By Kim McDarison

The Whitewater Area League of Women Voters State of the City and School District forum was held Thursday, Sept. 23.

Delivering a State of the City address, Whitewater City Manager Cameron Clapper was one of two presenters during the hour-long virtual event. He shared the platform with Whitewater Unified School District Superintendent Caroline Pate-Hefty, who delivered a State of the District address. A story about Pate-Hefty’s presentation is here: https://fortatkinsononline.com/whitewater-school-district-highlights-shared-during-state-of-the-district-address/.

Following an introduction given by League Co-President and forum moderator Mary Beth Byrne, Clapper, aided by slides, spoke about such topics as operating in the pandemic, strategic management and budgeting, the American Rescue Plan Act (ARPA), Whitewater’s housing dilemma, and new development, which included an overview of tax incremental financing districts, and business and industry growth.

Also included was an update on the Cravath and Trippe lakes rehabilitation project. A story, including Clapper’s comments about the project, is here: https://fortatkinsononline.com/cravath-trippe-lakes-restoration-plans-on-schedule-city-manager-says/.

A story about the most recent update on the lakes restoration project, including plans to treat some 100 acres of connected lakebed with herbicide, is here: https://fortatkinsononline.com/herbicide-application-explained-could-begin-next-week-whitewater-officials-say/.

Operating in the pandemic

During his presentation, Clapper said, based on guidance from the Center for Disease Control and Prevention, city employees working indoors at city-owned facilities are required to wear masks, regardless of vaccination status, and members of the public conducting business in city-owned buildings are asked, but not required, to wear face masks.

Employees are required to wear masks for “safety purposes,” and for the purpose of “setting a good example,” Clapper said.

Every city facility is open and accessible, Clapper added.

Strategic Management and budgeting

Looking at strategic management and budgeting, Clapper said the city is a four-time recipient of the “Distinguished Budget Presentation Award,” earned in 2018 through 2021, as presented by the Government Finance Officers Association. The award recognizes the city’s budget document as offering sound policy, fiscal planning, operations guidance and as a good communication device.

Pointing to the budget document, he said “We want to make sure that it is something that is clear and transparent, so that you all as community members understand how your resources are being utilized for the benefit of the community as a whole.”

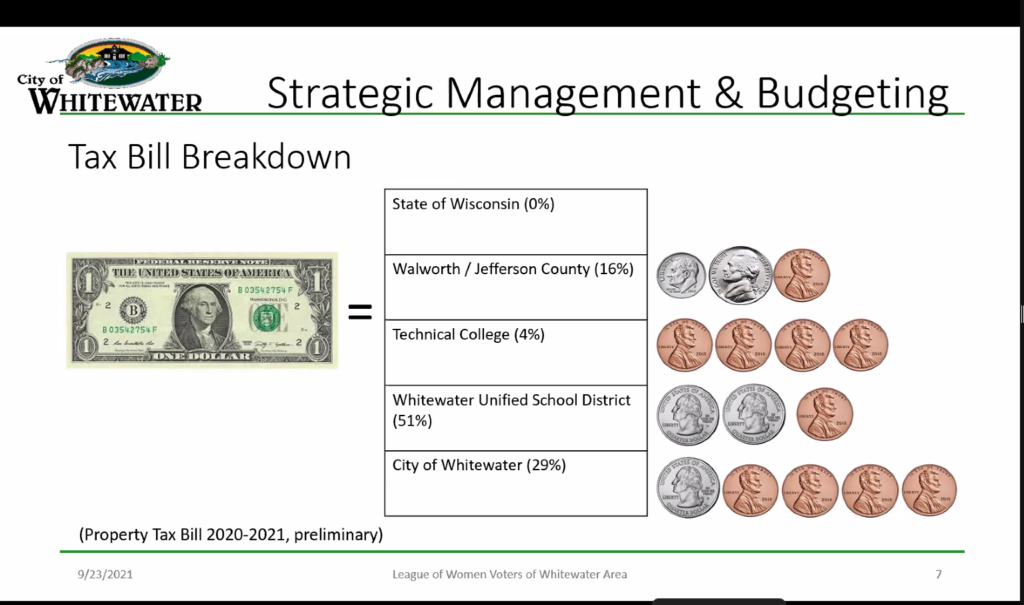

Additionally, Clapper offered a breakdown by percentage of resources paid to each taxing district annually by Whitewater residents. Using preliminary figures from the 2020-2021 property tax bill, Clapper said 16% of the total taxation goes to Walworth or Jefferson county, depending on where in the city the taxpayer lives; another 4% goes to area technical colleges, some 51% is allocated to the Whitewater Unified School District, and 29% is collected by the city.

“We don’t have to pay anything right now on property taxes to the state; fortunately the state has reduced to zero their draw on property tax from the property tax system, however we still distribute to other entities,” Clapper said.

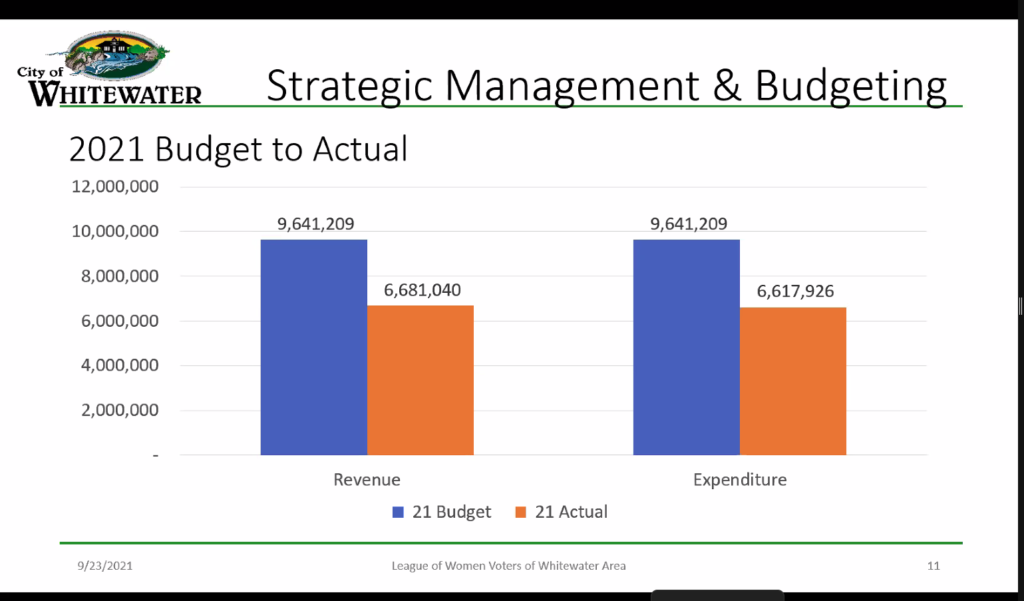

Looking at a comparison between the city’s budget in 2021 and the actual dollars spent thus far in the budgetary cycle, he said, the city developed its budget anticipating revenues of $9.6 million, and has thus far received $6.68 million. Of that amount, the city has thus far spent $6.61 million.

Referencing a slide showing the city’s revenue sources, Clapper said: “You can see property taxes and intergovernmental revenue make up the largest chunk of our dollars coming in, and intergovernmental revenues is actually more than property tax, so we are very dependent on the state for the dollars that they choose to allocate annually in the biannual budget to municipalities.”

Clapper said monies collected through the tax levy support 42% of the city’s operating budget and 47% come from intergovernmental revenues. Other sources, such as public charges for services, forfeitures, licenses and permits, special assessments and miscellaneous charges, each account individually for anywhere from 1% to 5% of the full general fund revenue pie.

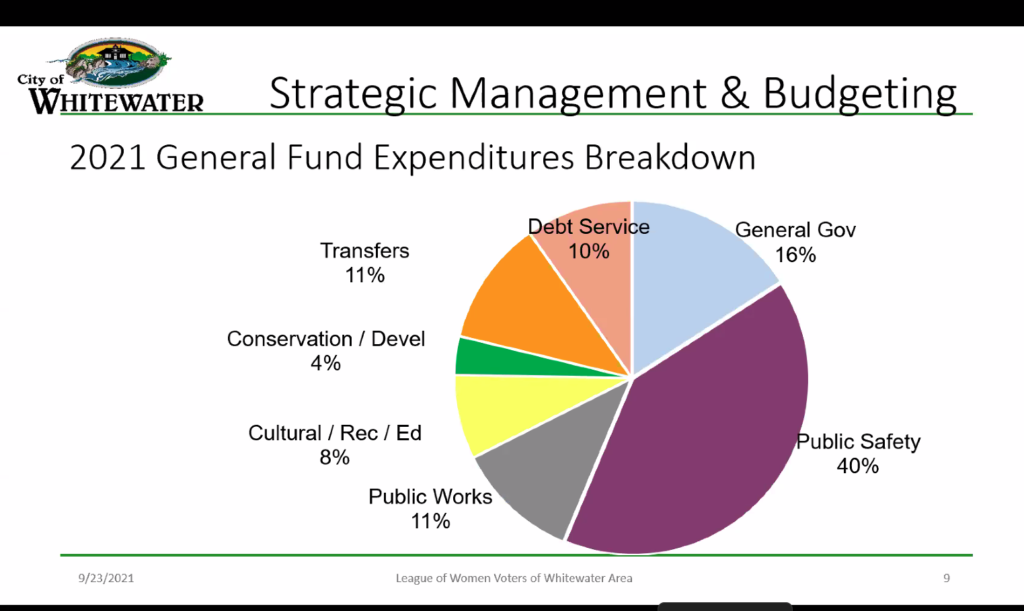

Looking at general fund operating expenditures, he said, public safety accounts for 40%; followed by general government expenses, at 16%; public works expenses and transfers, each coming in at 11%; debt service accounts for 10%; cultural, recreational and educational activities consume 8%, and conservation and development are allotted 4%.

Clapper defined expenditures associated with public works and public safety as “significant.”

“Public Safety, of course, is very expensive, with all of the equipment and training that’s required of our public servants,” he said.

Looking at the city’s expenses thus far in the current budgetary cycle, Clapper said: “I just want to report, in the state of the city, currently, we are moving forward as projected this year with how we budgeted in terms of dollars for expense and use of city resources. We are about two-thirds of the way through the year and we are about two-thirds of the way through where we expected to be with our budget, so things are moving along smoothly. Our budget, this year … is just over $9.6 million, and so we are very fortunate to have a lot of frugal people and intelligent people working to maintain operations and keep us low on expenses as much as possible.”

American Rescue Plan Act

As of March 11, 2021, Clapper said, the federal government earmarked some $1.9 trillion through the American Rescue Plan Act (ARPA) of which $362 billion was dedicated to state and local governments through the Coronavirus Fiscal Recovery Fund.

Of those monies, he said, the state of Wisconsin received $2.5 billion, the counties of Walworth and Jefferson received $20.2 million and $16.5 million, respectively, and the City of Whitewater received $1.5 million.

Monies received by the city could be used for lost public sector revenue, and water, sewer and broadband infrastructure.

Looking at the city’s appropriation, he said: “We are thrilled about that because those dollars are very useful for a number of things.

Clapper noted that levels of government, such as state and county, are able to use the ARPA funds for such expenses as public health responses, negative economic impacts from the pandemic, premium pay for public sector essential workers, and infrastructure projects such as water, sewer or broadband.

Whitewater is classified as a NEU, or non-entitlement unit of local government. As such, he said, the city’s ARPA funds can be used to cover two areas that the other levels of government will not cover. They are a loss of public sector revenues and infrastructure projects.

“So that’s where I anticipate we will be focusing the majority of the dollars that will be coming to us. We’ve already received about $770,000, that’s the first installment of a two-installment payment of that $1.5 million. So those dollars are sitting in a fund, and will sit there until we come up with, as a community, the way we are going to disperse those dollars,” Clapper said.

He said the money would give the city an opportunity to improve infrastructure, which, he said, had been “neglected for some time.”

Whitewater’s housing dilemma

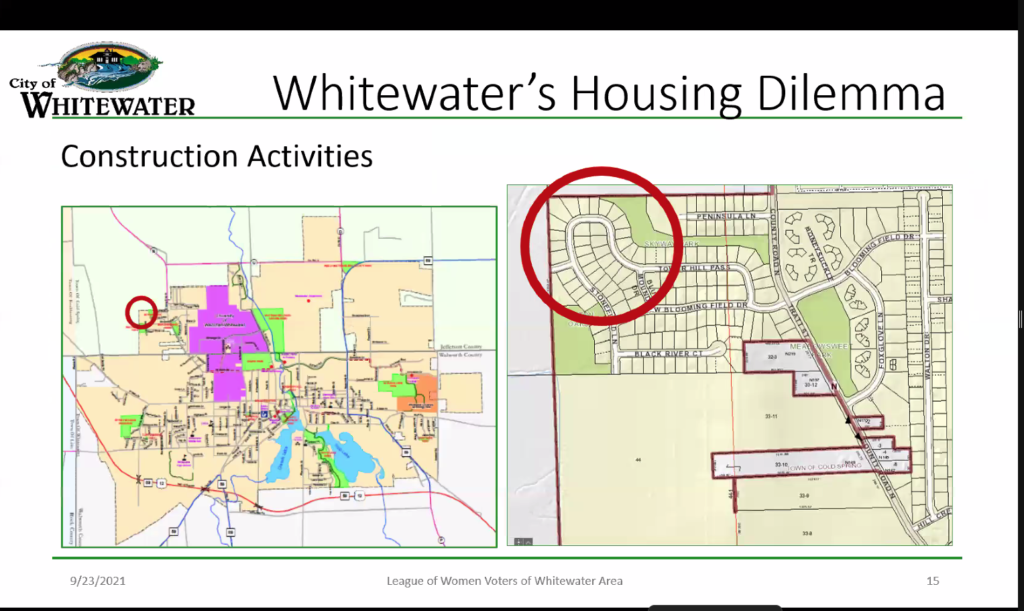

Clapper stressed a need within the city to address housing shortages, which, he said, affected all variety of housing stock designed to accommodate all population segments. He said plans were in the preliminary stages to create owner-occupied housing on the city’s northeast side.

Said Clapper: “Right now we know there is a national crisis for housing — having homes available for the people that are searching for them, wanting to buy them, and occupy them. Whitewater’s dilemma has actually lasted a lot longer, but thanks to what’s happening nationwide … the silver lining is our entire community and surrounding area now sees the importance of housing.

“Something that we’ve noticed professionally, as staff, and subject matter experts have seen, has not been as evident for the general public. Some of you have caught it because you are smart and absorbent to those things and you’ve been experienced living in the Whitewater community for a number of years. Others did not. So now having the national crises helps focus (attention) on the importance of housing and the need to develop more in our community.

“Right now,” Clapper continued, “the only area where we are seeing significant development of housing is in an area known as the Park Crest subdivision, and it is in what was phase 4 of that subdivision.”

Fifteen construction permits have been issued by the city for homes to be built in that area over the last two years, Clapper said.

“The challenge is we need more,” he added.

Aided by a slide, Clapper talked about “the lifecycle of housing.”

He defined various subsets of homebuyers as people with different needs, defining some as families with young children, while others might be single. Still others, he said, are empty nesters who may no longer enjoy caring for a yard.

Each lifestyle, he said, “demands a different type of house product.”

In Whitewater, he said: “We don’t necessarily have residential product or residential options for individuals looking for their own space. Space suitable for partners and families is lacking in the area as well.

“It’s really been a challenge for our community to grow in a healthy way because our housing stock is really imbalanced. We are heavily loaded with rental housing primarily built for young adults attending the university, and then we have a significant amount, or maybe not as much as we need, of homes for individuals at the other end of that life spectrum, where you are looking to have a place that’s yours, and you don’t need any assistance or medical care, but you don’t want to mow the lawn everyday. In between those is really lacking at this point,” Clapper said, adding that the city is currently working on a housing plan, which, he said, he thought would be available for the public to view potentially before the end of this year.

With a plan in place this year, he said, “we could hit the ground running next year on projects to develop additional homes. Our primary focus is owner occupied, and I think that’s probably our number one effort, whether it be in condominium style or individual homes. We are looking for a greater amount of density, but also owner-occupied spaces.”

New development: Tax incremental financing districts

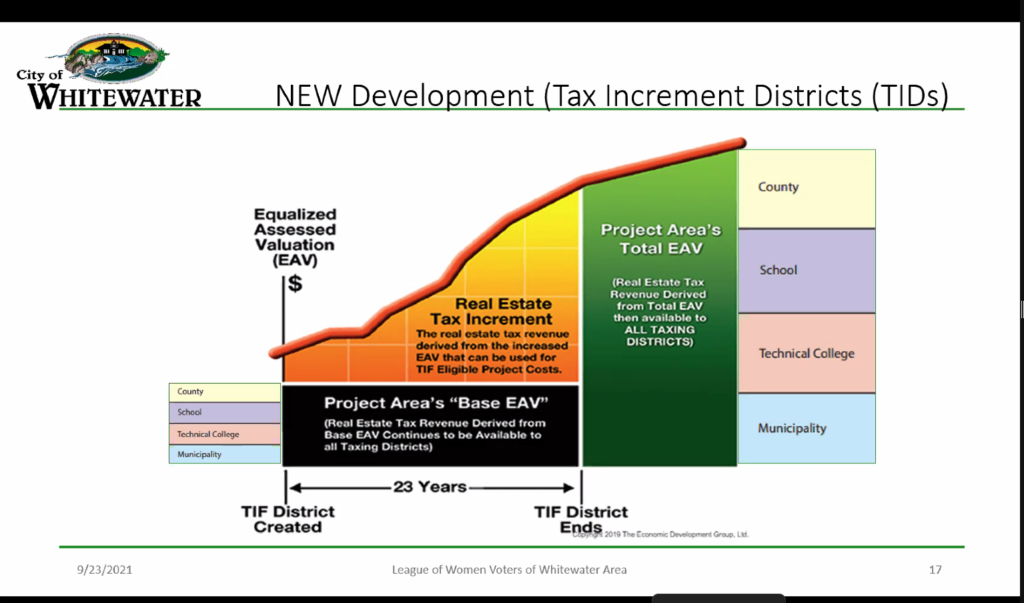

Under the heading of new development, Clapper shared a graphic designed to explain tax incremental financing districts, noting that on one end of the graphic were inputs such as taxes that are collected from property owners for use as revenue by the various taxing districts, including the county, school district, technical college and municipality.

Using tax incremental financing methodology, the graphic showed, a tax incremental financing district (TID) is determined and the properties within the district are collectively given a base equalized assessed valuation. With that value set as a starting point, any taxes from any new value created in the district above the base value are held within the TID for the life of the TID, which, Clapper said, could be anywhere from 20 to 27 years, depending upon how the district is set up. The taxing districts — county, school, technical college and municipality — agree to allow those dollars to remain as revenue of the TID, with those monies used to finance new projects within the TID, until such time when the TID sunsets or closes.

When the TID closes, the tax revenue streams are returned to the original taxing districts, which, in theory, would be larger than amounts collected before the TID was established because the value of taxable property within the TID would have increased over the base value as a result of new and completed projects within the TID. That increment, or new value above base, would then become available as collectable property tax income to the original taxing districts.

“Tax increment financing, and the districts we’ve developed to utilize tax incremental financing, are probably the most successful and really a fundamental economic development tool for local governments in Wisconsin,” Clapper said.

After the district closes, Clapper said, “all the dollars that were generated by using that district are 100% allocated to those same taxing jurisdictions,” and the increment is created using a system, which, he said, “does not increase the tax burden for any resident. It simply reallocates the tax dollars to fund development, until enough development is funded, that it will actually benefit from tax revenue to those jurisdictions.”

Clapper added: “Over time, value is increased, and ultimately that end goal is so that that value can be translated to revenues for those local governments that survive on property tax revenue.”

New development: Business and Industry growth

Clapper said several lots within the city’s business park are “shovel ready,” which, he said, means they are ready for development.

Clapper credited the city’s Economic Development Director Cathy Anderson with “the great amount of activity we are seeing.

“She is an outstanding dynamo, and just a ball of energy. She has been very responsive to businesses in the community as well as developers looking to relocate to our community, and so we have a lot of leads, individuals or businesses looking to purchase these lots,” Clapper said.

He said many developers are in discussion with the city, and he expects more to come in the future.

“That’s a big positive for our community, and really comes as a result of Cathy Anderson’s efforts,” he said.

Questions from the moderator, audience

Following his presentation, Clapper responded to several questions posed by Byrne, many of which, she said, originated with members of the virtual audience.

Byrne began the question-and-answer period with a comment which, she said, was received from the audience.

“I’m thrilled to learn that the city is working on diversifying our housing stock with a focus on owner-occupied. (I) cannot wait to see the housing plan,” the comment stated.

Byrne asked: “How is the city actively working to bring in new businesses into existing empty spaces in the area? Especially on the east side and in downtown? Additionally, how is the city currently working with existing business owners to ensure the good health and longevity of their businesses?”

Said Clapper: “I mentioned Cathy Anderson. Cathy is no stranger to the businesses in our downtown area and on the east side as well, and also in our business park. She is truly a dynamo; she is building relationships with existing businesses, frequently connecting with them, and then she makes phone calls to businesses in our community to check in on their well-being, but also frequents those businesses as a patron, and as an in-person visitor.”

Clapper said Anderson worked to stay up to date with resources available through the ARPA and CARES Act, as well as other programs, including those offered in-house, through the city, to make sure businesses were aware of the resources available to them.

“Personally, I spend, unfortunately this last year, year and a half, I’ve spent less time out and about because most of my meetings are still virtual. But Cathy has spent a great deal of time in person, helping our business community. She also works with the Downtown Whitewater organization and she sits on the chamber board as a representative from the city,” Clapper said.

Byrne asked: “What is the greatest challenge facing the city this fiscal year?”

Said Clapper: “I would say probably levy limits.”

Clapper said he believed property taxes were among the most transparent of taxes, and, he said, he recognized the importance of keeping them “reined in.”

“However,” he said, “the way levy limits are structured right now, we continue to see a diminishing return. For example, for 2022, we will be looking at about an increase of $50,000. And in a community with about a $9.6 million budget, … $50,000 doesn’t go very far in covering all of the increases in costs. Especially if you want to maintain competitive rates … That’s, I think, the biggest challenge and I don’t see it going away anytime soon. So it’s just navigating around that, and what can we forego now in order to make operations as they are.”

He said the challenge is to make every dollar stretch further.

Byrne asked: “With regard to owner-occupied housing, how affordable will these new homes be, and will this area be a part of the new Ward 13?”

Addressing the second part of the question first, Clapper said: “We don’t have a specific area designated. There are lots of areas where we would like to see new homes developed. That’s really going to depend on the impact or influence of whatever development groups or people we end up working with and what properties are available. Currently, we don’t have a lot of acreage owned by the city for development so that’s really up in the air. As soon as we have a map or idea where that is, we will be sharing that.”

Addressing the first part of the question, Clapper said: “We hope that starter homes … starter homes in general are homes that hover around $150,000. That hasn’t really changed; the amount in people’s pockets hasn’t really changed, just the increased cost of houses has changed. Personally, my hope is that we can develop … looking at homes that are under $200,000.

“The way that we would do that is utilizing some programs that have come our way. One is the tax increment districts that we have established (this year); another is an extension of some increment collection that we were able to obtain from the state with old districts that were recently closed also this year. We should have somewhere between $1.5 and $2 million of revenue generated back exclusively for housing development, and then an additional amount to be determined based on need that we would finance through those new tax increment districts.”

He said the money would be used to subsidize the cost of building homes, most likely, with a possibility that some could be used for rehabilitating existing housing.

“Much of it obviously would go to new homes. And so we would subsidize the cost of new construction, and as a result of that, we would be able to reach a price point that people can come into our community and afford,” he said.

Byrne asked: “Are you saying that the city would have to buy more land in order to build more homes?”

Clapper responded: “Yes, if the city has interest in being the developer, we would have to buy more land.”

He pointed to the Mound Acres subdivision on the city’s west side, noting that the project began when a developer approached the city to purchase land. The city was involved with working with a developer, a contractor, and selling the lots, he said.

The city could consider a similar option again, he said, adding that the housing plan that is under development would provide more details. That plan could be available for the public to view by the end of October, he said.

Byrne asked: “How can we learn about what the latest Census tells us about what is happening with the demographics in Whitewater?”

Clapper suggested those interested could visit the Census website.

“We are in the process right now of redistricting, so some of that information has been made available to our clerk so that she can really look at how to equitably distribute aldermanic districts and wards throughout the community. On that note, I would just say, stay tuned. There is more to come in the next few months and as information is released, and as those districts get finished, at this point, I’m at a loss for resources just as you may be,” he said.

Clapper said he has received “occasional updates on population from the Department of Administration,” adding that the city has an estimated population of 14,889 people.

“We haven’t seen a lot of growth over the last decade in terms of the number of people. How that number breaks out in the area of socioeconomics is the only thing that’s changed,” Clapper said.

Byrne asked: “Does that number include college students?”

Said Clapper: “It does. That number is not the full enrollment of UW-Whitewater because a number of programs are online and people are coming in during the day from out of the community, traveling from home here and then back again. But we are willing to say about 50% of that number and possibly a little more, even 60% of that number, is population directly related to the university, and most of that, students.”

Responding to a question about the impacts of COVID to the city, Clapper said the city was in better condition than initially predicted. He attributed that to people staying at home and using fewer services after the pandemic began and federal dollars that helped offset some city expenses. He cited the CARES Act and ARPA as among sources of those dollars.

According to information released in advance of the forum, the event was live-streamed on the LWV-WW Facebook page: facebook.com/lwvwhitewater.org, and was recorded for future broadcast on the City of Whitewater local access Channel 990.

The league’s next virtual program will focus on gerrymandering, according to a recent press release. The program is scheduled for Thursday, Oct. 21.

For more information about the league, visit its website: https://my.lwv.org/wisconsin/whitewater-area.

The above slide as shared by Whitewater City Manager Cameron Clapper during his State of the City address shows the breakdown by percentages of a city of Whitewater resident’s property tax bill.

The above slide as shared by Clapper shows the city’s 2021 budget. The blue bar represents the actual budget and the orange bar shows how many of those dollars have thus far been collected and spent. Clapper said during his address that about two-thirds of the budget had been spend and the budget schedule was running smoothly.

The above pie chart shows the breakdown of general fund revenues received.

The above pie chart shows the breakdown of general fund expenditures.

The side above shows the city’s most recent housing development activities. Clapper said some 15 construction permits have been issued by the city in the area known as the Park Crest subdivision over the last two years.

The above graphic shows how tax incremental financing districts work. Clapper noted that inputs from various taxing jurisdictions are small when the district’s base is created, as represented by the colored bars at the graphic’s left side, and increase in size after development, paid for by the tax revenues from the frozen base, fund the development of taxable construction within the district. The larger increment, which is returned to the initial taxing jurisdictions, is represented by the larger corresponding boxes on the graphic’s right side.

Cameron Clapper

This post has already been read 1173 times!