By Kim McDarison

The Fort Atkinson City Council participated Tuesday in a budget workshop.

During the workshop council members received information outlining preliminary numbers associated with the city’s 2023 operating budget.

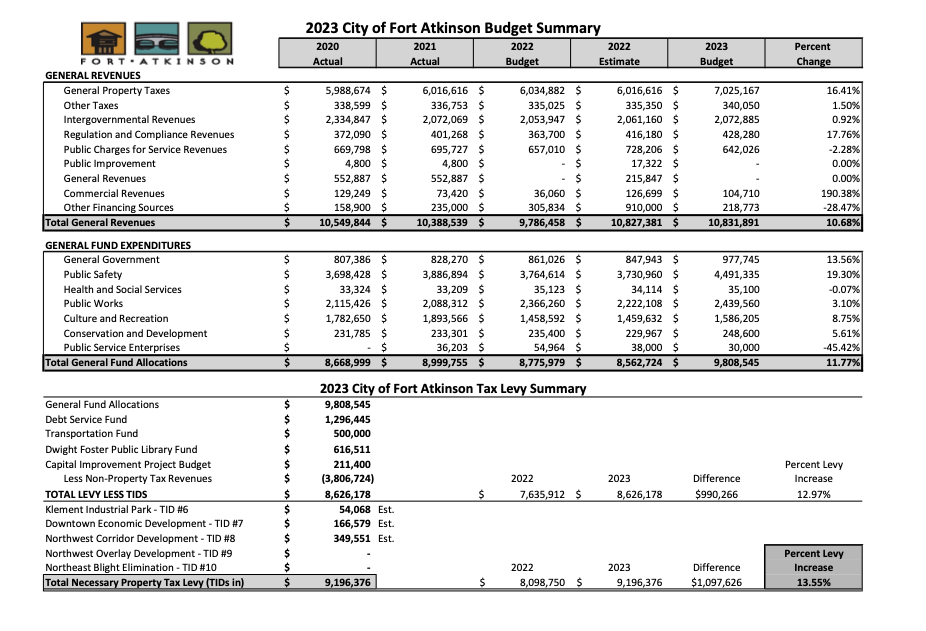

According to information shared with council in advance of the workshop by City Manager Rebecca Houseman LeMire, a proposed draft budget estimates that the city will operate next year using total general fund revenues — including revenues achieved through the tax levy and “other revenues” — of $12.4 million.

Looking at a proposed budget summary, the document estimates that the city will require a tax levy of $9,196,376 to fund next year’s expenses. The tax levy is the amount of the budget that is funded by taxpayers through property tax. The proposed levy represents a 13.55% increase over the levy paid last year by city taxpayers in support of this year’s operating budget.

To support the tax-levied portion of the general fund balance required to operate the city next year, city staff is estimating that city taxpayers will be assessed using a mill rate of $9.88 per $1,000 of property value. The estimated mill rate shared Tuesday shows an increase over the mill rate paid by taxpayers last year, which was $8.75 per $1,000 of assessed property value.

Looking at the portion of the budget summary labeled “2023 City of Fort Atkinson Tax Levy Summary,” the document shows general fund allocations of $9,808,545, a Debt Service Fund amount of $1,296,445, a Transportation Fund Amount of $500,000, a Dwight Foster Public Library Fund of $616,511, and capital improvement project budget of $211,400, totaling $12,432,901.

The document next reduces the proposed levy amount by $3,806,724 in non-property tax revenues, for a new levy total of $8,626,178. The total excludes revenues from Tax Incremental Finance Districts (TIDs).

After adding estimated growth from the city’s five TIDs, Nos. 6-10, in the total amount of $579,198, the city is able to raise its levy to $9,196,376, according to the budget summary.

Information included in the workshop agenda noted: “It has become clear, especially in the public works operations and parks departments, that the need for new vehicles and equipment far outweighs the city’s ability to levy funds for these capital improvements.”

The information further noted that city departments have requested $3.6 million to fund capital improvement projects in 2023 of which the city can fund nearly $3.2 million “through various sources.”

The information stated that city staff is proposing to spend $211,400 on capital improvement projects in 2023 funded through tax-levied dollars.

“The level of funding is not sustainable due to the city’s aging fleet,” the information shared by LeMire noted.

Listing other sources of revenue for capital projects and equipment, she cited a 2022-23 general obligation borrowing of $454,000; levied funds of $500,000 and vehicle registration fees of $210,000 for the transportation fund; American Recovery Plan Act (ARPA) funds of $32,900; the Library Trust in the amount of $16,500; the Museum Trust, in the amount of $17,000; the water utility in the amount of $1,282,600; the sewer utility in the amount of $182,000, and the stormwater utility in the amount of $93,490.

Looking at considerations that would affect the city’s levy, LeMire listed the public safety referendum approved by voters in April. The referendum adds $769,335 as additional revenue the city can levy above its state-imposed levy cap.

Also listed: additional debt payments from a 2022 borrowing added $198,883; net new construction of .0336% adds $22,067, and a “substantial” increase in Tax Incremental Financing District (TID) value, added $106,384.

According to the document, the total levy increase in the 2023 budget over the amount levied in 2022 without TIDs is $990,267, representing a percentage increase of 12.87. The total levy increase for 2023 over 2022 with TIDs included is $1,096,651, representing a percentage increase of 13.55.

A public hearing to discuss the budget is scheduled for Tuesday, Nov. 1, at 7 p.m., at the Fort Atkinson City Hall, 101 N. Main St.

The full budget packet from Tuesday’s workshop is here: https://cms8.revize.com/revize/fortatkinson/10.11.22%202023%20Budget%20Workshop%20Packet.pdf.

The 2023 city of Fort Atkinson budget summary is shown above. A larger version of the document is here: http://fortatkinsononline.com/wp-content/uploads/2022/10/budget-summary-fort-2023.pdf.

This post has already been read 731 times!