By Kim McDarison

A budget workshop was held by the City of Fort Atkinson on Tuesday, Oct. 12.

Information shared by City Manager Rebecca Houseman LeMire during the nearly four-hour meeting included a draft of the 2022 operating budget and the city’s 2022-2027 (five-year) Capital Improvement Plan (CIP).

LeMire opened the workshop with an operating budget summary, including revenue and expenditure line items for the city’s general fund. Summaries of several other operational city funds, such as utility funds, were also included within the presentation.

Within a memo drafted by LeMire and presented to workshop participants, LeMire noted that the city’s budget document is a tool to help communicate goals to the city council. The document “can also tell the story” of the services provided by the city and the revenues it takes to support them, LeMire wrote.

“When I started in February of 2021, I recognized that the city’s existing budget and capital improvements documents presented opportunities for both efficiencies in process and expansion of detailed information,” LeMire noted.

Using new web-based tools, LeMire continued, she and City Finance Director Michelle Ebbert worked to create a new document aimed at guiding the city’s operations in 2022 and, LeMire wrote, to “show the need for additional capital equipment and improvements in 2022 through 2027.”

A story about the city’s utility funds and 2022-2027 CIP will follow at a later date.

Within Tuesday’s workshop, LeMire said 2022 General Fund revenues and expenditures used information provided by staff up to Oct. 7.

General Fund revenues and estimated tax levy

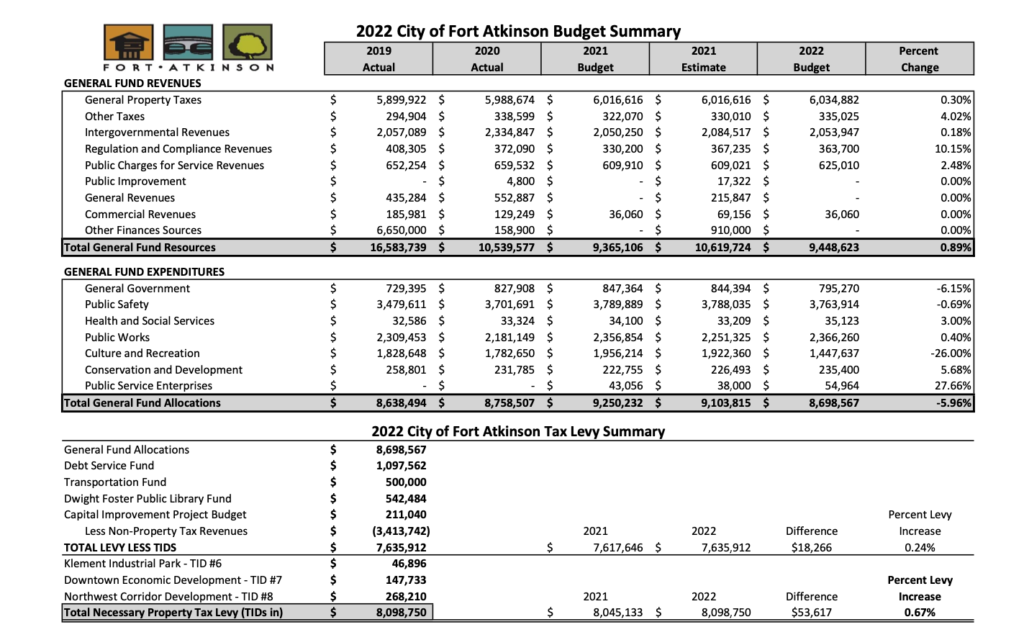

As presented within the draft budget summary, total general fund resources are estimated in 2022 at just under $9.45 million.

In 2021, the resources were estimated at $10.6 million, with the actual 2021 budget coming in at $9.36 million.

The estimated percent of change between the 2021 budget and the estimated 2022 budget, according to the draft document, is 0.89%.

Looking at some budget history, in 2020, the city operated using a general fund budget of $10.5 million and in 2019, the city budget was $16.5 million.

During the meeting, Councilwomen Megan Hartwick asked for clarification about why the 2019 revenues showed $6.6 million, labeled “other finances sources,” that appeared not to have a corresponding expenditure. LeMire and Ebbert noted that the money represented a borrowing obtained to fund the city’s new fire station project. The monies were expended over time on items associated with the project, they said.

In 2022, the estimated tax levy, not including adjustments for the city’s tax incremental financing districts (TID), for city taxpayers is $7,635,912, which is an increase of $18,266 or 0.24% over last year’s tax levy of $7,617,646.

Adjusting for funds invested in TID Nos. 6, 7 and 8, such as the Klement Industrial Park (TID 6) in the amount of $46,896; downtown economic development (TID 7) in the amount of $147,733, and the northwest corridor development (TID 8) in the amount of $268,210, under a heading of “necessary property tax levy” the document showed the full estimated levy earmarked to cover city expenses calculated at $8,098,750, which, when compared to the 2021 tax levy of $8,045.133, shows an increase of $53,617 or 0.67%.

The draft provides an estimated mill rate for city taxpayers of $8.75 per $1,000 of assessed property value, which, LeMire noted in her memo, is slightly up from last year’s mill rate of $8.64 per $1,000 of assessed property value. The mill rate as presented by the city represents funding to be appropriated from city taxpayers to fund the operations of the city and TID districts, and does not include levies from other taxing jurisdictions such as the state, county, technical college and the school district.

General fund revenues include: general property taxes and other taxes, intergovernmental revenues, regulation and compliance revenues, public charges for service, public improvement revenues, general revenues and commercial revenues.

Looking at the percentage each category supplies to the full budget funding, numbers are as follows:

General property and other taxes: In 2021, the city received $6,338,686. In 2022, the city estimates it will receive $6,369,907, showing a “variance” or increase of $31,221. General property and other taxes make up 67.4% of the city’s general fund operating budget.

Intergovernmental revenues: In 2021, the city received, $2,050,250. In 2022, the city estimates that it will receive $2,053,946, showing a “variance” or increase in intergovernmental revenues of $3,696.51. Intergovernmental revenues make up 21.7% of the city’s general fund operating budget.

Regulation and compliance revenues: In 2021, the city received $330,200. In 2022, the city estimates that it will receive $363,700, showing a variance or increase of $33,500. Regulation and compliance revenues make up 3.8% of the city’s general fund operating budget.

Public charges for services: In 2021, the city received $609,910. In 2022, the city estimates that it will receive $625,010, showing a variance or increase of $15,100. Public charges for services make up 6.6% of the city’s general fund operating budget.

Public improvement revenues: The city recorded no revenues in 2021 or 2022.

General revenues: The city recorded no revenues in 2021 or 2022.

Commercial revenues: In 2021, the city received $36,060. In 2022, the city estimates that it will receive $36,060. Commercial revenues make up 0.38% of the city’s general fund operating budget.

LeMire further noting that numbers presented within the draft qualify the city for the 2023 Expenditure Restrain Program (ERP) as administered through the state, which is designed to provide unrestricted aid to qualifying municipalities that limit growth in spending. The payment is in addition to aid paid under the county and municipal aid program. A description provided by the Department of Revenue of ERP is here: https://www.revenue.wi.gov/DORReports/erp.pdf#:~:text=The%20expenditure%20restraint%20program%20%28ERP%29%20provides%20unrestricted%20aid,do%20not%20qualify%20for%20payments%20under%20this%20program.

General Fund expenditures

Also included within the draft document were estimates for general fund expenditures.

In 2022, according to the draft document, the city anticipates expenditures of nearly $8.7 million. As a matter of comparison, in 2021, the city estimated expenditures of just over $9.1 million with actual expenditures coming in at $9.25 million. Offering some history, the document shows that in 2020, the city’s actual expenditures were $8.7 million, and in 2019, they were $8.6 million. The document further notes that the city’s expenditures between 2021 and 2022 are estimated to decrease by 5.96%.

The city’s general fund expenditures include: general government expenses, public safety, health and social services, public works, culture and recreation, conservation and development, and public service enterprises.

Looking at the city’s expenses as a matter of percentage, numbers are as follows:

General government expenses

Within the full category, in 2021, the city spent $847,364. In 2022, the city anticipates spending $795,270, a decrease of $52,094 from last year. The allocation within this category is 9.1% of the city’s total anticipated 2022 general fund expenditures. A list of expenditures found in this category follow.

City council: In 2021, including council salaries, supplies, dues and benefits, the city spent $33,755. In 2022, the city anticipates spending $27,920, a decrease from last year of $5,835.

Court: In 2021, the city spent $88,955. In 2022, the city anticipates spending $68,425, a decrease from last year of $20,530.

City manger: In 2021, the city spent $125,000 for the city manager’s salary and benefits. In 2022, the city anticipates spending $83,800, a decrease from last year of $41,265.

Clerk/Treasurer: In 2021, the city spent $161,613, which includes salaries and benefits for both the clerk/treasurer and deputy clerk/treasurer, and expenses associated with elections and a citywide information technical network. In 2022, the city anticipates spending $110,250, a decrease of $51,363.

Job classification/labor relations: In 2021, the city spent $2,921. In 2022, the city anticipates spending $3,000.

Assessor: In 2021, the city spent $43,880. In 2022, the city anticipates spending $35,000, a decrease from last year of $8,880.

Audit totals: In 2021, the city spent $32,000. In 2022, the city anticipates spending $34,000, an increase from last year of $2,000.

Attorney: In 2021, the city spent $64,445. In 2022, the city anticipates spending $40,100, a decrease over last year of $24,345.

Municipal building: In 2021, the city spent $77,151. The category includes such expenditures as municipal building salaries and benefits, repairs, supplies, and utilities. In 2022, the city anticipates spending $50,150, a decrease of $27,001 from last year.

General government insurance, benefits, and miscellaneous expenses: In 2021, the city spent $217,500. In 2022, the city anticipates spending $342,625, an increase of $125,125 over last year.

Public safety

Expenditures for the police department, water patrol, fire department, building inspector, electrical, civil defense, emergency management, public safety miscellaneous, and public safety benefits are found in this category. Expenditures within the full category in 2021 were $3,789,889. In 2022, the city anticipates spending $3,763,914, a decrease from last year of $25,976. The allocation within this category is 43.2% of the city’s total anticipated general fund expenditure in 2022. A breakdown follows.

Expenditures for the police: In 2021, the city spent $2,784,284. In 2022, the city anticipates spending $2,058,157, a decrease of $726,127 from last year.

Water patrol: In 2021, the city spent $11,100. In 2022, the city anticipates spending $0, a decrease of $11,100 from last year. A notation on the document states that the expenditures have been moved and are included within the public works operations.

Fire department: In 2021, the city spent $713,749. In 2022, the city anticipates spending $603,037, a decrease of $110,713 from last year.

Building inspector: In 2021, the city spent $113,570. In 2022, the city anticipates spending $82,500, a decrease of $31,070 from last year.

Electrical: In 2021, the city spent $48,236. In 2022, the city anticipates spending $34,045, a decrease of $14,191 from last year.

Civil defense: In 2021, the city spent $1,060. In 2022, the city anticipates spending $1,500, an increase of $440 over last year.

Emergency management: In 2021, the city spent $10,090. In 2022, the city anticipates spending $8,550, a decrease of $1,540 from last year.

Public safety miscellaneous: In 2021, the city spent $107,800. In 2022, the city anticipates spending $116,800, an increase of $9,000 over last year.

Public safety benefits: In 2021, a value was not entered for this category. A notation on the document indicates that the category is new on the document. In 2022, the city anticipates spending $859,325.

Health and social services

Expenditures for the humane society are presented in the category.

In 2021, the city spent $34,100. In 2022, the city anticipates spending $35,123, an increase of $1,023 over last year. The allocation within this category is 0.40% of the city’s total anticipated general fund expenditure in 2022.

Public works

Expenses attributed to the full category in 2021 were $2,356,854. In 2022, the city anticipates spending $2,366,260, an increase from last year of $9,406. The allocation within this category is 27.2% of the city’s total anticipated general fund expenditure in 2022. A breakdown of expenditures by subcategory follows.

Public works operations: The document indicates that some expenditures have been moved from former categories no longer in use on the document and placed here. Expenditures listed in categories formerly called “garage” and “street name signs” are here, along with expenses that were formerly listed as “water patrol.” The category further includes salaries and benefits for public works employees, and operational expenses associated with the public works department building.

In 2021, the city spent $221,752. In 2022, the city anticipates spending $176,400, a decrease of $45,352 from last year.

Engineering: The category includes salaries and benefits for the city engineer and assistant engineers, along with consulting services, software licenses, supplies and other department miscellaneous expenses. In 2021, the city spent $105,625. In 2022, the city anticipates spending $74,430, a decrease from last year of $31,195.

Street maintenance: The category includes expenses and supplies associated with street, curb and gutter repairs, and salaries and benefits associated with street maintenance. In 2021, the city spent $262,447. In 2022, the city anticipates spending $195,950, a decrease of $66,497 from last year.

Street machinery: In 2021, the city spent $310,870. In 2022, the city anticipates spending $282,000, a decrease of $28,870 from last year.

Snow and ice removal: In 2021, the city spent $244,800. In 2022, the city anticipates spending $216,750, a decrease of $28,050 from last year.

Traffic control: In 2021, the city spent $105,895. In 2022, the city anticipates spending $93,700, a decrease of $12,195 from last year.

Street lighting: In 2021, the city spent $279,655. In 2022, the city anticipates spending $279,500, a decrease of $155 from last year.

Parking lot: In 2021, the city spent $4,210. In 2022, the city anticipates spending $5,680, an increase of $1,470 from last year.

Recycling/refuse: In 2021, the city spent $732,000. In 2022, the city anticipates spending $745,000, an increase of $13,000 over last year.

Airport: In 2021, the city spent $89,600. In 2022, the city anticipates spending $0, a decrease of $89,600 from last year. A notation on the document states the expenditure has been moved to Fund 20.

Public works benefits: In 2021, no amount was recorded. In 2022, the city anticipates spending $296,850. A notation on the document states that the category is new as of this year.

Culture and recreation

Expenditures, including those for the Hoard Historical Museum, the public library, youth center, senior center, recreation, aquatic center, festivals/art/riverwalk, parks, and culture and recreation benefits, fall within this category. Looking at the full category, in 2021, the city spent $1,956,214. In 2022, the city anticipates spending $1,447,637, a decrease of $508,577 from last year. The allocation within this category is 16.6% of the city’s total anticipated general fund expenditure in 2022.

Hoard Historical Museum: In 2021, the city spent $178,906. In 2022, the city anticipates spending $154,700, a decrease of $24,206 from last year.

Public library: In 2021, the city spent $554,290. In 2022, the city anticipates spending $0, a decrease of $554,290. A notation on the document notes that all library expenditures have been moved to a separate Fund 15.

Youth center: In 2021, the city spent $83,494. In 2022, the city anticipates spending $70,833, a decrease of $12,661 from last year.

Senior center: In 2021, the city spent $108,833. In 2022, the city anticipates spending $86,445, a decrease of $23,388 from last year.

Recreation: In 2021, the city spent $330,879. In 2022, the city anticipates spending $261,873, a decrease of $69,006 from last year.

Aquatic center: In 2021, the city spent $246,469. In 2022, the city anticipates spending $234,566, a decrease of $11,930 from last year.

Festivals/art/riverwalk: In 2021, the city spent $35,612. In 2022, the city anticipates spending $27,700, a decrease of $7,912 from last year.

Parks: In 2021, the city spent $417,704. In 2022, the city anticipates spending $351,445, a decrease of $66,259 from last year.

Culture and recreation: In 2021, the city did not record numbers in this category. In 2022, the city anticipates spending $260,075. The category, which is new this year, contains benefits for culture and recreation employees. The allocation within this category is 2.9% of the city’s total anticipated expenditure in 2022.

Conservation and development

The category contains expenditures in the subcategories of forestry, weed control, economic development, and conservation and development benefits. In 2021, within the full category, the city spent $222,755. In 2022, the city anticipates spending $235,400, an increase over last year of $12,645. The allocation within this category is 2.7% of the city’s total anticipated general fund expenditure in 2022. Expenditures in subcategories follow.

Forestry: In 2021, the city spent $199,040. In 2022, the city anticipates spending $141,500, a decrease of $57,540 from last year.

Weed control: The category includes salaries and benefits. There are no entries in this category.

Economic development: In 2021, the city spent $23,715. In 2022, the city anticipates spending $23,850, a decrease of $135 from last year.

Conservation and development benefits: The category contains employer benefits. There are no entries in the category for 2021. In 2022, the city anticipates spending $70,050.

Public service enterprises

A single subcategory of contingency/health insurance/utility is included within this category. In 2021, the city spent $43,056. In 2022, the city anticipates spending $54,964, an increase over last year of $11,908.

Significant changes in 2022

Under the heading of “Significant Changes to the 2022 Budget Process” LeMire identified the following:

- Narratives explaining the functions of the departments, the accomplishments from the current year, the goals for next year, and alignment with the city’s Comprehensive Plan, with those plans to be included in the Nov. 2 iteration of the budget.

- Employee benefits, including social security, Medicare, retirement, health, dental, life insurances, and longevity, are moved from the specific departments to applicable and corresponding areas within the General Fund, such as general government, public safety, public works, and culture and recreation.

- A 2% wage increase for full-time staff and 1% increase for part-time staff.

- A combined 2022 operating budget document with the five-year capital improvements plan document.

- A new budget design format.

- A goal of updating and improving the budget document annually in response to council, staff and public feedback.

Under a heading of “Capital Improvements Project Budget,” LeMire wrote: “It has become clear, especially in the Public Works Operations and Parks Departments, that the need for new vehicles and equipment far outweighs the city’s ability to levy funds for these capital improvements.”

Additionally, she wrote: “Staff is proposing $211,040 in capital improvements in 2022 using levied tax dollars, not including the Transportation Improvements Fund.”

She noted that the level of funding is “not sustainable, due to the city’s aging fleet.”

While mechanics employed by the city have worked to extend the life of city equipment, there are still costs associated with parts and labor.

As a remedy, she wrote, staff is proposing that the city borrow additional funds to support capital projects, equipment and services in 2022, as well as use some of the city’s American Rescue Plan Act (ARPA) funds.

As of Oct. 7, LeMire wrote, the following information is still unknown:

- Aggregate Assessed Value of all city property. The value is required to determine the final mill rate. The information is anticipated by the end of October.

- Requested levy amounts from the other taxing jurisdictions supported by tax dollars, including the state, county, school district and technical college. The amounts are anticipated in early November.

• The levy increase permitted as determined by completing the Levy Limit Worksheet. Worksheets are due by Dec. 15, and cannot be completed until a budget is adopted.

Budget timeline

A 2022 budget timeline of events is as follows:

- Oct. 12: draft budget and five-year CIP presented to the city council by the city’s management team.

- Oct. 18: a notice of public hearing about the budget summary published in the city’s official paper of record, which is the Daily Jefferson County Union.

- Week of Oct. 25: proposed 2022 budget document and five-year CIP to be released to the council and public prior to the scheduled public hearing.

- Nov. 2: public hearing held.

- Nov. 16: budget adopted at the regularly scheduled city council meeting.

The city’s estimated budget is here: http://cms1files.revize.com/fortatkinson/10.12.21%20COFA%202022%20Budget%20Workshop%20Packet.pdf.

The City of Fort Atkinson 2022 budget summary sheet is here. The full document can be viewed using the link above.

This post has already been read 2686 times!