Update: The following information was recently released by the Whitewater Unified School District: WUSD taxpayers will realize a lower than expected levy rate after the school board approved the district’s 2022-23 budget. As a result, the tax levy will decrease by about 7% from the previous year, with a mill rate of $8.76 per $1,000 of assessed property value. This marks a decrease from the originally projected rate of $9.91 per $1,000 of assessed property value.

By Kim McDarison

The Whitewater Common Council Tuesday received a presentation from several members of the Whitewater Unified School District outlining the district’s ask for a $17.6 million operational referendum.

The referendum question, which will appear on the November ballot, asks voters to extend an operational referendum approved in 2018. Would voters make that approval, the extension would allow the district to continue to operate with taxpayer-supported revenues above its state-imposed levy limit by $4.4 million over each of the next four years.

Voters within the Whitewater Unified School District on Nov. 8 will find the following question on the ballot: “Shall the Whitewater Unified School District, Walworth, Jefferson and Rock Counties, Wisconsin, be authorized to exceed the revenue limit specified in Section 121.91, Wisconsin statutes, by $4,400,000 per year beginning with the 2023-2024 school year and ending with the 2026-2027 school year, for non-recurring purposes consisting of the following: maintaining targeted class sizes, maintaining student support and mental health services, maintaining comprehensive instructional and co-curricular programs, and maintaining technology, safety, and facilities infrastructure?”

District representatives making the presentation to council Tuesday included Superintendent Caroline Pate-Hefty, Board of Education member Larry Kachel and Director of Business Services Ben Prather.

Impacts to taxpayers

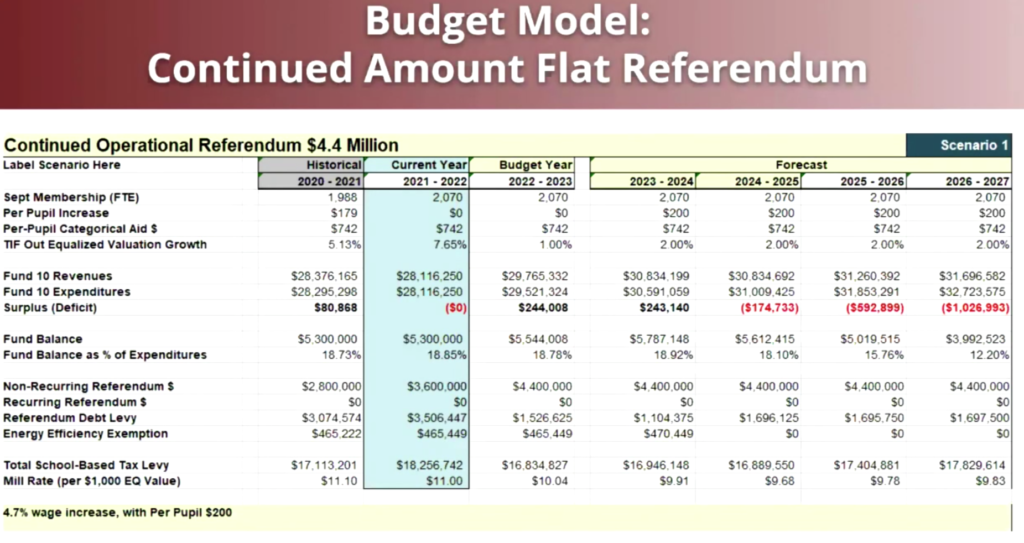

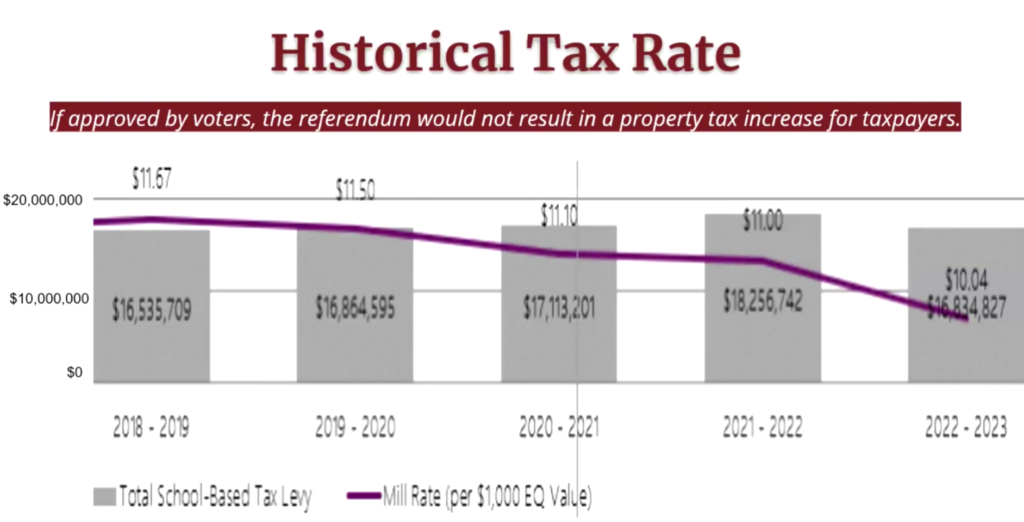

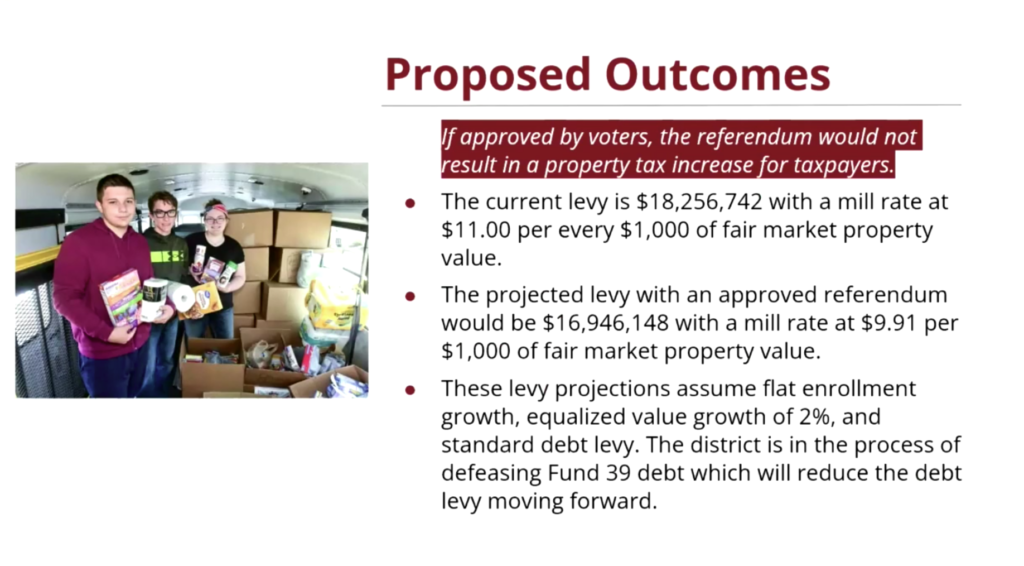

Aided by a series of slides, the district’s representatives noted that would the voters approve the referendum in November — voting to continue funding the $4.4 million above the state-imposed limit — the district’s levy and mill rate to support the 2022-2023 school year would decrease from the levy and rate paid to support the 2021-2022 school year.

Looking at the full budget, the team stated that the school district operates annually using a budget of approximately $28.3 million. In the 2021-2022 school year, the taxpayer-supported portion, called a levy, of that budget was $18.3 million. This year, resulting, in part, from early payments made to reduce a debt obligation, the district is projecting a levy of $16.8 million, lowering the levy by approximately $1.4 million.

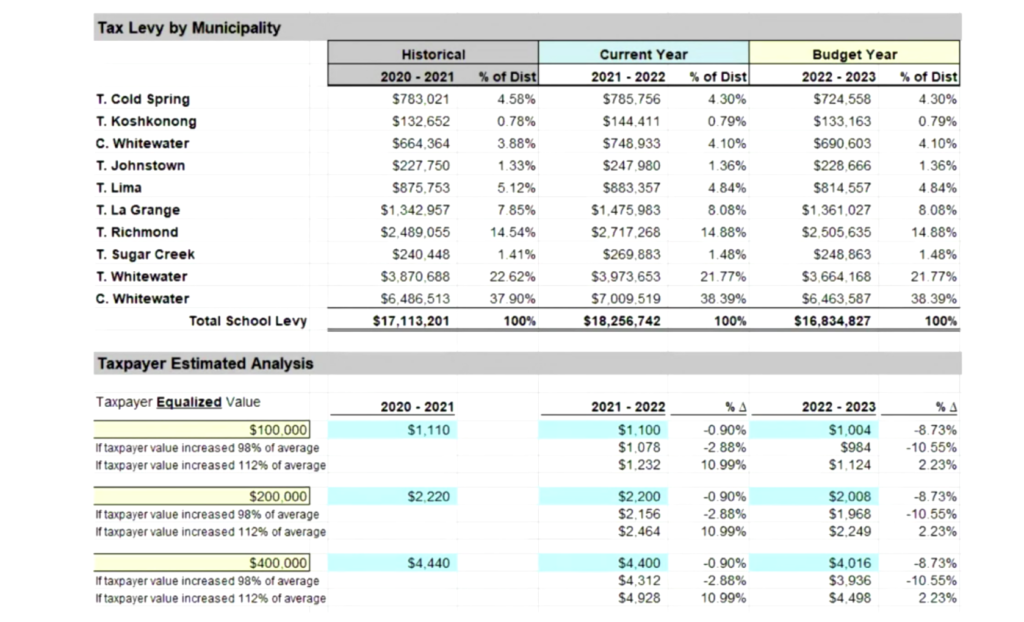

The district serves, in part or whole, several communities, including the city of Whitewater and the towns of Cold Spring, Koshkonong, Johnstown, Lima, LaGrange, Richmond, Sugar Creek and Whitewater. The portion of the school district’s levy paid by city of Whitewater taxpayers is approximately $8 million. Residents in the city of Whitewater also will find a referendum question on the November ballot, asking for $1.1 million in revenue above the city’s state-imposed levy cap to fund expenses associated with a new in-house fire and EMS department.

A story about the impact to taxpayers in Whitewater should both referendums receive voter approval is here: https://fortatkinsononline.com/whitewater-tax-impacts-associated-with-funding-an-in-house-fire-department/.

Looking at districtwide taxpayer impact, Kachel said: “There would be no property tax increase if this referendum is approved by the voters on the part of the school district.”

A slide noted that the current levy is $18,256,742 with a mill rate at $11 per every $1,000 of fair market property value. The projected levy, with an approved referendum, would be $16,946,148, with a mill rate of $9.91 per $1,000 of fair market property value.

Presenting a slide showing a “taxpayer estimated analysis,” and using equalized property value, the district produced several examples showed anticipated tax impacts to homeowners within the district. According to the slide, a taxpayer within the district with a home valued at $100,000, would have paid $1,100 last year in support of the school district’s levy. This year, the homeowner, would the referendum pass, could expect to pay $1,004. Looking at a home within the district valued at $200,000 — which city officials have said is the average value of a home in the city of Whitewater — the taxpayer would have paid $2,200 last year and could expect to pay $2,008 this year.

Referencing an operational budget slide, shown above, Pate-Hefty said that more than 70% of the district’s $28.29 million budget is used to support salaries and benefits for those working in the district.

“This is really common in public schools,” she said, adding: “We’re a human-rich field serving little humans.” She continued: “There is not one segment of that pie that this district can take out and say, ‘well, we’ll just cut that program or cut that service.’ These are critical services for our kids.”

Pointing to a “budget model,” Prather said the slide, shown above, offers a budget projection beginning with the 2021-2022 school year through to the 2026-2027 school year.

“You can see that currently, 2021-22, we had an $18.2 million levy. Going forward, we’re trying to control that amount to keep it under that amount, and that’s also going to reduce the mill rate. Some of these things can fluctuate based on equalized value of property and also based off of our enrollment growth or decline,” he said.

Pointing to a line on the chart labeled “referendum debt levy,” Prather noted that this year, the debt was listed at $3.5 million. Going forward, he said, payments will bring the debt to $1.5 million next year, and continue to lower debt each subsequent year.

“So we are able to save that projected $2.5 million in these interest costs alone by being fiscally responsible and paying that long-term debt off early,” Prather said, adding: “Overall, we’re able to say we can reduce the overall levy because we paid off that debt.”

“These levy projections assume flat enrollment growth, equalized value growth of 2% and standard debt levy. The district is in the process of defeasing Fund 39 debt, which will reduce the debt levy moving forward,” Kachel said.

A larger representation of the budget model above can be viewed here: http://fortatkinsononline.com/wp-content/uploads/2022/10/Screen-Shot-2022-10-06-at-10.07.56-AM.pdf.

The upper half of the slide above shows the portion of the district’s tax levy collected from taxpayers within each of the municipalities the district serves. The lower half of the slide offers several examples of impacts to taxpayers based on the equalized value of a home.

“The takeaway here is that the mill rate’s going to go down and our levy is going to be reduced as well,” Prather said.

A larger representation of the Taxpayer Estimated Analysis slide is here: http://fortatkinsononline.com/wp-content/uploads/2022/10/taxpayer-estimated-anaylsis-pdf.pdf.

Why is the referendum needed?

During the presentation, Kachel told those in attendance that the referendum approved by voters in 2018 “has been critically important to our district’s operations and more important for the ability of our schools to provide programs and services to students.

“If our district is to continue to have access to these funds, we need to return to voters for a replacement referendum.”

Pointing to a slide, shown above, Kachel said: “The grey bar represents the total school-based levy for our district, while the purple line represents the mill rate or property tax rate for the school district’s portion of the tax bill. The mill rate has steadily declined in recent years, and would continue to do so even with approval of our referendum.”

According to the graph, in school year 2018-19, the levy was $16.5 million with a mill rate of $11.67; in 2019-20, the levy was $16.8 million with a mill rate of $11.50; in 2020-2021, the levy was $17.1 million with a mill rate of $11.10; in 2021-22, the levy was $18.2 million with a mill rate of $11, and projected for 2022-23, the levy is $16.8 million with a mill rate of $10.04.

Said Prather: “So many of you might be asking, why are referendums necessary for school districts? A major reason is that it’s tied to a 1993 state statute where what we were spending in ’93 is what the state locked us into. So, as you know, 30 years have gone by and costs have changed.”

Addressing costs, he said: “So, just the day-to-day fuel for buses; one major cost we’re seeing is an increase in special ed needs, as well as metal health, and so those are a lot different than they were in ’93. So between the revenues locked in and also our expenditures going up, and just day-to-day things that everybody’s feeling right now, especially with inflation, that’s why we need a referendum.”

“The State Department of Public Instruction says that they do not believe there is any chance the school funding formula will be changing anytime soon. This means districts like ours will continue to need operational referendums to avoid significant cuts to programs and services,” Kachel said.

He added that Whitewater is among 130 districts in Wisconsin that have brought operational referendums before voters in the past decade. Communities have approved about 72% of those referendums.

Since 1993, when the funding system used by the state was put in place, Whitewater has “engaged in this operational referendum process 10 times,” Kachel added.

Student populations and needs

According to Pate-Hefty, the school district has 2,003 students. Data presented in a slide offered information about the student body based on an enrollment of 1,949 students, which, she said, “is our last verified data.”

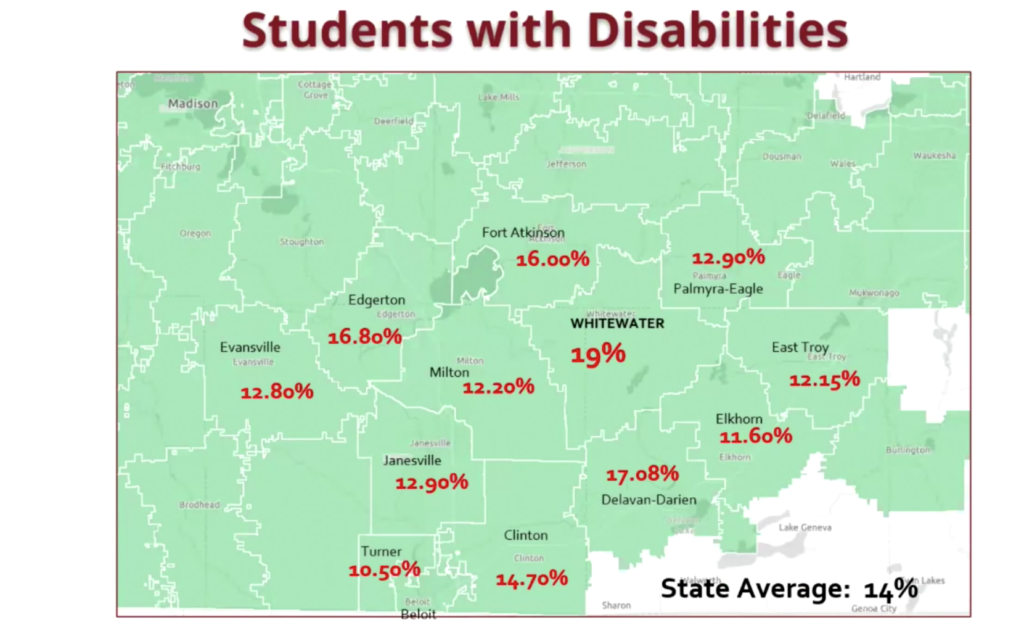

Among students in the district, some 50% are within a range that qualifies them for free or reduced lunch programs. Pate-Hefty said she anticipates that the number will increase. Some 13% of students within the district are English language learners, defined as students who speak a language other than English at home. Another 19% of the district’s students are enrolled in special education.

“Just to give you some context, about 10-13(%) is a national average for special education. I also want to share some regional data with you so you know where we stand regionally. But that 19% is high. And that’s what happens when you do really amazing things serving students. Our families come back and they let other families know that we’re a great place to serve our students,” she said.

The slide above, as shared by Pate-Hefty, shows the breakdown of student needs and populations within the Whitewater Unified School District.

Students with unique needs require additional funding and resources to ensure high-quality services, Pate-Hefty said. Growth in the district’s economically disadvantaged population and students with disabilities has been steady over time. A slide showed that between 2016 and 2021, the district’s economically disadvantaged population grew from 41 to 50% and the district’s students with disabilities population over the same period grew from 17 to 19%. Both growth trajectories place the district above the state average, according to the slide.

“Our students with disabilities rate has always been over the national average. Some of that is accounted for in that we serve three counties, but one of our largest counties is Walworth, and in Walworth we have a special education facility that can be serviced or provided for students, and so that attracts some percentage of families as well,” Pate-Hefty said.

The above graphic, presented Tuesday, shows the percentage of students with disabilities within each school district’s population. The state average is 14%.

Said Pate-Hefty: “So Whitewater is right there in the middle. Again, students with disabilities rate is 19%, and you can see we are significantly above those around us in terms of service. So when you hear cost of students and service, this is a connection that’s directly related … we’re legally required to provide things like OT (occupational therapy), speech, PT (physical therapy) and other services to make sure that they are reaching their potential.”

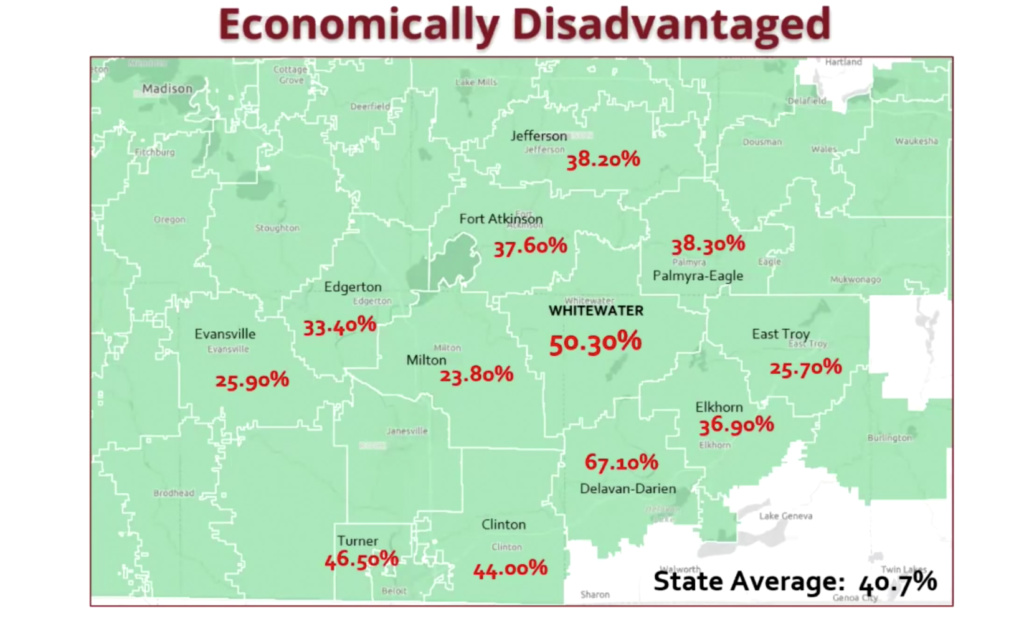

The above graphic, presented Tuesday, shows the percentage of students who are economically disadvantaged within each school district’s population.

Said Pate-Hefty: “Again, economically disadvantaged, we are only below Delavan-Darian (school district) in the area. The state average is about 40%, so we’re above that in comparison with regional school districts.”

The above graphic, presented Tuesday, shows the percentage of students who are English language learners within each school district’s population. The state average is 2.8%.

Said Pate-Hefty: “So we are inline with a couple of communities as far as English language learners. We expect this to go up. A snapshot was taken prior to about 120 new students moving in last year from Nicaragua, and so those students have needs related to acquiring English and kind of supporting them being part of our community.”

Programs

Pate-Hefty next talked about programming within the district, noting, in some cases, a need for creative thinking.

“Our teachers will tell you and our staff will tell you that students’ needs around depression and anxiety following COVID have been intense. We are trying to be creative with funds that we can have in the community. So we wrote a grant to have “Project Winston.” He’s our therapy dog and he will be reporting in January over at Washington school to support our students,” she said, adding that the district also has a therapy dog at the high school.

Prather listed several programs, which he described as among those “we absolutely value,” including growth in the district’s middle school tech program; “Whitewater Builds,” a summer school program through which students this year built three sheds and donated them to area veterans; K-12 Drama and Theater, which, he said, will extend programming to the elementary-school-level, and Project Lead the Way, a STEM program that has been successfully piloted in two of the district’s three elementary schools.

Pate-Hefty said approval of the referendum by voters would protect robust academic and athletic opportunities, citing athletic programs offered at the fifth-grade level, which, she said, are “really competitive now with the region, and that’s a new change we made.”

Additionally, she cited “Ferradermis,” which she described as a robotics program with nationwide recognition.

“Student support and mental health services are critical,” she said, citing as example the displacement of a family recently resulting from a situation within the home.

“That included a significant travel of 45 minutes away. That enacted the McKinney-Vento (Homeless Education Assistance) act because they become homeless, and we had to make sure that all seven kids could come to school and receive services based on their experience and stabilize them in our schools. And that’s a reality of what public school looks like. The referendum will protect those metal health services,” she said, adding that the district has a clinician in every school building and career, mental health and social needs counselors that support students.

Citing advancements in comprehensive instructional and co-curricular programs, Pate-Hefty said: “We revamped math curriculum this year and adopted a new math curriculum that we’re really excited and proud with called Bridges, very research-based. Our elementary schools are implementing that. Our teachers are receiving professional development around that. We started the year learning about positive ways to communicate as teachers in the field; we call it Professional Learning Communities. Our teachers are also receiving professional development around strategies for multilingual learners so that we can continue to help them excel. And then expanding that career and tech ed segment that Ben mentioned to you previously.”

Questions from council members

After the presentation, council members were offered an opportunity to ask questions.

Councilwoman Brienne Brown asked: “I’ve been to a couple of your presentations, and the question that pops up often is how you used the ARPA (American Rescue Plan Act of 2021) funding. I’m wondering if you’re going to be putting that into your presentations or are you just waiting for those questions to pop up later so you can explain how that money was spent?”

Pate-Hefty responded: “We’re glad to talk a little bit about that. There were requirements from the federal government for how that funding was spent. And it was intentionally outlined to be spent to generate the economy. So that included some provisions; we could spend it on HVAC, which we did, you could spend that on recoupment and recovery for students or you could reinvest in your operational budget so that you could expend and save in your budget for long-term projects, which is exactly what we did. And so we invested — one of the projects that that allowed us to invest in was fields. Since 2008, the school board has been considering a fix — this is long before this administration and even that rotation of the board, but the board has been looking for a fix for flooded fields. We serve over 600 students in our athletic programs and it was a regular kind of story for them that their seasons were canceled and that they were shop-vaccing our fields so that they could have their events. So our families came out hard, and from the athletics, to say, ‘hey, this is really important to us.’ We were able to, without asking the taxpayers for support — local communities by us, Delavan-Darian just did a remodel to their fields and had to go to the taxpayers and ask for that. Within our budget, we were able to reapply those funds so that we could update fields and all 600 of our athletes now play in the stadium for all of their events.”

Whitewater Unified School District Superintendent Caroline Pate-Hefty, from left, and Whitewater Unified School District Board of Education member Larry Kachel address the Whitewater Common Council Tuesday. The two, along with a third district representative, Ben Prather, not pictured, gave a presentation about the history, tax impacts and programming needs associated with the district’s proposed operational referendum. A referendum question will appear before the school district’s voters in November. Kim McDarison photo.

A slide, as presented by the Whitewater Unified School District, shows proposed outcomes would voters approve the four-year operational referendum.

This post has already been read 1365 times!