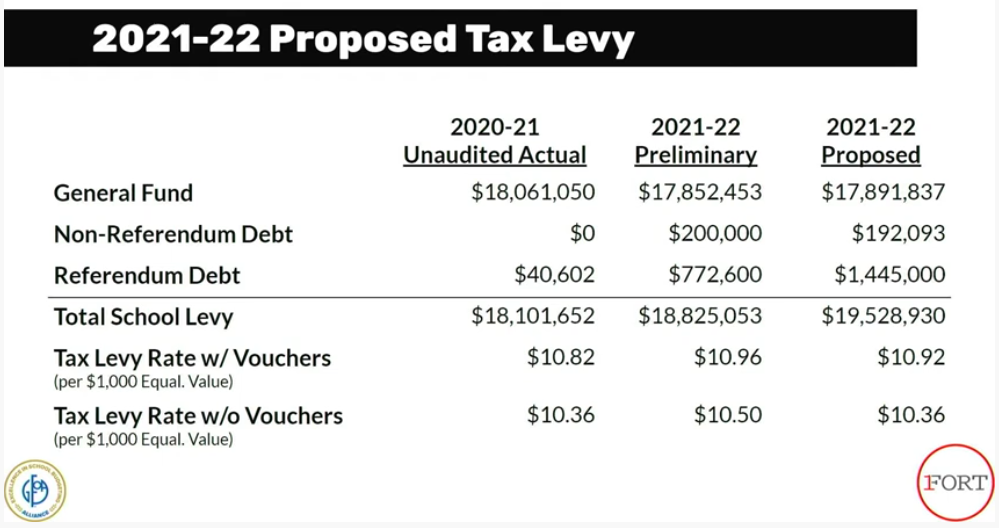

A tax levy of $18.8 million, with a mill rate of $10.96 was approved at the annual meeting. A tax levy of $19.5 million with a mill rate of $10.92, was approved and certified on Tuesday.

Assumptions and changes

In his presentation, Demerath shared some budget planning history, saying factors “that were assumed,” when the budget was in planning stages during the 2019-2020 referendum process for the 2022 budget, included a total tax levy of just over $18 million supported by a mill rate of $10.54 per $1,000 of home value. The district was projecting a budgetary surplus of $150,414.

Included within the assumptions, Demerath said, was a $150 per pupil state aid increase.

“What was approved through the 2021-23 state biennial budget was no increase in allowable revenue for each of the next two years,” he said.

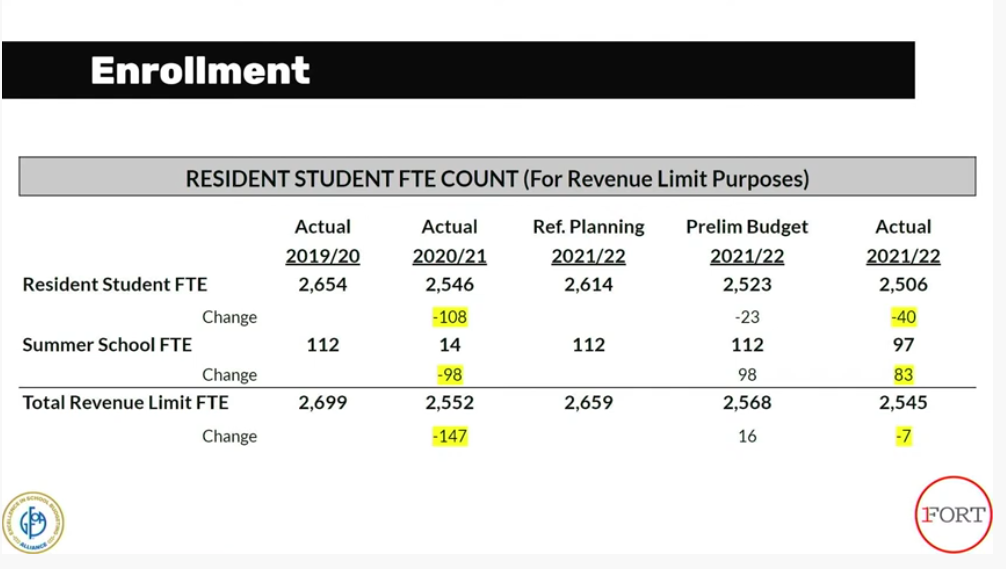

Demerath also pointed to budgetary changes brought about by student enrollment, noting that the district’s revenue limit is based on a three-year rolling average of enrollment, and the district’s allowable revenue follows enrollment trends.

“As you heard (School District Superintendent) Dr. (Rob) Abbott share earlier in the meeting, we declined in our student count this year,” Demerath said, adding that the district’s full-time equivalents, used for revenue limit purposes, including counts of students enrolled in summer school, which, he said, saw an increase as compared to last year when the district did not have summer school, were not enough to offset the regular enrollment decline districtwide.

A slide showed actual enrollment numbers for the 2021-22 school year at 2,506, which was down from actual enrollment in 2020-2021 of 2,546. The preliminary budget was calculated using an enrollment number of 2,523, Demerath noted.

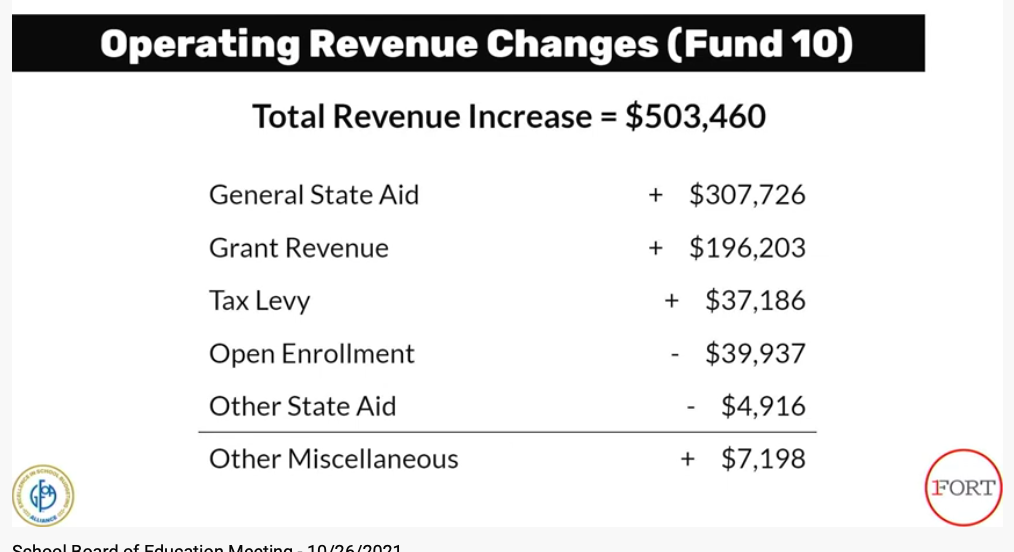

Looking at changes in the budget brought forward Tuesday as opposed to the one approved in August, he said, the district’s operating revenue increased by $503,460.

“On Oct. 15, the state of Wisconsin certifies the amount of general aid for the year. Under the way the revenue limit is structured, whatever is not covered by state aid gets covered by local property taxes and vice-versa. As we learn these numbers from the state, we can then set our final tax levy and budget,” Demerath said, adding that this year, general aid was $307,726 higher than the district had planned.

“This is a result of the biennial budget, where we needed to be increased in order for the state to meet their requirements in maintaining the amount of their spending on education. However, with no corresponding revenue limit increase, all of this aid goes to offset local property taxes,” he said.

Also affecting the budget was an offset in grant revenue, which, Demerath said, was related to COVID relief funds and Elementary and Secondary School Emergency Relief (ESSER) funds that the district is receiving. A slide showed grant revenue coming in over what was originally budgeted by $196,203.

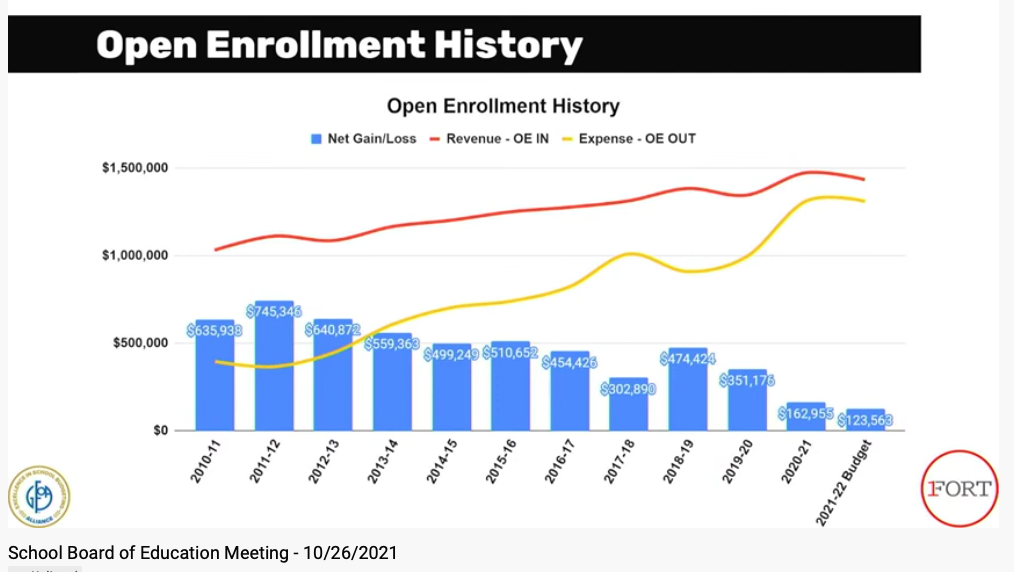

“Finally, we see the changes in the tax levy (plus $37,186) and open enrollment (down $39,937),” Demerath said.

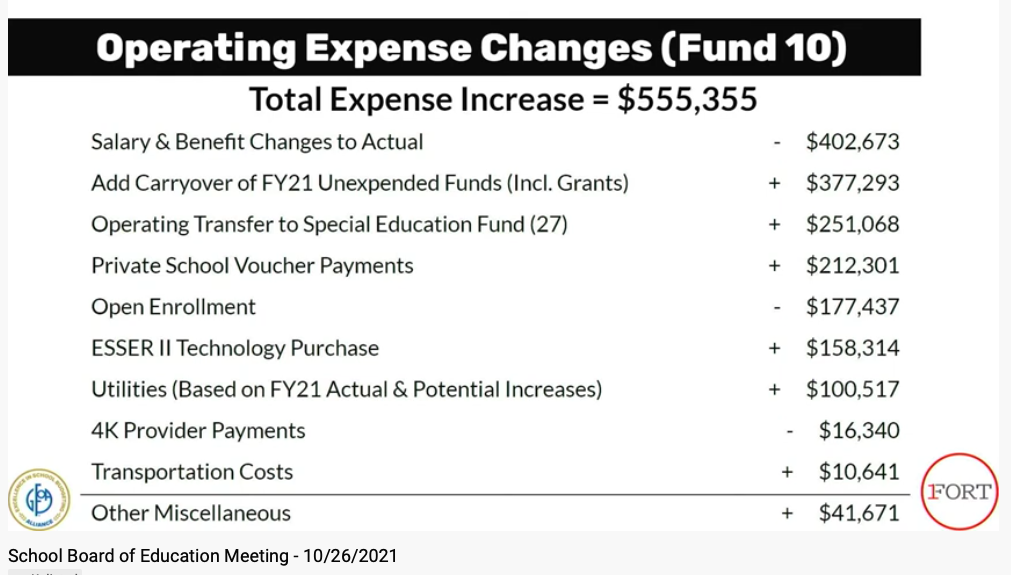

On the expense side, he said, the district’s total expenses increased by $555,355 as compared to the budget presented at the annual meeting. A slide showed that a decrease in anticipated expenses came in employee salary and benefits, open enrollment, and 4K provider payments. Increases in anticipated expenses came in funds carried over from the previous year’s budget, an operating transfer to the special education fund, private school voucher payments, an ESSER II Technology purchase, utilities, transportations costs and other miscellaneous expenses.

Speaking more specifically about COVID relief or ESSER funds, he said monies came in three waves over the past 18 months.

According to Demerath, a first wave came in the beginning of the pandemic. The district received $250,000, with some of those monies used to prepare for opening schools for in-person learning last fall about six months after the March shut down.

About $67,000 of that money remains unspent by the district, he added.

A second wave came last winter, he said, when the district received just under $1 million. A more recent distribution of funds has increased that amount to $1.3 million, he said.

Demerath said few restrictions have been placed on how this money can be spent. So far, the district has spent $158,313 on interactive TVs which will replace failing smart boards, he added.

The district still has over $1 million of its ESSER II funding unallocated, he continued.

The final wave came this past spring, Demerath said, at which time the district received $2.15 million. At least 20% of these dollars must be used for “learning loss,” he noted.

Allocation of these funds include $950,000 to pay the salaries of elementary math interventionists and coaches for three years. Some $1.2 million remains unallocated.

All together, the district has approximately $2.4 million remaining out of $3.7 million awarded through the ESSER program.

Each wave of funding has a deadline by which it must be used. The deadlines are created with the intention that school districts use the funds to adjust as the pandemic continues and any learning impacts are discovered over the course of the next three years, according to Demerath.

With regard to the use of ESSER funds, he said: “It was very public during the consideration of the state biennium budget that there was a perception among the Legislature that these funds could be used by districts to cover operating increases and therefore, no new funding was needed. As a result, the state did not increase our allowable revenue, as I outlined earlier, with the intension of school districts using these funds in place of any state funding increases.

“Since these are one-time funds, if we use them for ongoing recurring expense increases, we run into a sustainability issue.”

In consideration of the use of the funds, he said, he will be sharing a five-year forecast during the December school board meeting.

An earlier story about school financing and the development of the 2021-22 budget is here: https://fortatkinsononline.com/district-official-voucher-funding-decreasing-open-enrollment-contribute-to-148955-budget-shortfall/.

Two slides above as presented Tuesday by School District Director of Business Services Jason Demerath show the changes in general operating Fund 10 revenues and expenses as opposed to revenues and expenses approved by the districts electors at the annual meeting held in August.

Two slides above show changes between the district’s budget as shared in August, labeled 2021-22 preliminary budget and the budget approved Tuesday as well as the tax levy and mill rate as approved in Augusts and the tax levy and mill rate certified on Tuesday.

The slide above shows a history of declining enrollment defined as FTE or full time equivalent counts.

The slide above show a history of the district’s open enrollment. While the district continues to have a positive margin in open enrollment, Demerath said, it is “the smallest in recent history.”

This post has already been read 1224 times!