By Kim McDarison

The School District of Fort Atkinson Board of Education Monday approved three potential tax levies to fund the 2022-23 school year, with final levy certification predicated on the outcome of the district’s two referendum questions that will come before the district’s voters on Nov. 8.

District voters will find on their ballots two referendum questions, one asking for funding above the state-imposed revenue cap for operational expenses and a second asking for funding above the state revenue cap for capital improvements.

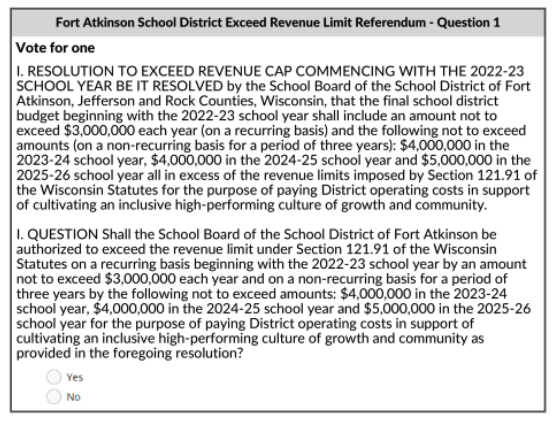

Two-part operational referendum question

According to information released by the district, the question asking voters to approve funding for operational expenses has two components. The question will appear before voters owning property within the School District of Fort Atkinson, which includes, in part or whole, nine communities.

Within its first component, the question asks voters to approve a funding increase not to exceed $3 million annually on a recurring basis, meaning the district, if the referendum is approved by voters, will be granted authority to exceed the state-imposed revenue cap, defined as the amount of money it can collect through property taxes, by $3 million in perpetuity, beginning with the 2022-23 school year.

The amount of revenues collected each year by the school district through property taxes is called the levy. Approving the recurring levy cap extension gives the district the ability to exceed the levy cap by an amount up to $3 million beginning in the 2022-23 school year and into the future until a time when the district might deem it unnecessary to collect the funds.

A second component of the question asks voters to approve additional funds over the revenue cap on a nonrecurring basis, meaning that the increase is in effect for a specific period of time, in this case, three years. The question that will appear before voters in November asks for nonrecurring increases as follows: in 2023-24, an amount not to exceed $4 million; in 2024-25, an amount not to exceed $4 million, and in 2025-26, an amount not to exceed $5 million.

Answering question by phone, School District of Fort Atkinson Director of Business Services Jason Demerath said that approval of the operational referendum question would have a combined effect, allowing the district to exceed the state-imposed revenue cap by both the recurring and nonrecurring amounts in each year that the nonrecurring amounts apply. In 2023-24, the combined extension would result in the district’s ability to exceed the revue cap by $7 million; in 2024-25, the district would be able to exceed the cap by a combined total of $7 million, and in 2025-26, the district would be able to exceed the cap by a combined total of $8 million, after which time the nonrecurring component of the referendum would sunset. In subsequent years, unless a new nonrecurring referendum question would receive voter approval, the district would be allowed to continue to exceed its cap annually by $3 million.

During Monday’s presentation, Demerath said: “I will note that through this referendum we are asking voters permission to levy up to those amounts, so these would be maximums that we could levy, but as the financial environment changes over the next four years the Board could consider levying less than those amounts accordingly.”

A single vote cast — yes or no — affects both parts of the question.

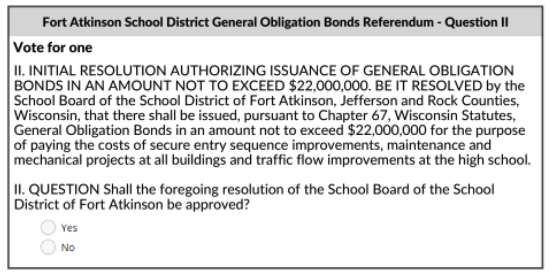

Capital improvements referendum

A second referendum question appearing before property owners within the School District of Fort Atkinson asks for approval to issue general obligation bonds in an amount not to exceed $22 million. Would voters approve the referendum, the funds would be used to pay for costs associated with secure entry sequencing improvements, maintenance and mechanical projects in all of the district’s school buildings, and traffic flow improvements at the high school.

Referencing future capital needs, during Monday’s meeting, Demerath said: “In addition to these referendum questions on the ballot in two weeks, we will continue to plan and message for a referendum in November 2026 to build a new middle school.”

Four possible outcomes

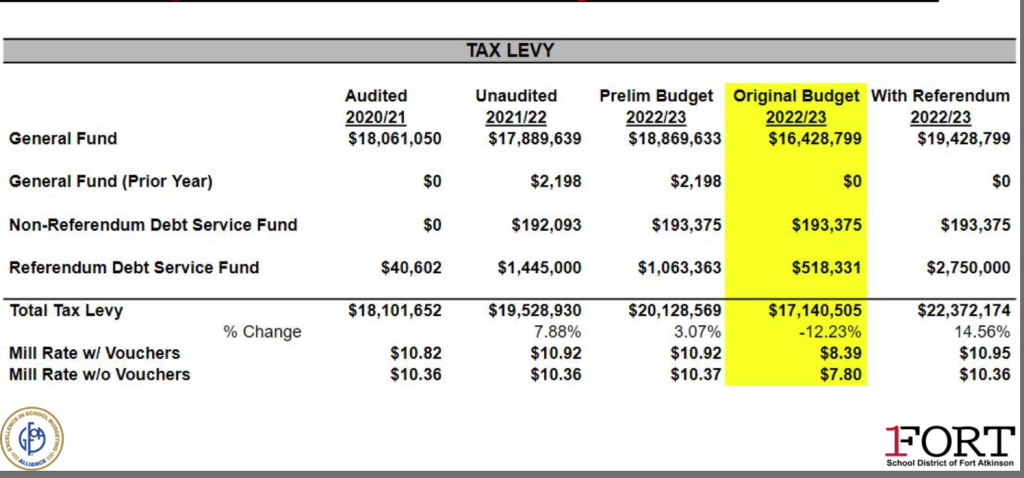

Following Monday’s budget presentation, board members approved three possible levies, noting that final certification will be made after the election.

According to Demerath, the four possible outcomes anticipated in advance of the election are:

• Both questions pass: which would allow for the tax levy to be set at $22,372,174. In this scenario, taxpayers could expect to pay a tax rate of $10.95 per $1,000 of equalized property value.

• Capital passes, operational fails: which would allow for the tax levy to be set at $22,372,174. In this scenario, taxpayers could expect to pay a tax rate of $10.95 per $1,000 of equalized property value.

• Operational passes, capital fails: which would allow for the tax levy to be set at $20,140,505. In this scenario, taxpayers could expect to pay a tax rate of $10.92 per $1,000 of equalized property value.

• Both questions fail: which would allow for the tax levy to be set at $17,140,505. In this scenario, taxpayers could expect to pay a tax rate of $8.39 per $1,000 of equalized property value.

The full budget

During his presentation, Demerath shared budget charts and summaries indicating how revenues are received by the district and how they are spent.

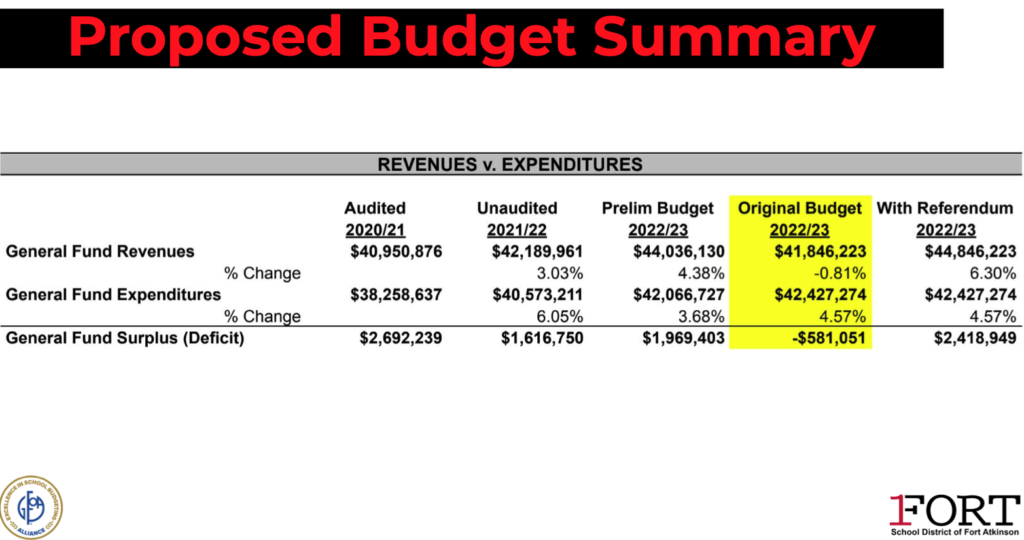

Looking at the district’s full general fund operating budget, in the 2020-21 school year, the cost anticipated to operate the district was $40,950,876. After expenditures that year of $38,258,637, the district saw a general fund surplus of $2,692,239. In the 2021-22 school year, unaudited figures show that the district received revenues of $42,189,961 and spent $40,573,211, showing a surplus of $1,616,750. In this, the 2022-23 school year, the district’s preliminarily budget showed revenues of $44,036,130 and expenditures of $42,066,727, leaving a surplus of $1,969,403.

With the 2022-23 school year, the district’s previously approved nonrecurring referendum sunsets. Looking at figures without the previously approved revenue cap increase, labeled “original budget,” the district shows a budget, assuming no revenue cap extension, of $41,846,223. After expenses, estimated at $42,427,274, the district shows a shortfall of $581,051.

Looking at an operational budget in 2022-23 with a new operational referendum amount of $3 million included, would voters make that approval in November, numbers are as follow: revenues, $44,846,223; expenses, $42,427,274, leaving the district with an anticipated surplus of $2,418,949.

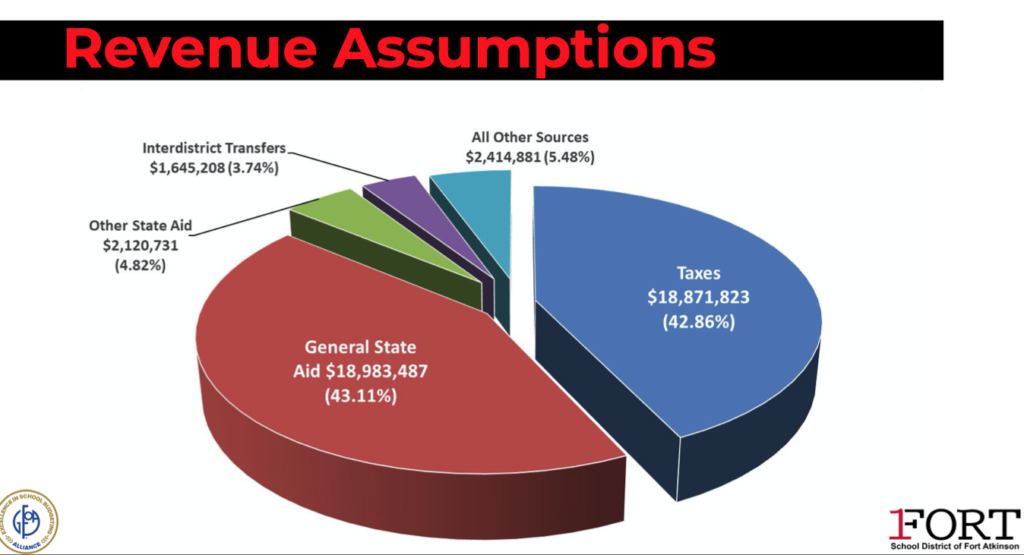

As noted within a budget presentation given by Demerath to board members during the district’s annual meeting in August, of the district’s full operational budget, some 43% is funded through the taxpayer levy while another 43% is funded through general state aid. The remaining 14% is funded through a combination of other state aids, inter-district transfers and 5.48% is funded through “all other sources.”

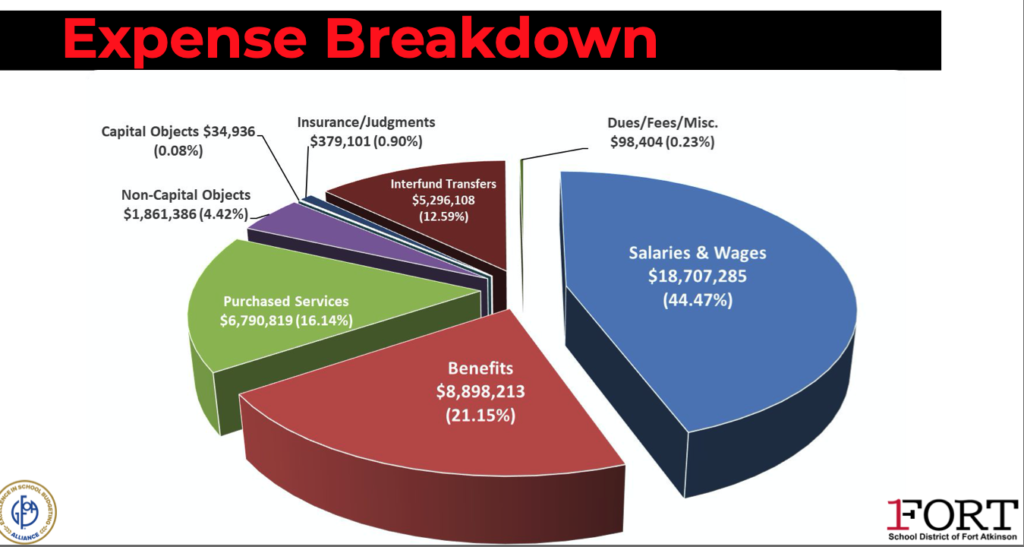

Looking at expenses, some 44% of the district’s operating budget is used to support salaries and wages, with another 21% used to fund benefits. A remaining 35% of the budget supports “purchased services,” “capital objects,” “insurance/judgements,” “inter-fund transfers,” and “dues/fees/misc.”

A pie graph, shown above, as presented to the school board in August as part of the budget hearing held during the district’s annual meeting shows a breakdown of revenue sources within the district’s general operating fund.

A pie graph, shown above, as presented to the school board in August as part of the budget hearing held during the district’s annual meeting shows a breakdown of expenditures paid using resources held within the district’s general operating fund.

The above slide, shared Monday, shows the difference between revenues collected and expenditures paid in the 2020-21 and 2021-22 school years, and looks at the various budget scenarios in 2022-23 assuming both the absence and inclusion of monies derived from passage of both referendums. The column highlighted in yellow shows the scenario without the inclusion of the $3 million coming from the operational referendum.

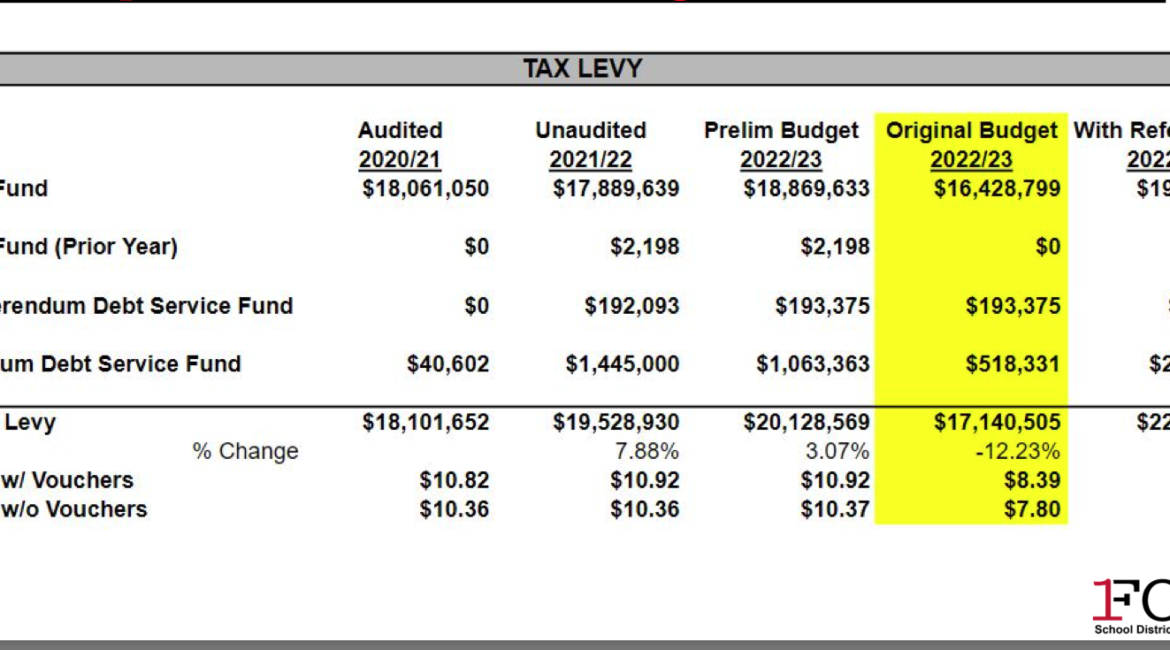

The above slide, shared Monday, shows the differences in levies and their associated mill or tax rates under several scenarios, including those associated with both referendums failing, shown in yellow, and both passing, shown in the final column. Also offered is the difference in the mill or tax rates used to support public school expenses, shown in the bottom row, and those that will be collected by the school district from taxpayers and used by the state to fund both public school expenses and its voucher program. Demerath described the district’s involvement with collecting voucher program dollars as “pass through,” meaning that the money is collected by the district from its taxpayers, but used to support the education of students from within the district who are being educated through the private school system. The differential in 2022-23 is 59 cents per $1,000 in equalized value.

Tax bills and increases

During Monday’s presentation, Demerath noted that a stabilization made within the district’s mill rate would not guarantee that a taxpayer would not see an increase in taxes. Year-over-year, he said, the two factors most likely to increase a taxpayer’s bill are an increase in home value and an increase in the amount the state collects from the district annually to support its voucher program.

Said Demerath: “Over the past few years, the private school voucher part of the tax rate … has continued to increase. This year that part of the tax rate has increased slightly as we are now over $1.2 million dollars in local private school vouchers being funded as a pass through on the tax levy. That is an increase over last year of about $200,000.

“As we have shared before, we get no information whatsoever about how many students are using private school vouchers or are projected to use private school vouchers, and we don’t know how much to add to the tax levy until the state gives us those numbers in mid-October,” he said, adding, “this year, just like the past few, the only increase in the local tax rate is due to private school vouchers.”

What will voters find on the ballot?

The two referendum questions appearing on the November ballot are as follows:

Including the city of Fort Atkinson, there are nine municipalities within the Fort Atkinson school district. A polling place for city residents is at the municipal building, 101N Main St.

Polling places for the eight rural towns within the School District of Fort Atkinson include:

Koshkonong, W5609 Star School Rd.

Oakland, N4450 County Road A

Jefferson, 434 County Road Y

Cold Spring, N1409 Fremont Rd., Whitewater

Lima, 11053 Willow Dr., Whitewater (Rock County)

Hebron, N2313 County Road D.

Palmyra, 100 W. Taft St.

Sumner, N1525 Church St., Edgerton

This post has already been read 1268 times!