Following is the second of a two-part series examining two budgets drafted for possible use in the city of Whitewater in 2023. Part two explores impacts to taxpayers in both Walworth and Jefferson counties and changes those residents can expect to see on their tax bills if the proposed EMS referendum receives voter approval in November.

By Kim McDarison

Whitewater Interim City Manager John Weidl and Director of Finance Steve Hatton Thursday provided Fort Atkinson Online with a “budget briefing,” explaining the development of two possible budgets, one of which likely will be placed in use next year.

Part 1 of this two-part series presented overviews of the two budgets. A link to Part 1 is here: https://fortatkinsononline.com/elementor-89201/.

As reported within Part 1, two budget proposals have been drafted for use by the city of Whitewater in 2023. One is developed for use if the EMS referendum question, which will come before the city’s voters in November, is approved and the second is developed for use by the city would the referendum fail.

The two budgets are as follows: in 2023, the city anticipates operating with a budget of $11,511,608, funded, in part, with a tax levy of $5,756,852. Would taxpayers approve the referendum, the city would be able to exceed the levy limit by $1.1 million “going forward,” as language within the referendum question states, meaning in perpetuity, or as long as the city deemed it necessary.

Would voters decide against the referendum, in 2023, the city anticipates operating with a budget of $10,114,853, funded, in part, with a tax levy of $4,656,852, which is the initial levy limit as imposed by state statute.

During a special Whitewater Common Council meeting held in July, Hatton presented information showing impacts to the taxpayers within the city of Whitewater derived from the city’s portion of the full tax levy paid annually by residents. Along with the city’s portion, the full tax bill includes levies from other taxing jurisdictions, including the Whitewater Unified School District, the county — Walworth or Jefferson — depending upon where within the city the resident lives, and the area’s technical college.

Adjusted mill rates from 2021

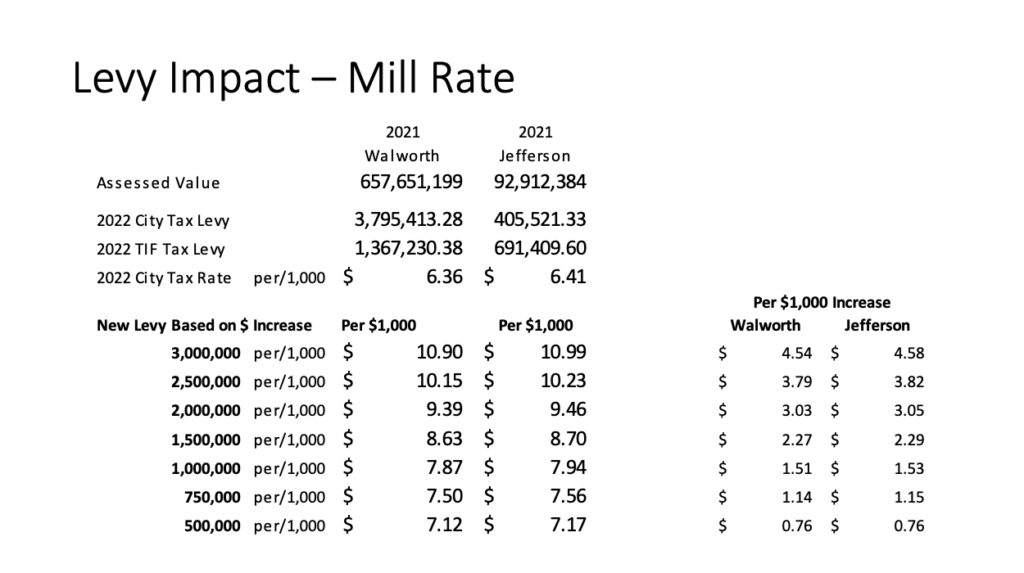

Isolating the city’s levy and using statistics from 2021, in July, Hatton said, impacts, were as follows: In Walworth County, the assessed value of the city’s total taxable assets was $657,651,199. The city’s 2022 tax levy was $3.795 million. In 2022, a Tax Incremental Finance (TIF) tax levy was $1.367 million. The impact to the taxpayer was $6.36 per $1,000 of assessed property value.

In 2021, in Jefferson County, the assessed value of the city’s total taxable assets was $92,912,384. The city’s 2022 tax levy was $405,521, with a TIF tax levy of $691,409. The impact to the taxpayer was $6.41 per $1,000 of assessed property value.

Looking at various estimated tax levy increases, which could be sought in November through the referendum process, Hatton produced several charts showing increases in mill rates and the associated impacts at differing levels of home value in both Walworth and Jefferson counties.

Hatton said the average home value in Whitewater is $206,000.

The slide above, which was initially presented to the city council in July, shows tax levied amounts assessed by the city and the associated mill rate. In 2021, city of Whitewater residents living in Walworth County paid $6.36 per $1,000 of assessed home value. City of Whitewater residents living in Jefferson County paid $6.41. The chart shows mill rate increases associated with varying tax levy amounts. Using this chart, and looking at a tax levy increase to fund the fire department of $1 million, a homeowner in Walworth County could expect to see an increase of $1.51 per $1,000 in home value, bringing their new mill rate to $7.87. A homeowner in Jefferson County could expect to see an increase of $1.53 per $1,000 of home value, bringing their new mill rate to $7.94.

With the average home in Whitewater valued at $200,000, highlighted in yellow, The slide above, which was initially presented to the city council in July, shows the tax impact as a yearly increase to a homeowner at varying levy amounts. Using this chart and with a levy increase of $1 million to fund the fire department, a homeowner with a home worth $200,000 in Walworth County could expect to see an increase of $302 to their tax bill. In Jefferson County, the homeowner could expect to see an increase of $306.

Blended rates

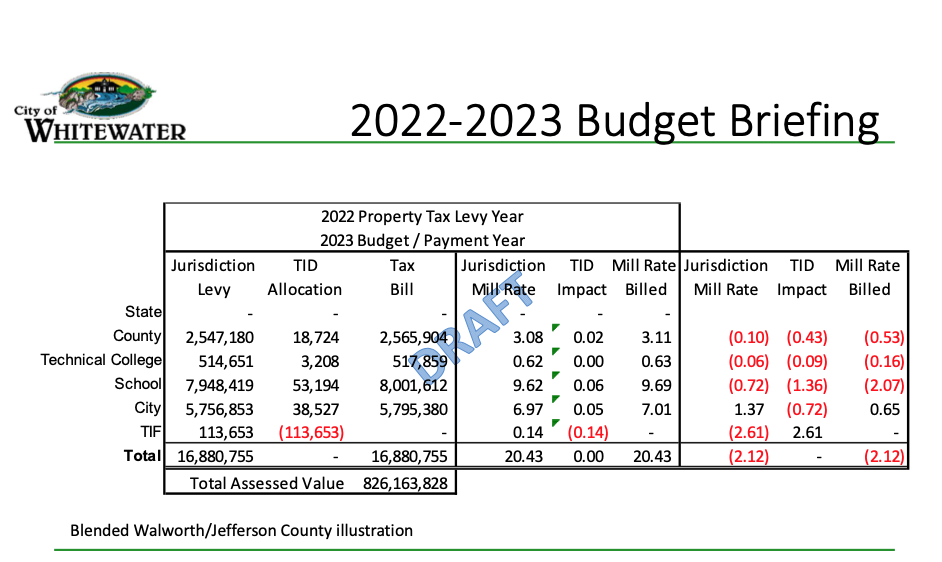

During Thursday’s budget briefing, Hatton presented similar figures using a “blended” illustration, which sought to create one set of statistics to represent both Walworth and Jefferson counties. Using the blended model, and using statistics from 2022, Hatton first produced a chart showing the full tax levy, with all the taxing jurisdictions represented. The full tax levy — including taxes collected to support the city at a levy of $5,756,853 (which is the amount the city would levy would the referendum receive voter approval); school district, at a levy of $7,948,419; county, at a levy of $2,547,180, and technical school, at a levy of $514,651 — is combined for a total amount of $16.9 million. The full levy to support all of the taxing jurisdictions is assessed against some $826,163,828 in total property value. To fund the full levy, the example uses a blended mill rate (defined by Hatton as a weighted average mill rate, based on equalized value in each county, used to represent rates in both Walworth and Jefferson counties) of $20.43. Within the full levy, mill rates to support each taxing district are as follows: Whitewater Unified School District, $9.69; city of Whitewater, $7.01; county, $3.11, and technical school, 63 cents.

Presented Thursday as part of the budget briefing, the chart above shows a breakdown of levies and associated mill rates for each of four taxing jurisdictions. A blended rate of $20.43 illustrates the full mill rate used to calculate tax bills for residents living within the city of Whitewater.

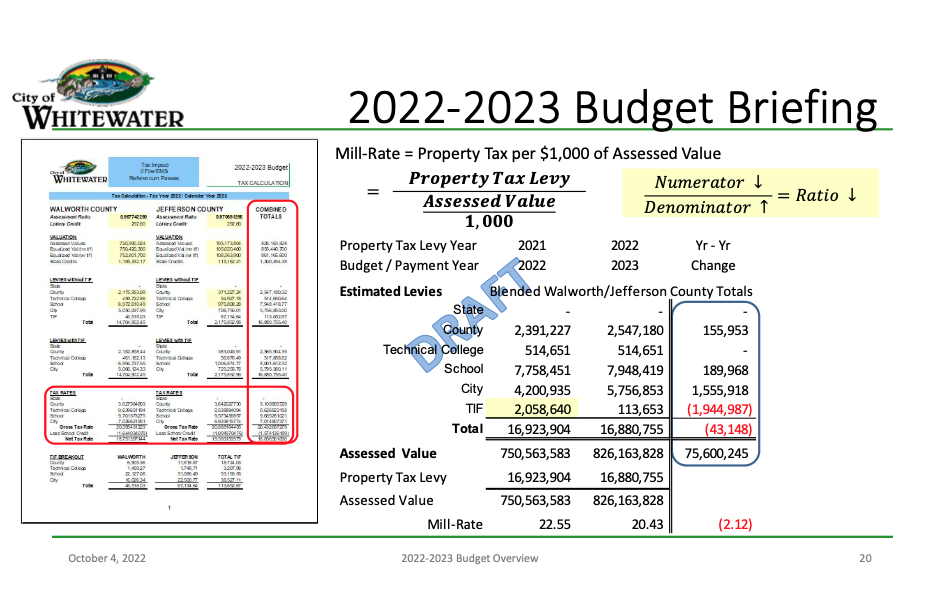

Another chart shared Thursday, shown above, is designed to show how mill rates are calculated, and, using blended mill rates, shows an anticipated reduction in the overall mill rate between 2022 and 2023. According to the chart, the blended mill rate used to collect taxes in 2021, and applied to the budget in 2022, was $22.55, as opposed to the mill rate that will be used to collect taxes in 2022, and applied to the budget in 2023, of $20.43. Additionally, the chart shows a decrease in the levy between 2022 and 2023 developed through a Tax Incremental Financing (TIF) increment of $1,944,987, which was applied to the levy, reducing the overall levy from $16,923,904 to $16,880,755, a decrease of $43,148.

Interim city manager: ‘Most’ residents will pay less taxes

During Thursday’s briefing, Weidl said that even if the city’s EMS referendum and a school district operational referendum, which also will be placed on the November ballot, each receive voter approval, the average homeowner, and even “most” of the city’s homeowners, will likely realize a reduction in their overall tax bill.

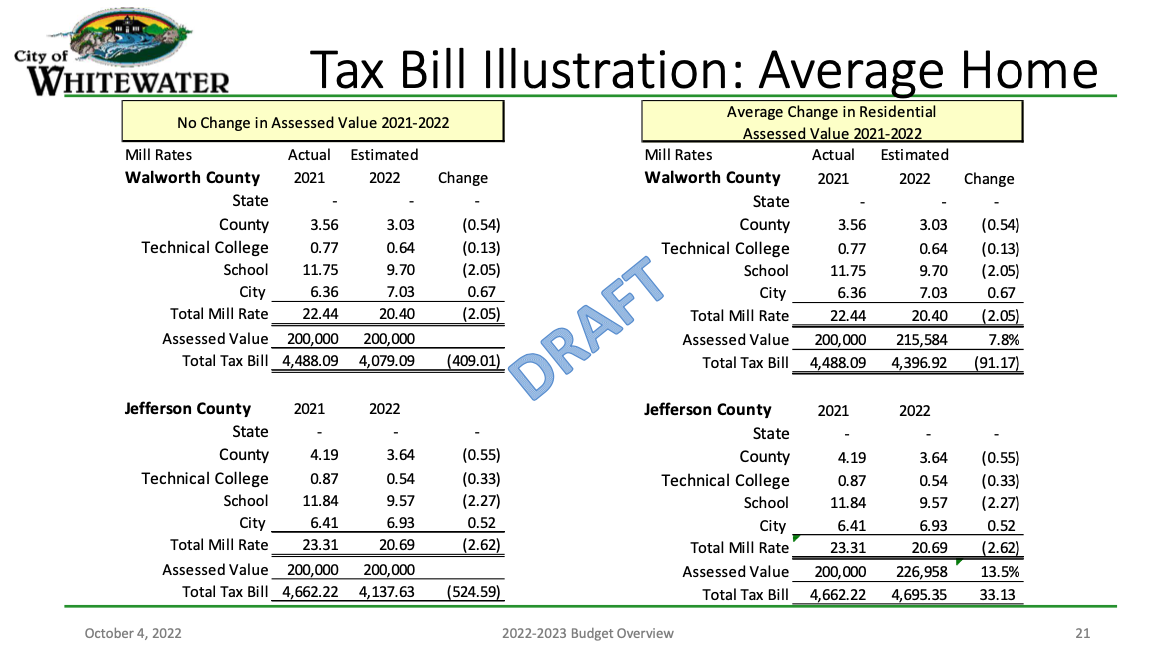

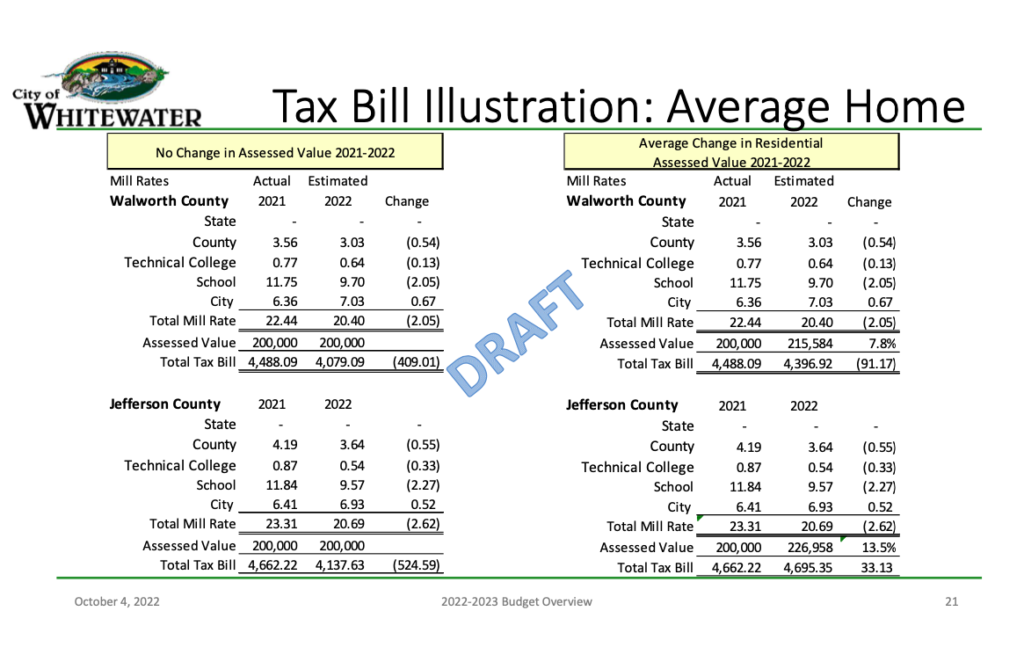

Looking at actual mill rates in Walworth County between 2021 and 2022, three of the four taxing jurisdictions are reducing their mill rates. The county mill rate will drop by 54 cents from $3.56 to $3.03; the technical college mill rate will drop by 13 cents from 77 cents to 64 cents, and the school district mill rate will drop by $2.05 from $11.75 to $9.70.

Looking at a home worth $200,000, Weidl said, if there is no change in the assessed value of the home, in Walworth County, that homeowner will see an overall decrease in their tax bill of $409. Looking at the potential for assessments to increase, Weidl said, in Walworth County the average assessed value increase is 7.8%, which would raise the value of a home worth $200,000 to $215,000. Even with that adjustment, he said, in Walworth County, that homeowner would see a decrease in their overall tax bill of $91.17.

In Jefferson County, looking at actual mill rates between 2021 and 2022, three of the four taxing jurisdictions are reducing their mill rates. The county mill rate will drop by 55 cents from $4.19 to $3.64; the technical college mill rate will drop by 33 cents from 87 cents to 54 cents, and the school district rate will drop by $2.27 from $11.84 to $9.57. If the assessed value of a home stays the same, a homeowner with a home valued at $200,000 will see a reduction in their overall tax bill of $524.59. In Jefferson County, the average assessment increase is 13.5%, which would mean a house worth $200,000 in 2021 would be worth $227,000 in 2022. In that case, he said, even with both referendums passing, the homeowner would see a modest increase in their overall bill of $33.13.

The chart above, shared Thursday, shows that while the city of Whitewater — would the EMS referendum gain voter approval in November — would increase its mill rate in Walworth County by 67 cents from $6.36 to $7.03, and in Jefferson County by 52 cents from $6.41 to $6.93, the other three taxing jurisdiction which make up the full levy for residents within the city in both counties are reducing their mill rates. The overall calculation shows a reduction in the total amount of taxes the average resident will pay even if both the city’s EMS and school district’s operational referendums pass, according to Weidl.

Information on the city’s website notes the following: “If both referendums pass, the net impact will actually be a reduction in tax bills. Due in large part to an increase in state per-pupil funding available for students within the District, the School District’s annual levy is expected to go down. The reduction in the District’s levy in combination with growth in the City’s tax base more than offsets the increase in property taxes for EMS staffing.”

On Thursday, Weidl noted that much of the city’s tax base growth is associated with the recent closing of its Tax Incremental Financing District (TID) No. 4.

With the closing of the TID, Hatton said, the city is legally obligated to return at least 50% of the increment to the taxing jurisdictions.

School district operational referendum

The Whitewater Unified School District’s operational referendum question that will appear before voters in November is as follows: “Shall the Whitewater Unified School District, Walworth, Jefferson and Rock Counties, Wisconsin, be authorized to exceed the revenue limit specified in Section 121.91, Wisconsin statutes, by $4,400,000 per year beginning with the 2023-2024 school year and ending with the 2026-2027 school year, for non-recurring purposes consisting of the following: maintaining targeted class sizes, maintaining student support and mental health services, maintaining comprehensive instructional and co-curricular programs, and maintaining technology, safety, and facilities infrastructure?”

What is tax incremental financing?

According to an overview published by the Wisconsin Economic Development Association (WEDA), titled: “Tax Incremental Financing: An Analysis of Wisconsin’s Most Important Economic Development Tool,” the Wisconsin Legislature adopted tax incremental financing (TIF) statutes in 1975. The financial tool is meant to facilitate tax base expansion within municipalities, which, in turn, is meant to create revenues to fund projects to support economic and industrial development, job growth, urban renewal and tourism.

The process allows a municipality to establish a geographical area, called a tax incremental financing district, or TID. Once established, the assessed value of the geographical area is frozen. That frozen value is called the “base value” of the TID. During the process, the taxing jurisdictions, which receive tax revenues from the TID, agree to receive tax revenues on the base value only for a set period of time. As the TID’s assessed value increases, by virtue of growth through investment over the base value, those revenues, called an “increment,” are placed in a separate fund, with those dollars used to fund investment projects over the life of the TID. When the TID closes, or sunsets, tax revenues created from the full assessed value of the TID, including the base and increment, are returned to the original taxing jurisdictions. When the TID closes, the value of the taxable property within the TID is meant to be higher than the taxable value of the property at the time that it was frozen. A goal of tax incremental financing is that the increment created within the TID will fund investment and increase the value of the property within the TID. TIDs, depending on their purpose, typically have a life of between 23 and 27 years.

Included within the process of forming a TID is the establishment of a municipal Joint Review Board. Its purpose is to approve the creation of the TID and, in so doing, determine that, “but for” the public investment afforded by TID expenditures, sufficient development or improvements within the TID would not occur.

The Joint Review Board’s voting members include representatives from the host municipality and taxing jurisdictions whose revenues will be affected by the TID, including the county and school district.

In Whitewater’s case, that also includes the area technical school.

Once created, eligible TID costs, coming in the form of investments in the TID, are paid from property tax revenues generated as increment by increased taxable property values within the district.

“TIF is not a tax cut nor a tax increase, but an allocation method for incremental property taxes collected within the district,” The WEDA document states.

Additionally, the document states, state statutes outline the maximum life of a TID, how much of a community’s value can be in TIDs, reporting requirements for TIDs, the process for creating a TID, and what costs are eligible to be reimbursed or paid out.

When creating a TID, its purpose must be designated. Wisconsin statutes currently allow for blight remediation, conservation or rehabilitation, industrial, mixed-use, town, and environmental remediation.

The full document, produced by Baker Tilly Virchow Krause LLP in 2019, is here: http://www.weda.org/wp-content/uploads/2020/01/TIF-study.pdf.

This post has already been read 1553 times!