By Chris Spangler

The Fort Atkinson City Council has advanced borrowing $2.275 million to fund capital improvement projects and equipment purchases in 2022 and 2023.

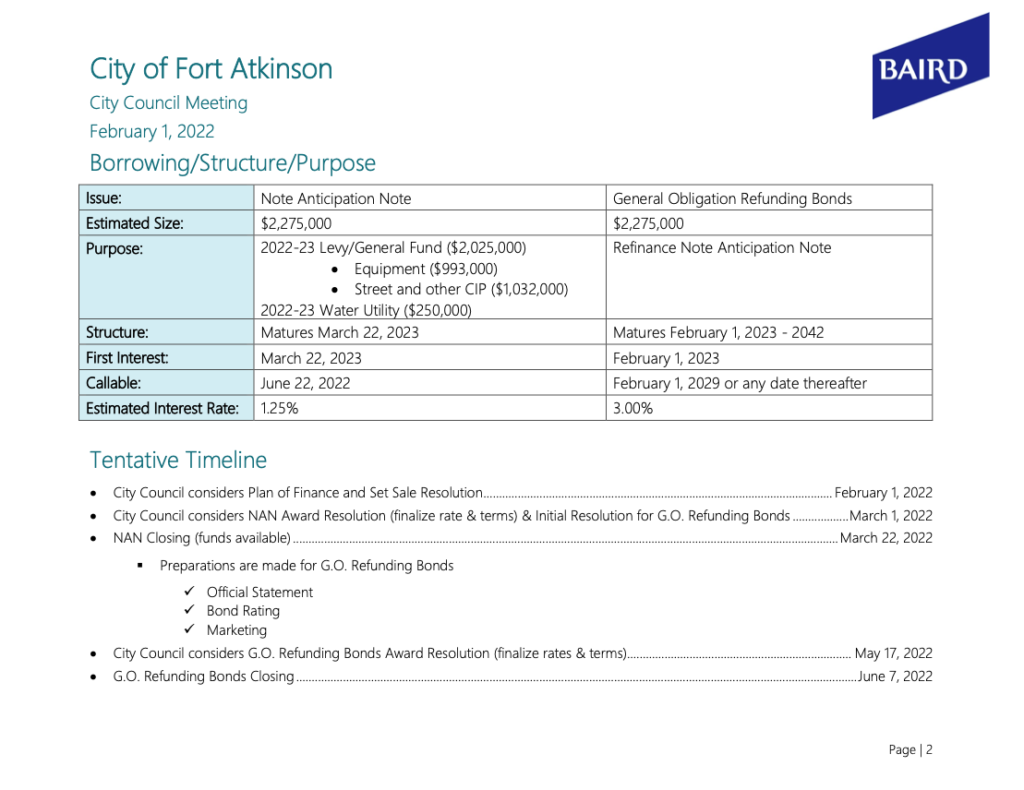

Meeting in regular session Tuesday, the council adopted a resolution providing for the sale of an approximately $2.275 million note anticipation note.

It then will be refinanced through general obligation refunding bonds later this year.

A total $1.574 million would be borrowed for 2022 for purchasing a police department squad car and a single-axle dump truck/plow, skid loader and transit van with water tank for the Public Works Department; remediation and demolition of the former Loeb-Lorman Metals site; covering the city’s payment toward this summer’s deck replacement on the Robert Street bridge; and undertaking the annual street reconstruction program.

The streets and Loeb-Lorman projects also would receive gap funding. The Robert Street bridge reconstruction will be covered in part by state Department of Transportation monies.

Funding in 2023 would go toward a police department squad car; the city’s portion of the Whitewater Avenue milling and overlay project; replacing the fire department’s squad with a rescue/EMS unit; purchasing equipment, hoses and a personal protective equipment (PPE) dryer for the fire department; and replacing a Parks and Recreation Department flatbed truck.

The majority of the 2023 CIP projects were pushed back from 2022 and prior years, according to city officials.

At this point, the costs associated with each project or piece of equipment are estimates, city officials added.

City Manager Rebecca Houseman LeMire was asked whether the city’s department heads have weighed in on the projects recently.

“We have not had specific discussions on all of these things and where they might be moving; however, … we do have some flexibility still with some of these, especially equipment projects,” LeMire said. “Some could go away if bids come in high, but we wouldn’t add anything in if bids came in exceptionally low,” she said.

On hand at Tuesday’s meeting was Justin Fischer, director for Baird, who serves as the city’s financial adviser.

He noted that the city is not locked in to the $2.275 million figure.

“If bids come in (less) between now and when we go to lock in the interest rate for the anticipation note, … we can reduce that note anticipation note,” Fischer said, citing a March 1 bid deadline.

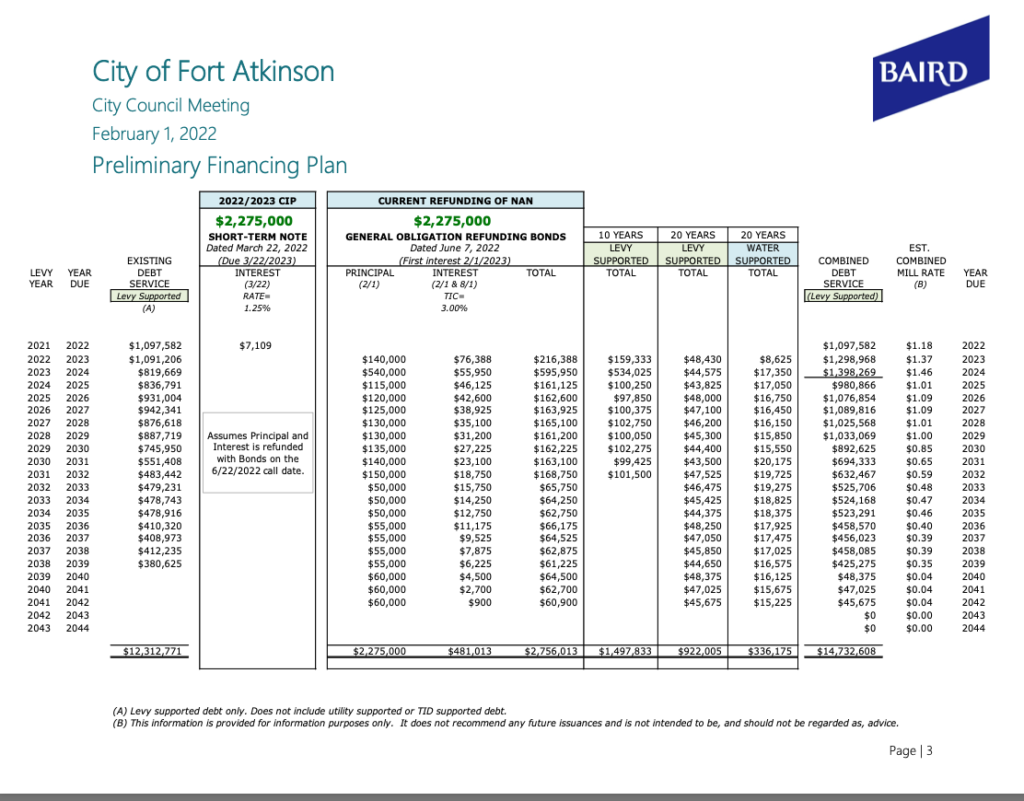

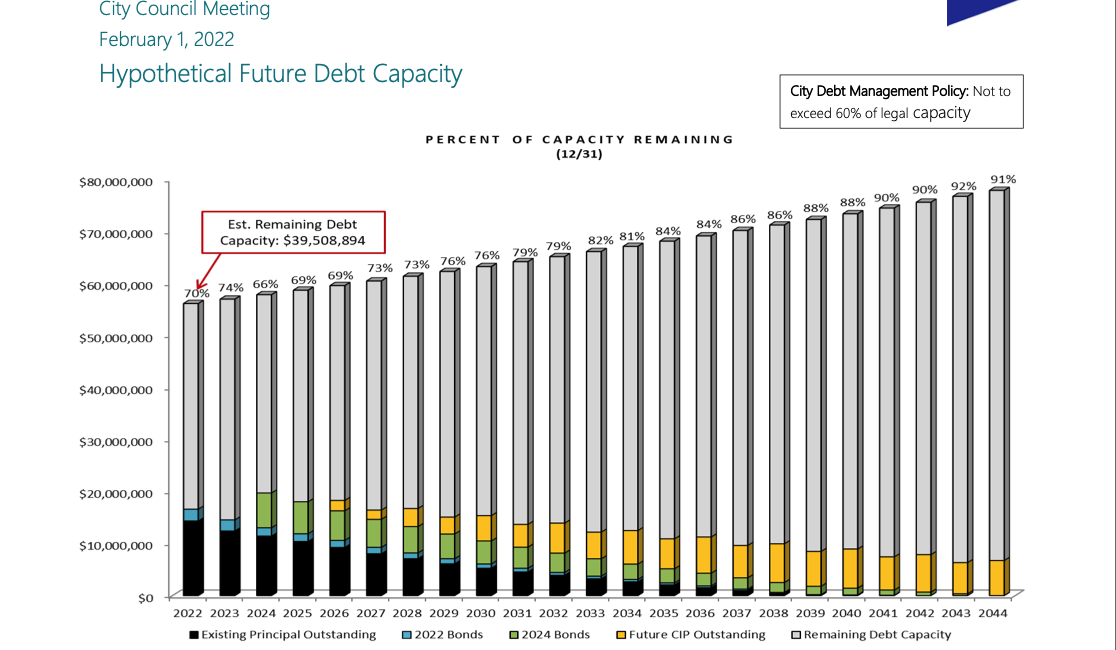

He reviewed several charts outlining the proposed bonds and how they would add to the city’s debt service.

The city’s levy-supported debt service payment in 2022 is $1,097,582. The additional borrowing in 2022 would increase the 2023 levy-supported debt service payment to $1,298,968, which is a difference of about $200,000, he said.

“There is a nice drop in the debt service come 2024,” Fischer noted.

“We’re thinking about what other projects you have down the pipeline, not just this year and next year, but what do you have in three years, five years, etc. that we need to start planning for now, so when the time comes, the city’s in good position to take on those projects and not have so large an increase to the debt service or mill rate,” he added.

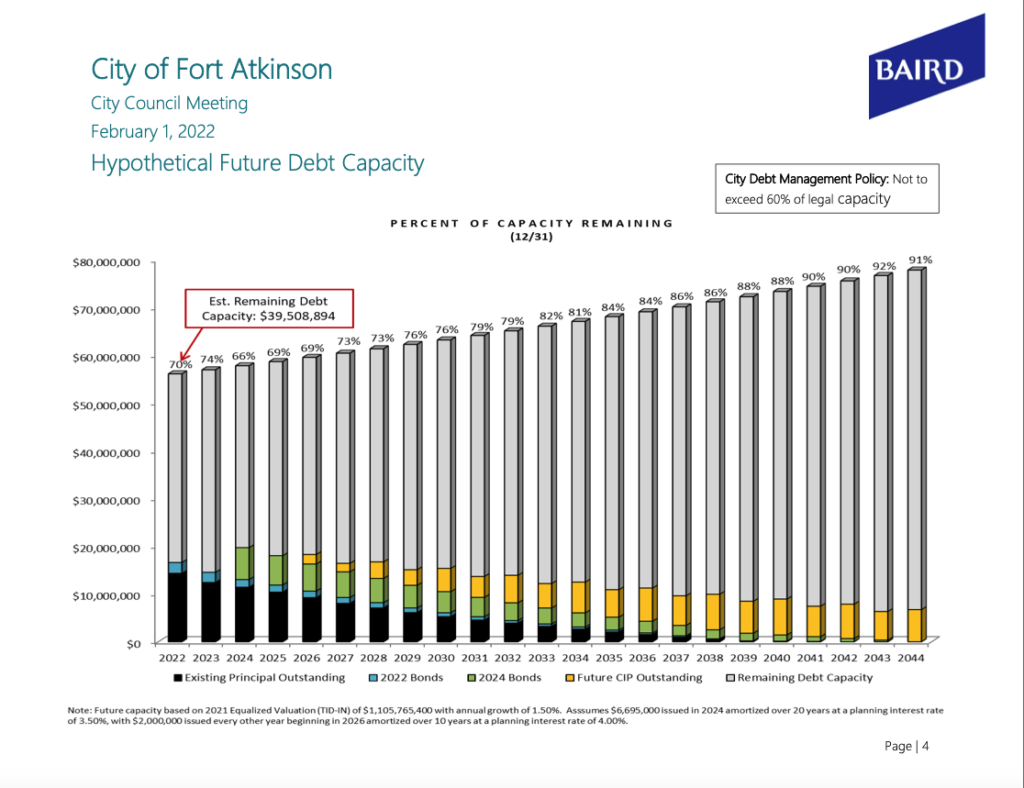

Fischer said that after the $2.275 million in bonds are issued, the city still will have about $40 million remaining in its general obligation bonding capacity.

“Municipalities are allowed to borrow 5% of their equalized value; that’s kind of the max that you can borrow,” he explained.

Said Fischer: “Well, the city’s valuation is about $1.1 billion … we have over $55 million that is available for us to borrow. Obviously, we don’t want to get near that, and the city has policies in place to protect us from that, but it still shows that even after this, you’re going to have 70% remaining capacity at your disposal.”

Responding to a question from council member Megan Hartwick, LeMire later said that the city’s policy is 60% of capacity.

“So our capacity is at 5% of the equalized value, and then our internal limit is 60% of that capacity,” she said.

Fischer said that Fort Atkinson has a good plan in place, not only for this year, but going forward.

“It puts the city in a good position from a borrowing standpoint, and because of this and keeping the financials strong, I only anticipate that the city continues to maintain a strong bond credit rating,” he said.”

Fischer noted that Fort Atkinson’s bond credit rating is above average from a debt-borrowing standpoint.

“A lot of communities your size are closer to using half their capacity or more at this particular point,” he said, adding that Fort Atkinson has a good fund balance and good policies in place.

“The city has an outstanding double A-minus rating, which is one of the strongest bond credit ratings you can receive. You’ve done everything you can from your standpoint to get the best rating and interest rates as possible. You are doing very well. You should be very proud,” the financial adviser said.

Plans under consideration call for the city to award general obligation bond bids on May 17, with the closing slated for June 7.

Three Tables above show information shared by Baird during Tuesday’s city council meeting. A closer, reader-friendly view is here: http://fortatkinsononline.com/wp-content/uploads/2022/02/prs-plan-of-finance_fort-atkinson-cy-020122.pdf.

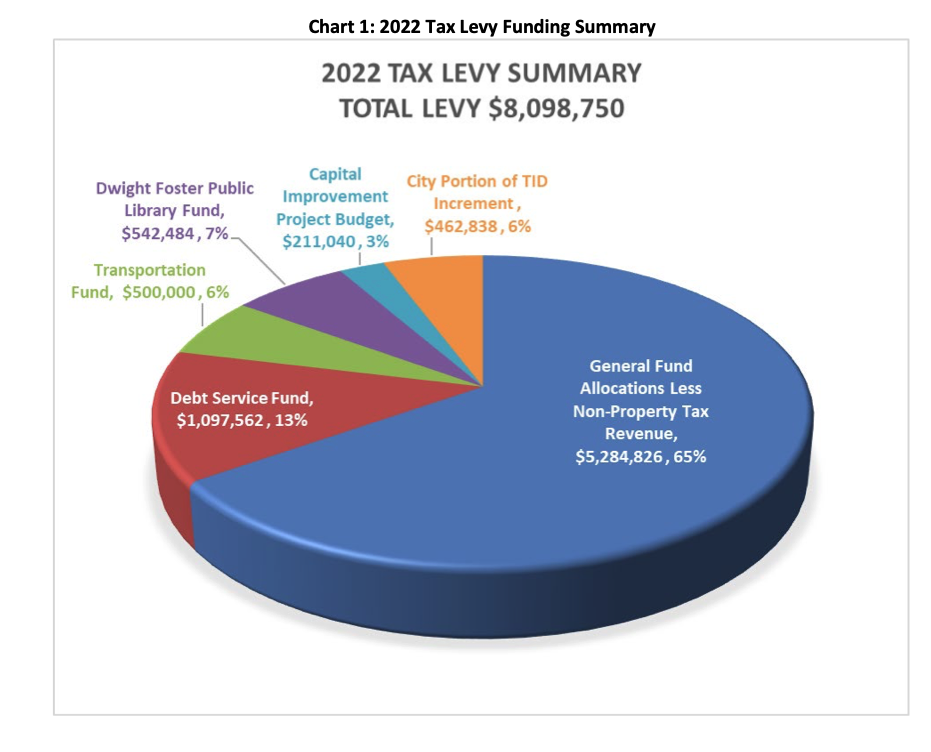

A graph from the city’s “2022 Operating Budget & 2022-2027 Capital Improvements Project Budget” shows an approved capital improvement project budget in 2022 of $211,040 to be funded through the general tax levy. A complete list of projects and their associated funding sources found within the document is below. The full approved budget document is here: http://fortatkinsononline.com/wp-content/uploads/2022/02/2022-COFA-Adopted-Budget-Document.pdf. Section 21 of the above linked document, titled: “Capital Improvement Budget and Five Year Project Plan,” begins on page 219.

This post has already been read 1426 times!

What is projected cost of replacing the fire dept. Squad with an EMS unit?