By Kim McDarison

The City of Whitewater Common Council Tuesday received an updated report outlining a need for $1 million in additional taxpayer dollars to support the newly integrated fire and EMS department.

The report received Tuesday from Whitewater Finance Director Steve Hatton updates an earlier report received by council during a special meeting held last Thursday.

During Thursday’s meeting, Hatton described a scenario in which the city would possibly need $700,000 to finance operational expenses associated with its new in-house fire and EMS department. The department, which was formerly run as an independent agency, was integrated as a city-run department effective July 30.

During Thursday’s special meeting, held to discuss fire and EMS department funding, both Hatton and City Manager Cameron Clapper noted that the development of the full financial picture and the referendum question anticipated to come before voters in November were both a “work in progress.”

On Tuesday, updated numbers delivered by Hatton outlined a need for a referendum question, asking voters for $1 million, rather than the earlier estimation set at $700,000.

During the meeting, Hatton noted that council could approve action to allow city staff to begin to formulate a referendum question based on the need for $1 million additional tax-levied dollars coming from the city’s taxpayers or council could opt to wait and approve action after city staff formulated a referendum question, at which time the requested dollar amount and the question’s associated language would be placed on an upcoming agenda.

Following advice offered by City Attorney Wally McDonell, council opted to instruct city staff to formulate a referendum question for approval by the voters in November, bringing the full question with its associated dollar amount and language before council for approval at an upcoming meeting.

Additionally, council approved the scheduling of a special meeting, with intent that it should be held sometime before the next regularly scheduled council meeting, to consider the completed referendum question.

The next regularly scheduled city council meeting is set for Aug. 16.

A date for the special meeting, as of Tuesday, remains pending.

A $1 million ask and its impact

During Hatton’s presentation made Tuesday, new information associated with an increase in the tax levy by $1 million was shared.

Hatton proposed that the city use a “weighted model” to allocate costs between the various communities, including the city of Whitewater, that contract fire and EMS services with the Whitewater Fire Department.

As noted in his earlier presentation delivered Thursday, the department’s service area, along with the city of Whitewater, includes, in full or part, the towns of Whitewater, Cold Spring, Koshkonong, Richmond, Lima and Johnstown.

Revisiting information shared Thursday as part of a financial overview, Hatton said that the fire department’s operating budget in 2022 was set at just over $1.5 million, but expenses in 2022 are anticipated to reach just over $2 million. Additionally, the department uses a vehicle replacement schedule which comes at a cost of $384,000 annually. When adding the operational costs and vehicle replacement costs together, he said, they come to a total cost for fire and EMS services of $2.4 million. After deducting known monies, coming through city, towns and user service fees set aside to fund the department, the city would be left with a “funding gap” of just over $1.3 million.

An earlier story explaining the department’s expenses and funding gap is here: https://fortatkinsononline.com/whitewater-council-approves-bringing-fire-department-in-house-explores-november-ballot-referendum/.

New information provided Tuesday offered a first look at a cost allocation model that would meet the city’s identified goals of objectivity and transparency, Hatton said.

He noted Tuesday, as he did last Thursday, that the department’s previous practices to allocate costs were “not well documented or understood.”

Looking at the immediate need associated with funding the new in-house fire and EMS department, Hatton said the department could not function if, from day one, there was not manpower and equipment to respond to calls. He noted that the city needed to be ready to provide services “absent township involvement.”

Hatton said that the city had been involved with a planning process to move the fire and EMS department in house for some time and therefore, had some time to prepare for the financial changes the move would bring. The towns that contract for services provided by the department did not have that advantage, he said.

He did not believe the towns were prepared to make the required financial changes needed to fund the department or bring a referendum question to their voters before the end of the year, which, Clapper said Thursday, is when their contacts with the department will expire.

Until that time, the city would need to fund its department, Hatton said Tuesday.

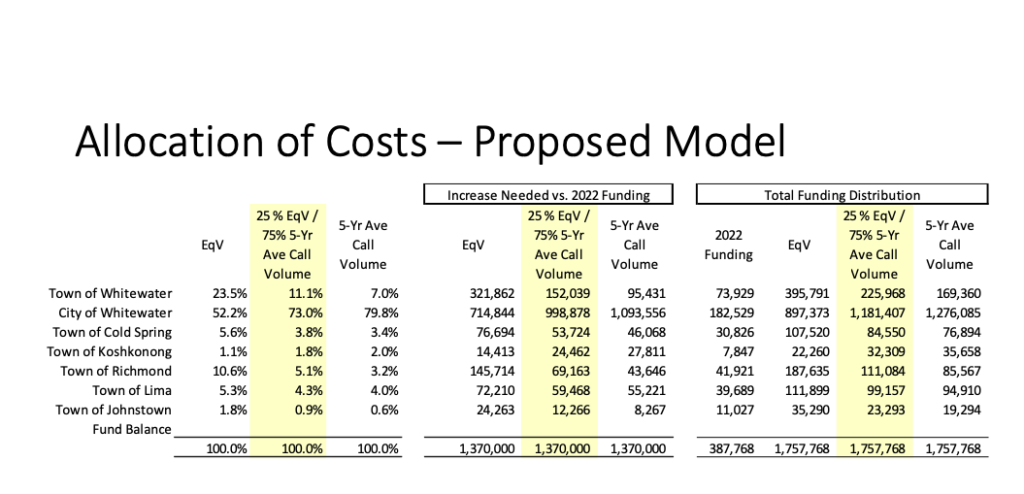

Looking at a weighted approach, Hatton said that he recommended the use of a model that would allocate costs using equalized value, weighted at 25% of each community’s total cost, and EMS call volume, weighted at 75% of each community’s use of the department’s equipment.

Listing the advantages of using equalized value, Hatton said the metric was simple, objective and used data maintained by the state and counties, and is used by the Milton/Edgerton Fire District and area school districts.

Listing the advantages of using the call volume metric, he said it recognizes the differences in service demands made by each community and is based on a five-year average to minimize volatility of measure.

Providing a chart, show above, depicting call volumes, Hatton said, when compared with the contracted towns, the city of Whitewater has the largest average call volume of users within the department’s service area. Of the total number of calls to which the department responds, on average, 73% are from residents within the city, bringing the city’s weighted dollar contribution in 2022 to just under $1 million to fill the $1.3 million gap.

Looking beyond 2022, the chart showed the city’s contribution at $1.18 million, with a total budget to operate the service area at $1.76 million.

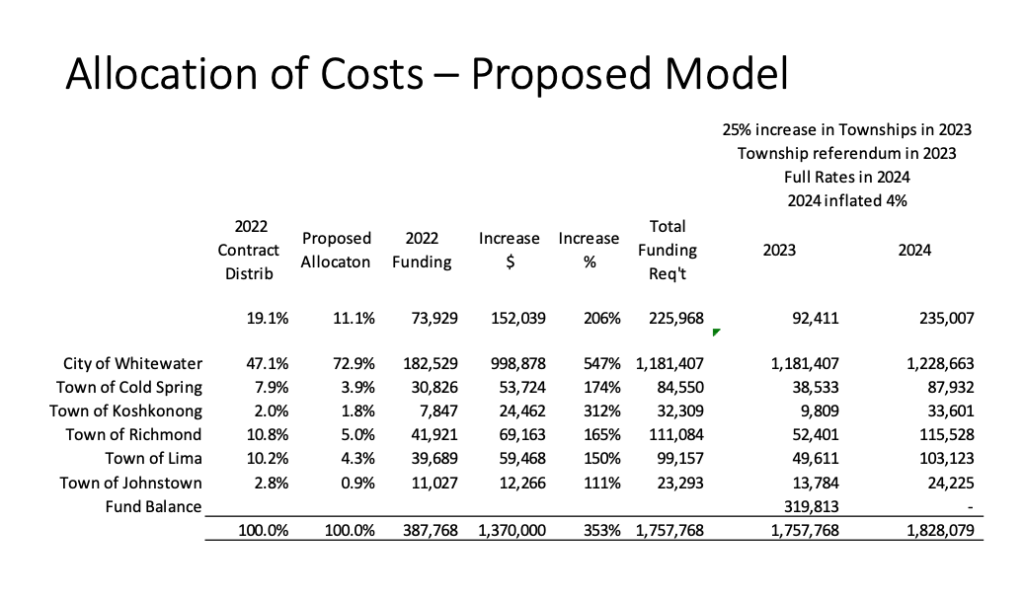

Within his presentation, Hatton provided a chart, presented above, showing the funding amounts required by city residents and those in each contracted town using a 25% increase to the towns’ budgets in 2023. The model assumes that the towns will look to bring referendum questions before their voters in 2023, with the city charging full rates to the towns in 2024. The 2024 increase also was adjusted for inflation by an additional 4%.

In 2023, the city’s contribution is calculated at $1.18 million with a total budget to operate the service area set at $1.76 million.

In 2024, the city’s contribution is $1.2 million with a total budget to operate the service area at $1.8 million.

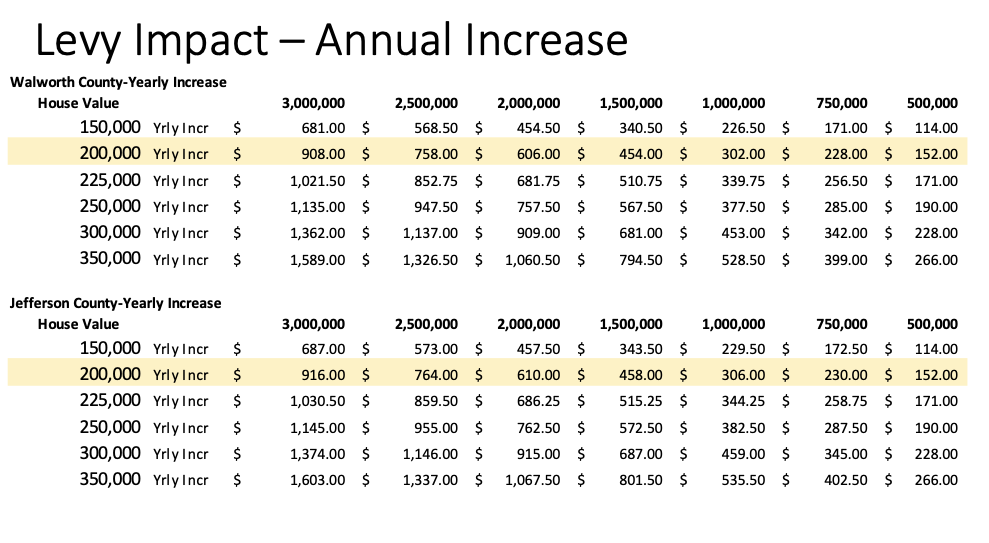

Looking at the mill rate paid by city residents to support city services, a chart, shown above, noted that the current mill rate for residents living in the Walworth County portion of the city is $6.36 while the mill rate paid by residents living in the Jefferson County portion of the city is $6.41.

Looking at an increased levy amount of $1 million, Walworth County residents would see an increase in their mill rate of $1.51, bringing their new total mill rate for city services to $7.87. City residents living in the Jefferson County portion of the city would see an increase of $1.53 in the mill rate paid to support city services for a total mill rate of $7.94.

The mill rate is the amount paid per $1,000 of home value.

Using the average cost of a home in Whitewater, which, Hatton said, is $200,000, the annual tax impact to a homeowner to support city services living in Walworth County, would voters approve the proposed referendum, would be $302, while the the annual impact to a homeowner to support city services living in Jefferson County would be $306.

Next steps

Looking at next steps, Hatton noted council’s next task was to seek voter authority to exceed the levy limit as set by the state through the referendum process.

He suggested the amount by which to exceed levy limits should be set at $1 million within the referendum question.

He asked council to authorize city staff and the city attorney to compose a question in compliance with Wisconsin statutes.

Additionally, the council received proposals from two firms — Mueller Communications and Michael Best Strategies — to help facilitate the educational and communication process in advance of bringing the referendum question before voters.

Council approved a proposal submitted by Mueller Communications at a cost not to exceed $52,690 by a vote of 5-1, with Councilwoman Brienne Brown casting the “no” vote. Councilwoman Jill Gerber, who attended the meeting remotely, abstained from the vote, citing her inability to review the submitted proposals. Proposals from the two communications firms were handed out during the meeting and were not included in the online meeting packet of information which could be viewed electronically.

A story with additional details about the proposals will be published by Fort Atkinson Online at a later date.

Members of the community attend Tuesday’s City of Whitewater Common Council meeting. Among items discussed was the continuing process to form an operational referendum question for placement on the November ballot to support the Whitewater Fire and EMS Department, which was recently brought in-house. Kim McDarison photo.

This post has already been read 1633 times!